Chicago Board of Trade Market News

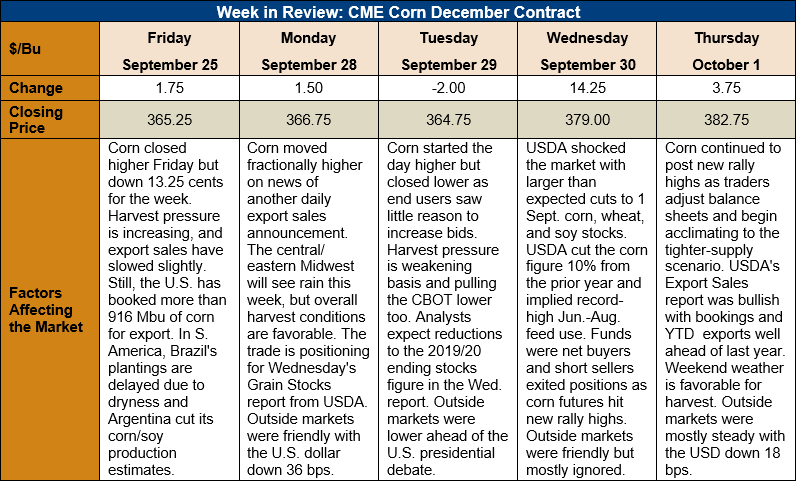

Outlook: December corn futures are 17.5 cents (4.8 percent) higher this week following a surprisingly bullish Grain Stocks report from USDA on Wednesday. The agency surprised the market with larger-than-expected cuts to 2019/20 ending stocks and an increase in production for that marketing year. The report also implied strong feed demand in the last quarter of the 2019/20 marketing year. The report was certainly bullish, and markets moved higher Wednesday afternoon and Thursday as traders adjust to a tighter-supply scenario for the coming year.

USDA reported that corn stocks as of 1 September (the end of the 2019/20 marketing year and the start of 2020/21) totaled 50.676 MMT (1.995 billion bushels). That figure was 5.919 MMT (233 million bushels) below the September WASDE estimate and 10 percent below 2019 levels. Corn consumption totaled 76.712 MMT (3.02 billion bushels) for the June-August period, up 1.2 percent from the prior year. The consumption estimate, combined with export data, implies a record-high feed and residual use of corn.

Based on the September stocks data, farm program reports, and exports, USDA adjusted its estimates for the 2019/20 corn crop size. The agency revised the production figure 68,000 MT higher to 347.77 MMT (13.691 billion bushels). The revisions also included a new planted area of 36.9 million hectares (89.7 million acres) and harvested area of 32.907 million hectares (81.3 million acres). Based on those figures, USDA increased the U.S. average 2019 yield to 10.519 MT/hectare (167.5 bushels/acre)

The weekly Export Sales report once again featured large export sales for corn. Net sales totaled 2.027 MMT, down 5 percent from the prior week but still well above 2019 volumes and the five-year average. Weekly exports totaled 0.75 MMT, down 11 percent from the prior week. YTD exports total 2.743 MMT, up 71 percent, while YTD bookings (exports plus unshipped sales) total 24.622 MMT, up 154 percent.

Cash corn prices are 4 percent higher this week with the national average price reaching $3.52/bushel, edging above September highs. Grain elevators report that farm sales picked up substantially following Wednesday’s CBOT rally as producers sold into the rally. Before this week, basis levels had started to weaken under the advancing harvest, but this week’s rally has caused basis bids to firm. Harvest was 15 percent complete as of this Monday’s USDA report and good weather for the Midwest is expected to allow farmers to make quick progress.

From a technical standpoint, December corn futures a posted a highly bullish day on Wednesday, closing 14 ¼ cents higher and at a new rally high. The close above the September high attracted additional technical buying and pushed the market above the key resistance level of $3.80 on Thursday. Trading volume has been heavy as funds extend their long positions and short sellers were forced to exit. Given the magnitude of the USDA’s Grain Stocks surprise, the corn market is likely to maintain its current levels and potentially grind higher, even as the U.S. harvest progresses.