Chicago Board of Trade Market News

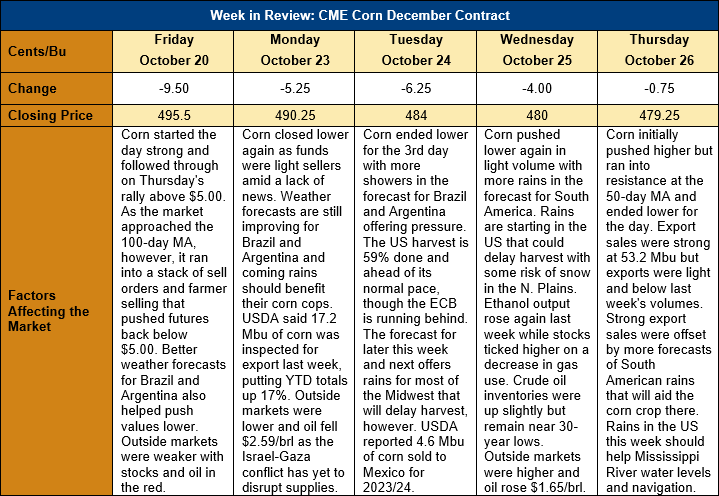

Outlook: Corn futures are 16 ¼ cents (3.3 percent) lower this week as the market continues to pull back from last Thursday’s short-lived breakout above $5.00. December futures’ rally above $5.00 last week sparked some follow-through and technical buying on Friday that took the market to the 100-day moving average. Once futures hit that point ($5.10), however, they ran into a stack of sell orders and farmer selling that pushed the market back below $5.00. Since then, futures have gradually drifted lower amid a lack of fundamental news and favorable weather developments in South America.

Fundamentally, one of the biggest drivers of this week’s pullback was improved weather forecasts for Brazil and Argentina. Both countries are slated for meaningful showers this week and next that will aid the development of the South American corn crop. There is still lingering risk, however, as southern Brazil – especially Rio Grande do Sul and Parana – are battling heavy rains and flooding. The excessive rains will negatively impact the first (and smaller) corn crop, which is currently being seeded. Additionally, while El Nino weather events typically bring favorable conditions to South America the current weather pattern has not behaved as expected, which suggests significant weather risks may persist across the crop year.

The U.S. corn harvest is 59 percent finished according to Monday’s Crop Progress report. That figure is up 5 percentage points from the five-year average and in-line with the 2022 pace. Notably, all states in the Western Corn Belt are running ahead of schedule this year while those in the Eastern Corn Belt, including Indiana, Ohio, and Michigan, are behind their normal pace due to recent rains. The relatively quick pace of this year’s harvest has helped minimize the risk of poor weather disrupting harvest or altering harvested acres and yields. That trend will see challenges in the coming week, however, as widespread showers are predicted for the Midwest with heavy rains in the southern Plains and parts of the Eastern Corn Belt. Fortunately, the 6-10-day outlook offers colder but drier conditions into early November before a warming trend begins.

The weekly U.S. Export Sales report featured 1.438 MMT of new corn sales, which was up sharply from the prior week. Exports of 483 KMT were down 6 percent from the prior week but put YTD exports at 4.483 MMT, up 21 percent. YTD bookings (exports plus unshipped sales) now total 17.527 MMT, up 24 percent and account for 41.5 percent of USDA’s projected export volume.

Sorghum export sales remain a bright spot for the market as well, with net sales of 191 KMT reported last week. That figure was up 218 percent from the prior week and put YTD bookings at 2.547 MMT, up 717 percent.