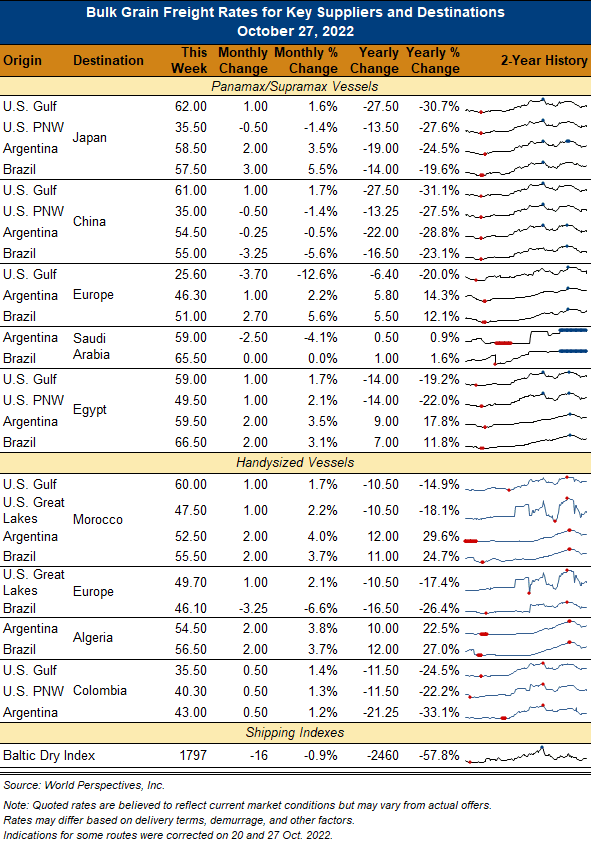

Ocean Freight Comments

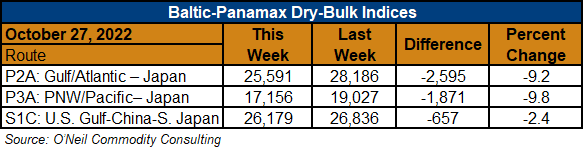

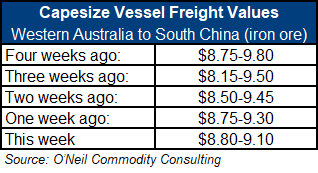

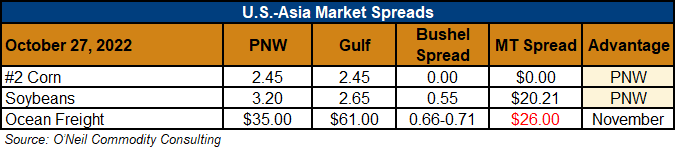

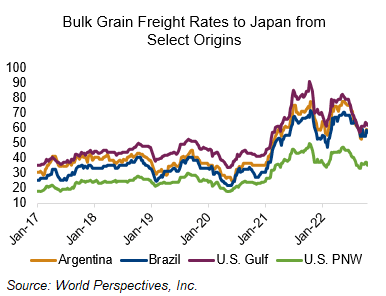

Transportation and Export Report: Jay O’Neil, O’Neil Commodity Consulting: Dry-bulk markets are not showing vessel owners much love. Overall markets remain weak, and considerable uncertainty remains regarding the global economic outlook for 2023. Panamax daily hire rates have dropped to $14,000/day for November and $11,300/day for Q1 2023. The dry-bulk new vessel order book is historically small, but cargo demand growth is also slack. As stated previously, much depends on China.

The low water situation on the Mississippi River has improved slightly and two-way barge traffic has reopened. More rain in needed, however, to ensure this is not just a temporary situation. With container rates dropping, it is good to see U.S. containerized grain exports starting to pick back up.

U.S. railroad labor contract negotiations continue without resolution and fears of a potential rail strike are increasing. Much the same is true for the ILWU union contract negotiations at West Coast Container ports. Should a rail or port strike occur, it is hoped that the government would step in with a demand for a 90-day cooling off period.