Chicago Board of Trade Market News

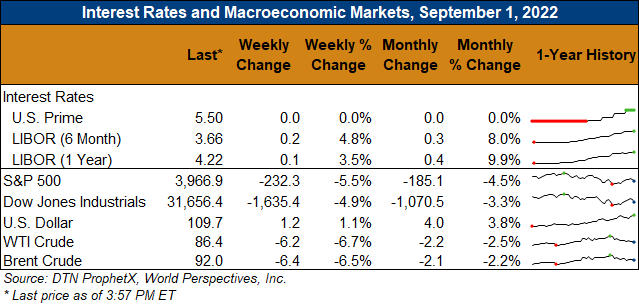

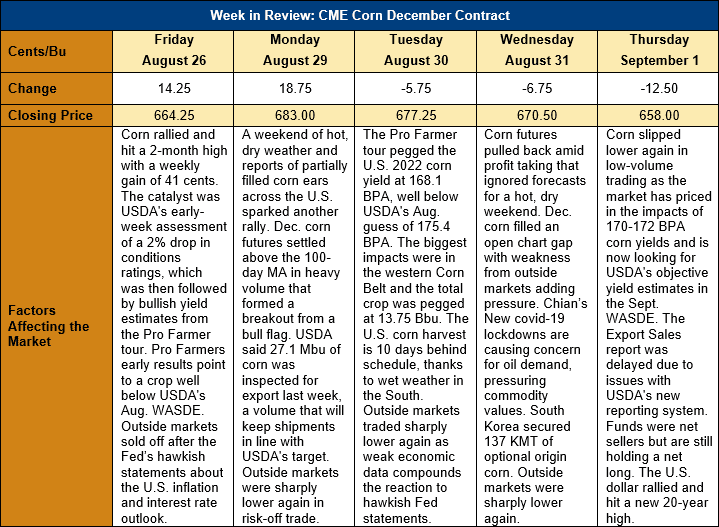

Outlook: December corn futures are down 6 ¼ cents (0.9 percent) from last Thursday after early week bullishness encountered technical resistance and slow, steady selling pressure. Outside markets have also worked against futures as declines in U.S. stocks and crude oil and a fresh rally in the U.S. dollar work against traders’ risk appetites. The market’s early rally was largely driven by declining yield expectations, which are now fully priced into the market. Futures traders are now largely content to maintain current positions while waiting for USDA’s assessment of the U.S. crop in the 12 September WASDE report.

The unusual heat that was a feature of the 2022 growing season for much of the Midwest, but the western Corn Belt in particular, has cut corn yields significantly. Early this week, the Pro Farmer crop tour pegged the 2022 U.S. average corn yield at 10.557MT/ha (168.1 bushels per acre), which was below USDA’s August forecast of 11.015 MT/ha (175.4 bushels per acre). The Pro Farmer tour estimated the U.S. 2022 corn crop at 349.497 MMT (13.758 billion bushels), which would be a 9 percent decrease from USDA’s 2021/22 estimate and a 4.2 percent decrease from USDA’s August 2022/23 estimate, if correct. Notably, the tour’s estimates are typically below USDA’s final yield and production estimates, a fact which has kept the futures market contained. Still, the Pro Farmer results, combined with other private forecasts putting the U.S. yield near 10.6-10.93 MT/ha (170-174 bushels per acre), point to upside potential for the corn market.

The USDA’s Export Sales report will not be published this week or next due to technical difficulties with a new reporting system. The weekly Export Inspections report, however, featured 0.689 MMT of old crop corn inspections, down 16 percent from the prior week. With just a half-week left in the Export Inspections reporting period for the 2021/22 crop year, YTD corn inspections total 54.591 MMT, down 17 percent from the prior year. That figure is below USDA’s August forecast of 60.33 MMT, but does not account for shipments to Canada, which will likely put the final 2021/22 export figure almost exactly in-line with USDA’s projection. The Export Inspections report also detailed 7.424 MMT of YTD sorghum inspections, a figure 5 percent above this time last year.

The heatwave in Europe continues to damage the region’s corn crop and a French consultancy recently pegged the country’s crop at 10.8 MMT, which would be a new 20-year low. Private firms are now estimating EU imports of 19-21 MMT for 2022/23, well above 2021/22 imports of 16 MMT.

From a technical standpoint, December corn futures posted an upside breakout from a bull flag on Monday but failed to follow through on that rally. The market has since drifted lower after resistance developed just shy of $6.85 with the market giving up its position above the 100-day moving average on Wednesday. Near-term support lies in the range $6.47-6.50 with trendline support at $6.29 below that. Notably, trading volume has been light on the recent pullback, which suggests the 23 and 29 September rallies that developed on heavy trading volume are technically more important than this week’s declines.