Ocean Freight Markets and Spreads

Ocean Freight Comments

This week included the 1,000 days since Russia attacked Ukraine and one year ago that the Houthi terrorist organization attacked the first vessel transiting the Red Sea. Ukraine was given authority by the United States to use its long-range missiles to attack Russian targets. Russia responded saying they have lowered the threshold to use nuclear weapons. The Houthis are claiming they are standing on their own and are not being led by Iran. No verified attacks on vessels by Houthis have been recorded for several weeks. Despite recent “calm” through the Red Sea, vessel owners and operators, and shippers refuse to transit the Red Sea in the foreseeable future. The carriers will continue using the longer route around the Cape of Good Hope.

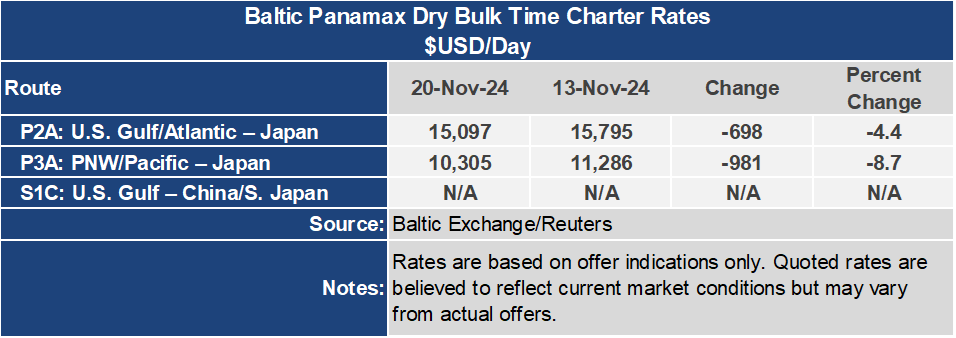

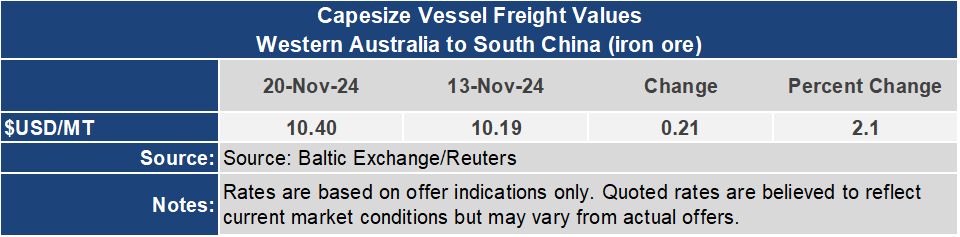

The strength of the Capesize sector could not outperform the weakness in the Panamax and Supramax sectors this week. The Baltic Dry Index dropped 0.9% or 14 points this week to an index of 1,616. The Capesize sector gained 2.3% for the week to an index of 2,810. The Panamax index lost 5.8% to 1,138. The Supramax lost 4.2% to an index of 992.

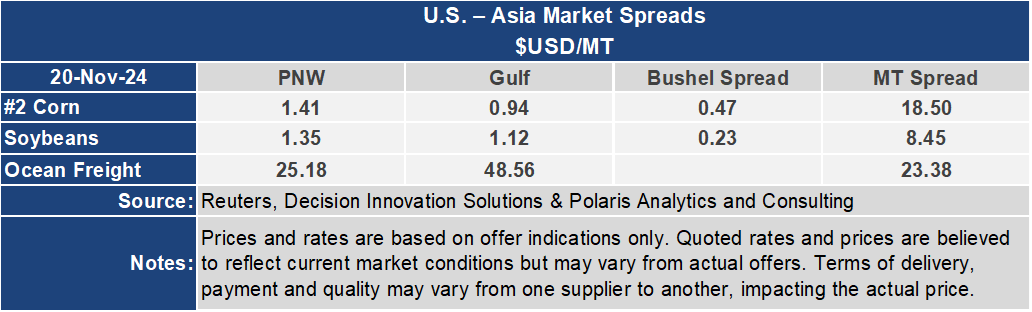

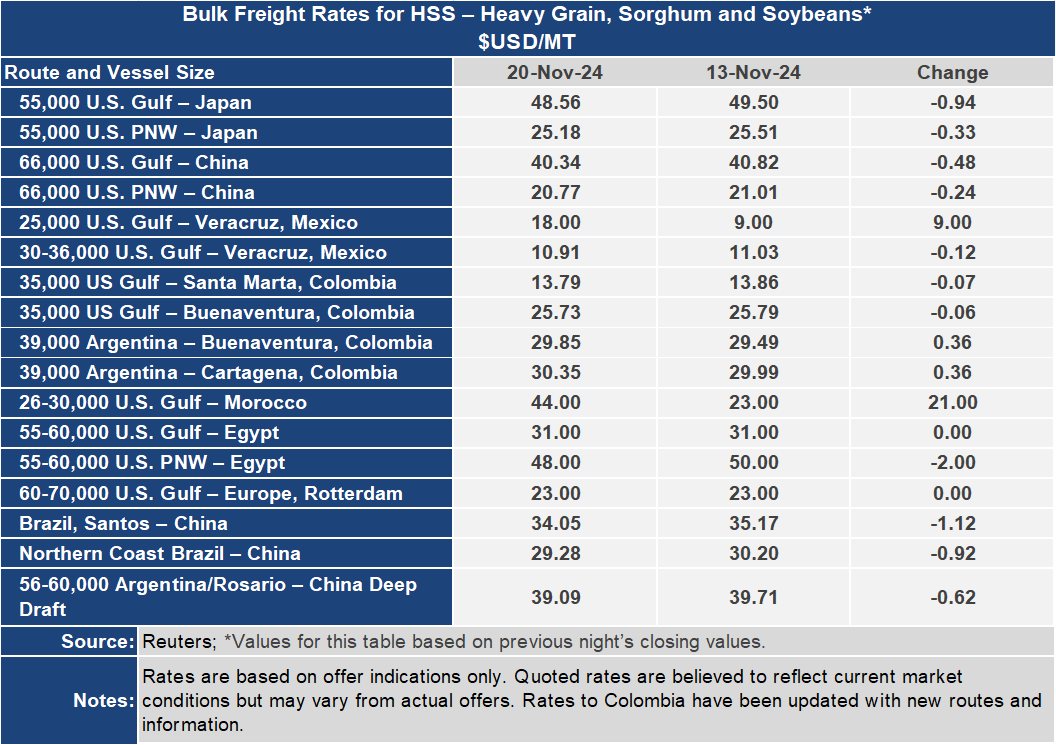

Voyage rates on the key routes to Asia were lower this week. The U.S. Gulf to Japan grain freight rate was down 1.9% or $0.94 per metric ton to $48.56. From the Pacific Northwest the rate was down 1.3% or $0.33 per metric ton to $25.18 per metric ton. The spread between these key U.S. based grain routes narrowed 2.5% or $0.61 per metric ton to $23.38 per metric ton. Both routes are quoted using vessels loaded with 55,000 metric tons.

To China the rate from the U.S. Gulf was $40.34 per metric ton for the week, down $0.48 per metric ton or 1.2%. From the PNW, the rate was down $0.24 per metric ton or 1.1% to $20.77 per metric ton. The spread on these routes narrowed by 1.2% or $0.24 per metric ton to $19.57 per metric ton. Both routes to China are quoted using vessels loaded with 66,000 metric tons.

Since the Houthis terrorist organization attacked the first vessel transiting the Red Sea on November 19, 2023, container ocean freight rates have displayed mixed outcomes. For loaded containers destined to the U.S. West Coast from Far East Asia, the rate for a forty-foot equivalent unit is up 173% to an index of 4,848. From North Europe to the U.S. East Coast the rate is up 125% to an index of 2,823. From the U.S. West Coast to Far East Asia, the rate is down 8% to an index of 702 while from the U.S. East Coast the rate is up 25% to an index of 577. The rates to the U.S. represent several issues pressuring rates, such as tightened capacity utilization, a shift in container discharge away from the U.S. East and Gulf Coasts to the U.S. West Coast until labor issues are settled, peak arrival for the Christmas holidays, and congestion. The rate from the U.S. West Coast reflects more than adequate container availability for U.S. exports.