Distiller’s Dried Grains with Solubles (DDGS)

DDGS Comments: DDGS values are higher this week with significant strength in the western rail market driving the rally. Rail values are up $17/MT for November and $22-25 for December and January shipment. Reasons for the rail market strength include the fact that ethanol and DDGS output has been essentially steady over the past several months while demand from the livestock sector has increased.

FOB ethanol plant DDGS prices are $5-10/MT higher this week and the DDGS/cash corn ratio hit 1.29 this week, up from last week and above the three-year average of 1.03. The DDGS/KC soymeal ratio rose to 0.44 this week but remains below the three-year average of 0.51.

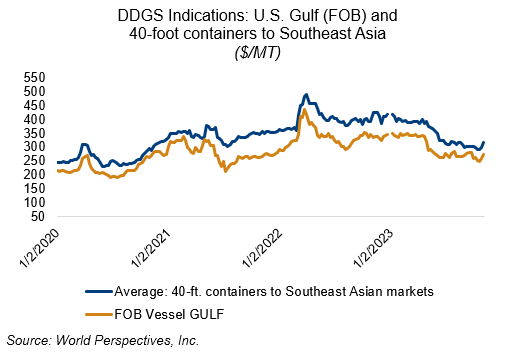

Demand for the rail market is, by extension, supporting prices along the river system and in the export market. Barge CIF NOLA offers are up $14/MT for November this week and are up $12-13 for December – January. FOB NOLA offers are $14/MT higher for spot positions and are up $9-10 for December and early 2024 positions. Prices for containerized DDGS to Southeast Asia have not escaped the rally and are up $16/MT for November this week at $315/MT with December and January shipments up $13 and $14, respectively.

The monthly Grain Crushing report from USDA featured 10.923 MMT (430 Mbu) of corn used in ethanol production in September, which was up 12.2 percent from 2022 and well above analysts’ pre-report expectations. Strong production margins during the month were responsible for the higher-than-expected usage rate. DDGS production was up 2 percent from August and up 4.8 percent from September 2022 at 1.70 million short tons.