Distiller’s Dried Grains with Solubles (DDGS)

DDGS Comments: Another week of declining ethanol run rates and the seasonal uptick in livestock inventories and feed demand supported DDGS values. FOB ethanol plant DDGS are up $5-6/MT this week amid an uptick in demand and a continuation of last week’s strength on the offer side. Despite a pullback in soymeal futures, physical soymeal values remain strong. Consequently, the DDGS/Kansas City soymeal ratio is down from last week at 0.47 and below the three-year average of 0.49. The DDGS/cash corn ratio is lower this week at 0.87 and is below its three-year average (1.07).

One factor keeping the DDGS market supported is the fact that production in July was below 2021 levels. According to the USDA’s latest Grain Crushing report, processors produced 1.934 million tons of DDGS in July, below the 1.97 million tons produced in the same month last year.

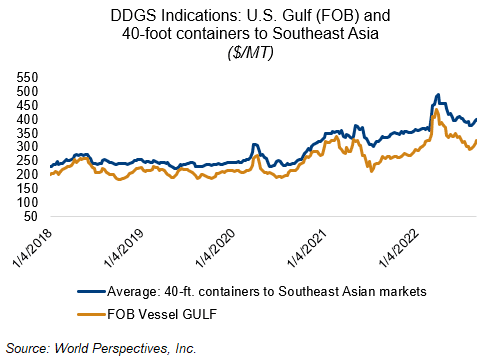

Tightening logistics for September and early Q4 shipments have pushed barge rates higher over the past few weeks. Barge CIF NOLA DDGS values are $12/MT higher for September positions this week while FOB NOLA offers are up $10/MT to $324 this week for spot positions. The DDGS container market was mixed with early-week weakness in ocean freight pulling offers lower until Thursday’s rally in freight values. Offers for 40-foot containers to Southeast Asia are up $7/MT on average this week at $404 for spot shipment.