Chicago Board of Trade Market News

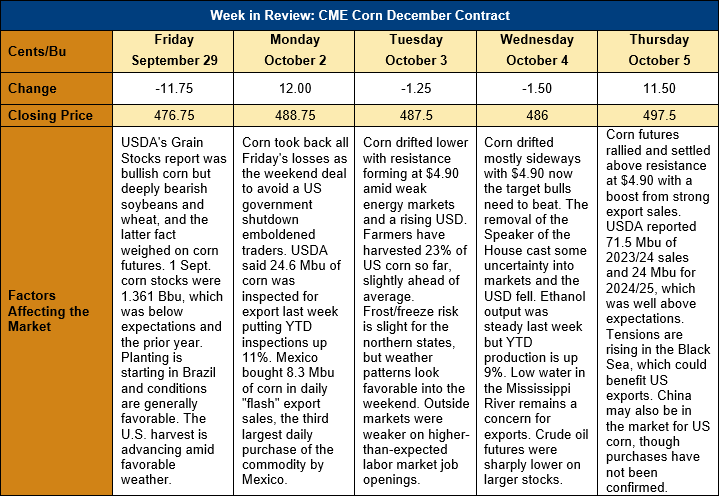

Outlook: Corn futures are 20 ¾ cents (4.4 percent) higher after volatile trade this past week. The market sold off sharply following a bullish Grain Stocks report with spillover selling from soybeans and wheat and political uncertainty driving the weakness. Subsequently, strong export sales and technical buying lifted the market, including Thursday’s 11 ½-cent gain. Typically, harvest and seasonal lows are scored during October, but it looks like those lows came early this year in September and the market is shifting to a steady/higher mentality.

The September Grain Stocks report found 34.579 MMT (1.361 billion bushels) of corn on-hand as of 1 September, which was down 1 percent from the prior year. The market was expecting stocks to increase 3-5 percent, which gave the report a bullish interpretation. Futures fell sharply on the day of the report’s release, however, as bearish stocks figures for soybeans and wheat combined with political uncertainty on a now-averted U.S. government shutdown broadly pressured markets.

The 1 September stocks created the ending stocks number for the 2022/23 corn marketing year, which allowed USDA to make final adjustments to its supply/demand estimates for the year. USDA revised 2022 corn production 381 KMT (15 Mbu) lower due to smaller harvested area (now estimated at 35.855 Mha or 88.6 million acres) and a slight increase in the 2022 corn yield.

U.S. corn export sales are picking up significantly despite a strong U.S. dollar and draft issues on the Mississippi River. USDA reported two daily “flash” export sales announcements this week of corn destined for Mexico, which together total 406.6 KMT. Of that, 319.2 KMT is for 2023/24 and the rest (87.4 KMT) is for 2024/25. The sales to Mexico follow last week’s daily sale of 1.6 MMT, which was Mexico’s third largest corn purchase from the U.S. in history. Additionally, the weekly Export Sales report featured 2.156 MMT of gross sales and net sales that were up 116 percent from the prior week. Exports dipped slightly from the prior week, but YTD shipments are up 19 percent.

Sales and exports of sorghum are also surging with 240 KMT of gross sales last week and 60.9 KMT of exports. Through the first five weeks of the marketing year, YTD sorghum exports are up 1,082 percent and YTD bookings are up 683 percent.

The U.S. corn crop is in the final stages of finishing with 82 percent of the crop “mature” as of Monday’s Crop Progress report and 23 percent harvested. Both figures are above the five-year average thanks to broadly favorable weather for the Midwest. There are some frost/freeze risks present for immature corn in parts of the Dakotas, Minnesota, Wisconsin, and Michigan, but little concern is required for now.