Chicago Board of Trade Market News

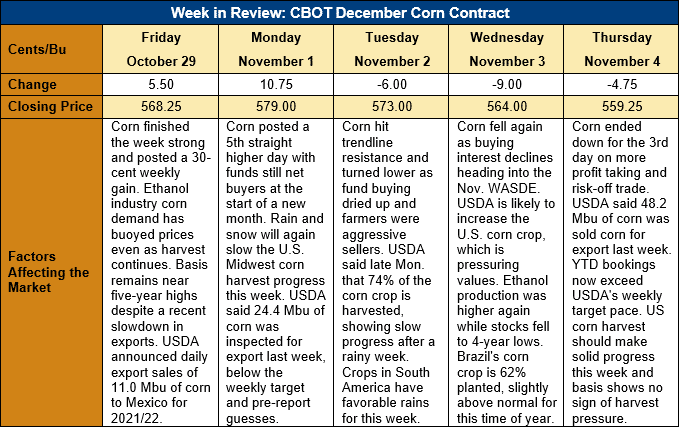

Outlook: December corn futures are 9 cents (1.6 percent) lower this week as the market has corrected lower after last week’s 30-cent gain. Fund buying and surging ethanol margins fueled much of last week’s rally, but traders are now focused on evening positions and managing risk ahead of next week’s November WASDE. Official pre-report estimates are still pending, but private forecasts published so far generally expect modest increases in the 2021 U.S. corn crop and ending stocks. Whether USDA’s report will confirm these numbers remains to be seen, but futures traders are booking profits in preparation for a neutral or possibly bearish report.

The U.S. corn harvest remains ahead of its normal pace, thanks to this year’s early and aggressive start. Recent rains and snow in some parts of the Corn Belt have slowed progress, however, with farmers harvesting 8 percent of the crop last week, bringing the total to 74 percent. That figure is up from the five-year average pace of 66 percent and last year’s pace as well. Harvest has been faster than usual in the northern Plains and Western Corn Belt while the Eastern Corn Belt (notably, Indiana and Ohio) have struggled to meet their normal progress rate. Fortunately, above-average temperatures are forecast for the coming week, which will aid fieldwork, though showers across the central Corn Belt may continue to delay progress.

U.S. corn exports rebounded last week with net sales hitting 1.223 MMT (up 37 percent from the prior week) while weekly shipments increased 9 percent to 0.748 MMT. The week’s activity put YTD bookings at 31.008 MMT (down 7 percent) and YTD exports at 5.893 MMT (down 14 percent). Sorghum net sales totaled 0.265 MMT and exports were up from the prior week at 3,700 MT.

Midwest corn basis levels remain near or at five-year highs with support coming from strong ethanol demand and the increase in export interest. On average across the U.S., basis is -14Z (17 cents under December futures), up from -17Z last week and above the -20Z recorded this time last year. U.S. farmers took advantage of the corn futures rally on Monday and early Tuesday to market some of the 2021 crop, but the fresh round of sales did little to pressure basis. The fact that basis remains strong suggests commercial firms are expecting or experiencing tighter than normal supplies.

From a technical standpoint, December corn futures formed a mildly bearish reversal on Tuesday after pushing to new rally highs at $5.86. The day’s highs coincided with trendline resistance that has been in place since 10 June 2021. December futures have short-term trendline support at $5.53 and more significant support at the 100-day moving average ($5.43). Overall, the market is still technically trending sideways within a large $5.06 to $5.84 trading range and is waiting for fresh fundamental development to spark a move outside this range. With funds and end-users both exhibiting a pattern of aggressive buying on breaks within this range, and corn futures seasonally starting to trend higher this time of year, it seems likely the corn market’s next major move may be to the upside.