Chicago Board of Trade Market News

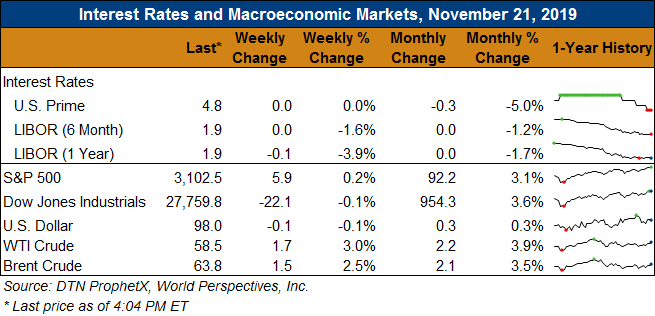

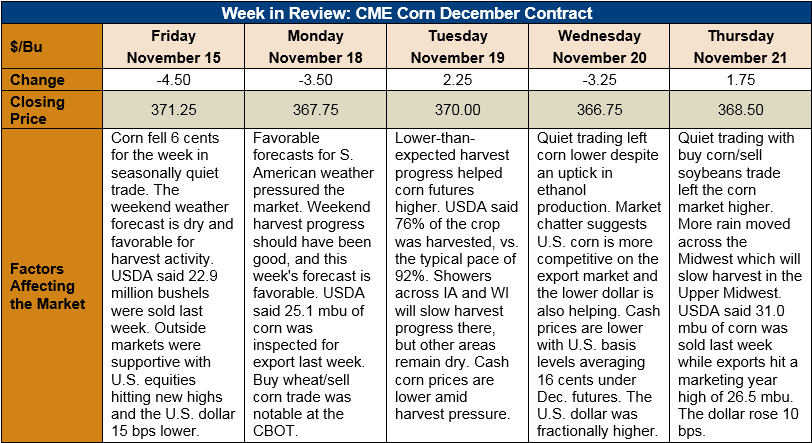

Outlook: December corn futures are 2.75 cents (0.7 percent) lower this week with cash prices slightly weaker and both bullish and bearish news in short supply. The harvest pace and U.S. exports are the market’s primary focus right now, with the U.S. weather remaining generally friendly for field work. On the export side, U.S. offers have become more competitive in recent weeks and a lower U.S. dollar has helped accelerate sales.

The weekly Export Sales report featured 788,000 MT of 2019/20 corn net sales and exports of 673,100 MT – the largest of the marketing year so far. The weekly export figure reflected a 12 percent increase from the prior week. YTD bookings (exports plus unshipped sales) are 13.26 MMT, down 45 percent from the prior year. Other highlights from the report include 26,000 MT of sorghum exports (YTD bookings are up 179 percent) and 1,200 MT of barley shipments (YTD bookings are up 5 percent).

The U.S. corn harvest continues to make progress, albeit at a slower than average pace. On Monday, USDA said 76 percent of the crop has been harvested so far, behind the typical pace of 92 percent. Despite bouts of wet weather this fall, farmers have largely been able to enter fields and harvest their crop, with market chatter about abandoned acres remaining minimal. The biggest concern this year is the high moisture content of the corn crop, with farmers and elevators alike facing higher drying costs. The need for drying the crop has led to tightened Midwest propane supplies and elevated prices.

Cash corn prices are lower this week with the average price across the U.S. reaching $138.76/MT. Futures prices and basis levels have both weakened this week, with basis averaging 16 cents under December futures. Barge CIF NOLA and FOB NOLA values are down from last week with FOB offers reaching $170.50/MT as exporters work to increase the competitiveness of U.S. corn on the export market.

From a technical standpoint, December corn is in a short-term downtrend but appears to have found support in the $3.68-3.70 range. Funds have been adding to short positions this week while end users have been covering their needs on price dips. On Thursday, buy corn/sell soybeans spread trading was supportive for corn futures. One of the biggest stories in the corn market this fall has been the pace of exports. Now that U.S. shipments appear to be accelerating, the futures market is likely to find support and start its seasonal grind higher.