Ocean Freight Markets and Spreads

Ocean Freight Comments

With the election of President Donald Trump to return to the Whitehouse on January 20, 2025, there are questions when he will put in place tariffs on targeted countries as a tool to level the playing field. The goal is to have reciprocity with trading partners. Reportedly, shippers are looking to “front load” cargoes to and from China and other countries on President Trump’s watch list. Such front loading could snarl commodity supply chains and logistics.

The International Longshore Association ended its three-day strike at ports along the U.S. East and Gulf Coasts on October 3. They settled certain aspects of a contract with the U.S. Marime Alliance. ILA and USMA resumed negotiations last week. The negotiations are expected to focus on automation. The extended contract expires January 15, 2025. Shippers will again divert cargo away from the U.S. East and Gulf Coasts until a final contract is approved.

The Houthis terrorist group, backed by Iran, has been silent in recent weeks with no reported attacks of vessels sailing through the Red Sea and around the Arabian Peninsula. The U.S. led military alliance continues to eliminate Houthi missile and drone assets. Vessel owners and operators are reluctant to return to the Red Sea anytime soon. Instead, they continue using the longer route around the Cape of Good Hope. The longer route has led to higher container utilization rates due to longer transit times. When vessel owners and operators return to the Red Sea, container utilization rates will fall, and those lower levels will bring freight rates down as well.

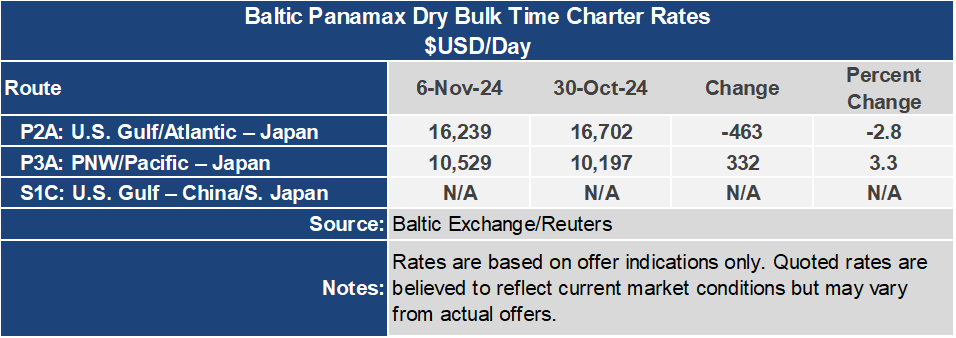

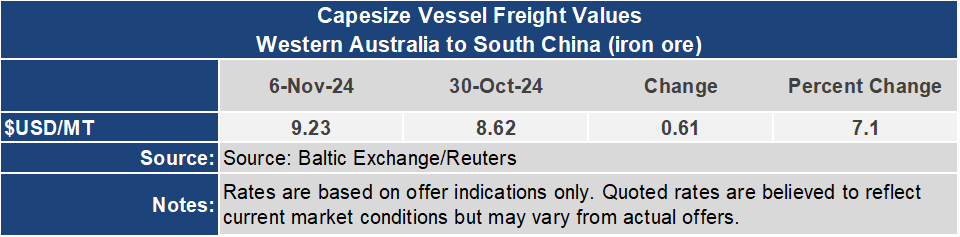

The Baltic indices halted their downward spiral this week. The Baltic Dry Index gained 2.3% or 32 points this week to 1,427. BDI is viewed as a barometer of the health of the dry bulk sector and economies dependent on them to deliver the feedstocks for food, fuel and manufacturing. Compared to one year ago, however, the BDI is 6.7% or 103 points below its level one year ago. The Baltic Capesize Index, which accounts for substantial movement in the BDI, surged 11.6% or 214 points to 2,060 for this week while 11.1% or 258 points below its level one year ago. The smaller vessel classes continued their weakness this week. The Baltic Panamax Index was down 1.4% or 17 points to an index of 1,185 while 19.4% or 285 points below its level one year ago. The Baltic Supramax dropped 7.4% or 89 points for the week to 1,118.

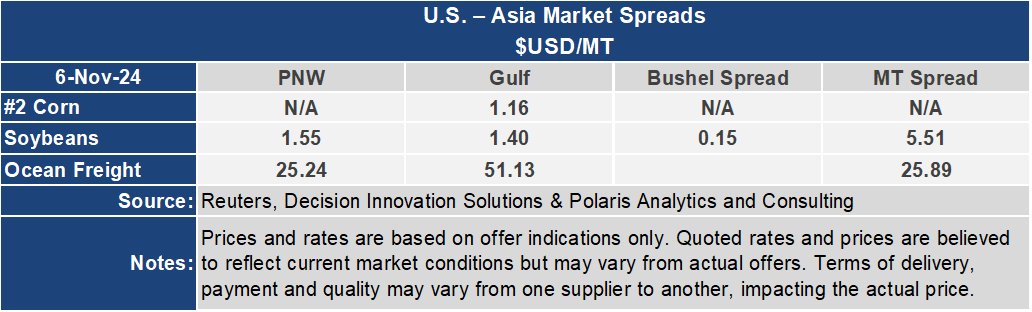

Voyage rates on routes to Asia reversed course this week, taking a stronger tone. The U.S. Gulf to Japan grain freight rate was essentially unchanged $51.13 per metric ton. From the Pacific Northwest the rate gained 2.2% or $0.54 per metric ton to $25.24 per metric ton. The spread between these key U.S. based grain routes narrowed 2.1% or $0.55 per metric ton to $25.89 per metric ton. Both routes are quoted using vessels loaded with 55,000 metric tons.

To China the rate from the U.S. Gulf was $42.09 per metric ton for the week, gaining $0.54 per metric ton or 0.9%. From the PNW, the rate was down $0.17 per metric ton or 0.8% to $21.37 per metric ton. The spread on these routes widened by 2.7% or $0.55 per metric ton to $20.72 per metric ton. Both routes to China are quoted using vessels loaded with 66,000 metric tons.