Ocean Freight Markets and Spreads

Ocean Freight Comments

As expected, the International Longshore Association went on strike, essentially shutting down container terminals and ports from Maine to Texas this week. They are striking for increased wages, no expansion of automation and other issues. Even though President Obama used the Presidential Emergency Board in 2012 to keep the ports operating, President Biden refuses to use such a tool. Bulk grain and soybean and product exports will not be impacted, however, meat and other agricultural products moved by container through U.S. East Coast and Center Gulf container ports will be impacted. Shippers have been exercising contingency plans for this strike to minimize the impact. The ILA is communicating it can strike against the U.S. Maritime Association for an extended time. The USMA has not commented but its members have been initiating contingency plans.

The Houthi terrorist organization in the Red Sea has not had successful attacks on vessels transiting the Red Sea in recent weeks. This week they targeted two vessels leading to slight damage. In the meantime, they are reverting to attacking ports and terminals in Israel. Vessel owners and operators continue to bypass the Red Sea to minimize attacks and to protect their crews.

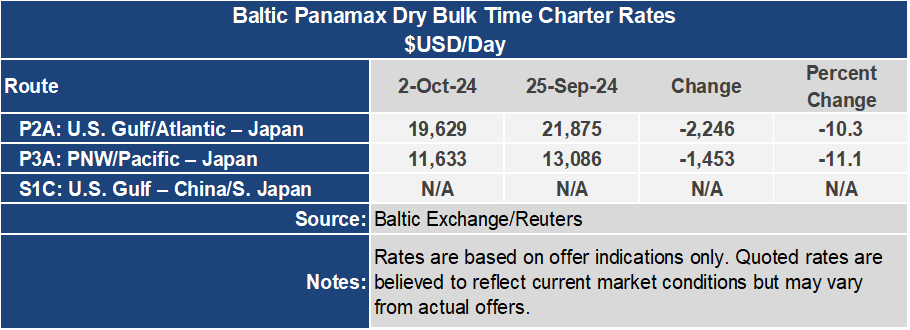

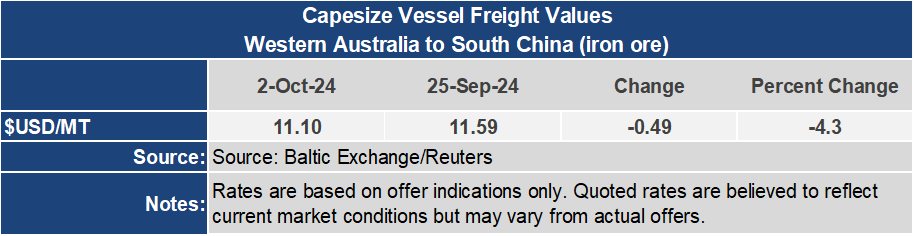

Despite strength in the Capesize market, the Baltic Dry Index reversed course this week, losing 1.9% or 38 points to an index of 1,978. The Baltic Capesize Index gained 84 points or 2.5% this week. The smaller vessel classes, however, were weaker. The Panamax sector lost 11.6% or 170 points to an index of 1,364. The Baltic Supramax Index dropped 3.4% to 1,272.

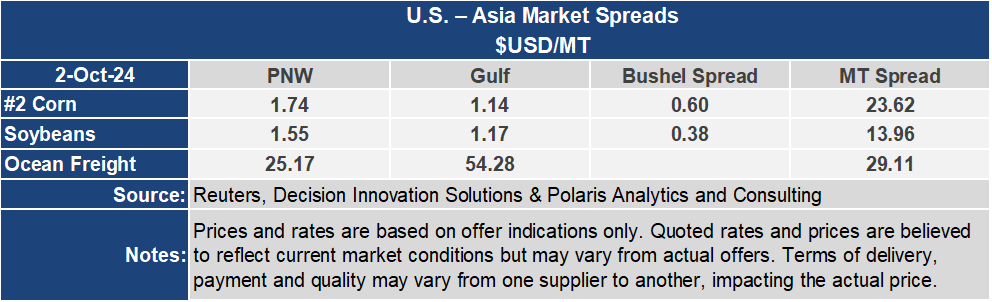

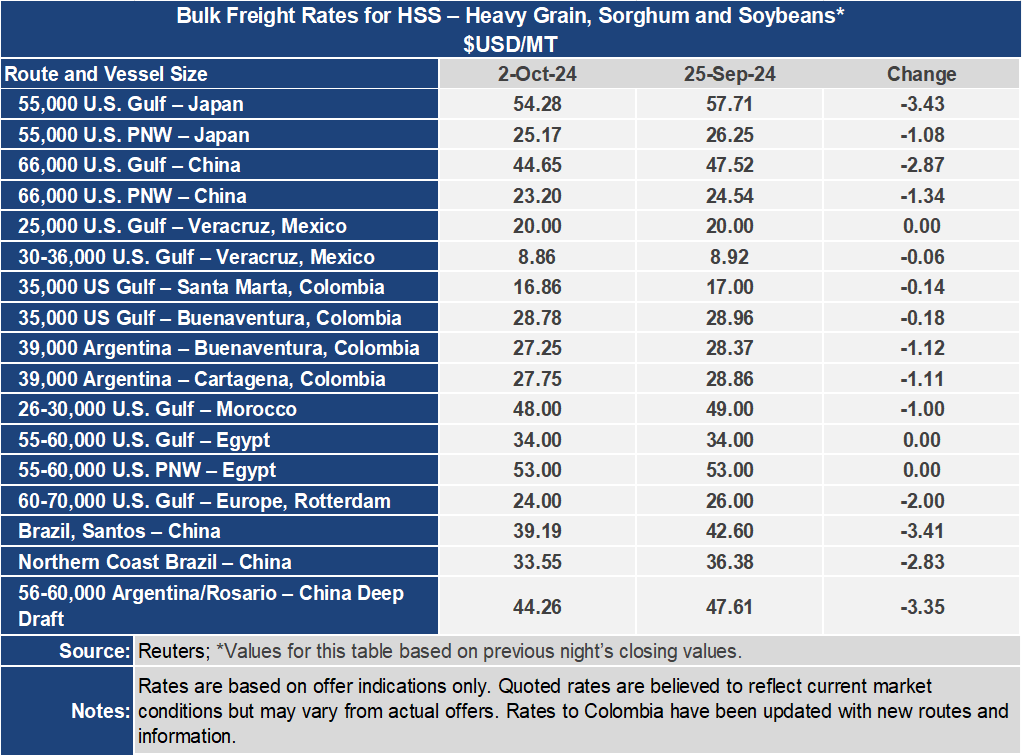

Voyage grain rates retreated this week. The U.S. Gulf to Japan freight rate lost $3.43 per metric ton or 5.9% for the week to $54.28 per metric ton. From the Pacific Northwest the rate dropped 4.1% or $1.08 per metric ton at $25.17 per metric ton. The spread between these revered grain routes narrowed 7.5% or $2.35 per metric ton to $29.11 per metric ton. Both routes are quoted using vessels loaded with 55,000 metric tons.

To China the rate from the U.S. Gulf was $44.65 per metric ton for the week, losing $2.87 per metric ton or 6%. From the PNW, the rate contracted $1.34 per metric ton or 5.5% to $23.20 per metric ton this week. The spread on this route narrowed by 6.7% or $1.53 per metric ton to $21.45 per metric ton. Both routes to China are quoted using vessels loaded with 66,000 metric tons.