Chicago Board of Trade Market News

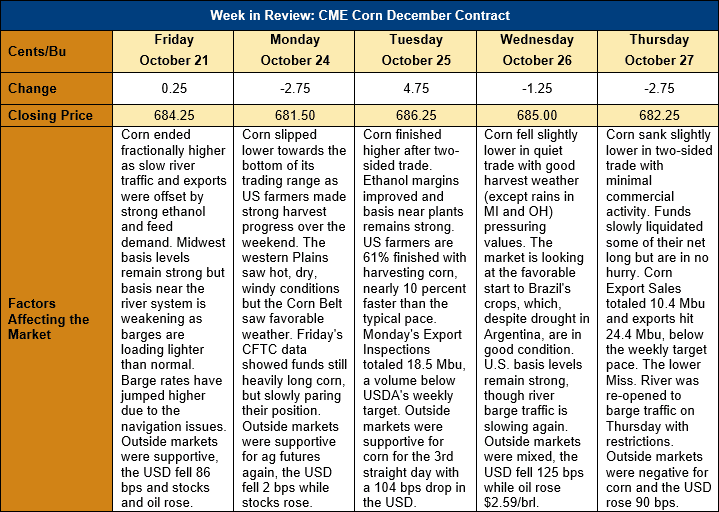

Outlook: December corn futures are 2 cents (0.3 percent) lower than last week as the market continues to drift sideways as the U.S. harvest reaches its peak. Corn has maintained a tight, sideways pattern since the October WASDE and the fact it has avoided any substantial harvest-time price pressure underscores the market’s relative strength. Ethanol and livestock feed demand remain bright spots for the corn market while persistent river navigation issues are creating challenges for the export market. Still, with U.S. 2022/23 ending stocks projected to be the smallest since the drought year of 2012/13 the current export pace is failing to elicit much bearish sentiment. Additionally, commercial buying has been active on market dips towards the $6.75 level, which indicates that point will likely become a trading range floor heading into 2023.

The U.S. corn harvest is now more than half-completed with USDA reporting 61 percent of fields were harvested through Sunday. Favorable weather last week and weekend allowed for an aggressive fieldwork pace that lifted completion rates above the five-year average (52 percent). Compared to the five-year average, most of the Corn Belt states have harvested more fields than usual, while the only major delays are in the western United States.

U.S. corn export sales were down sharply from the prior week and totaled 298.2 KMT for the week ending 20 October. Weekly exports, however, rose 52 percent and totaled 619 KMT and put YTD shipments at 3.695 MMT, down 28 percent YTD. YTD bookings total 14.095 MMT and account for 24.4 percent of USDA’s predicted 2022/23 export total.

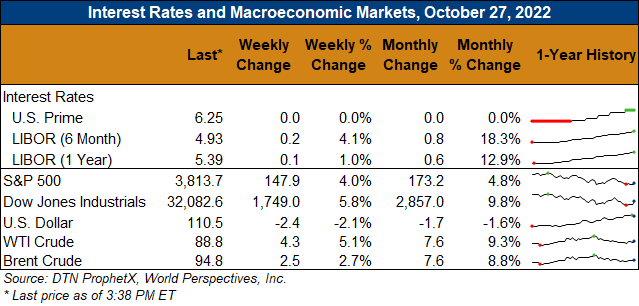

From a technical standpoint, December corn futures remain lodged in their sideways trading pattern with minor support at $6.75 and trading range support at the 7 October daily low ($6.71 ½). The trading range high lies at $7.06 ½ with minor resistance near $6.85. Trading volume has been declining as volatility and uncertainty in agriculture and non-agricultural markets has prompted managed money funds to pare position sizes. Again, the fact that new crop futures have avoided a selloff amid the quickly advancing harvest points to underlying strength, as does the Midwest average basis, which is trading 5 cents over December futures this week. The lack of selling pressure and a strong basis argues for steady/higher prices to develop this fall and winter.