Distiller’s Dried Grains with Solubles (DDGS)

DDGS Comments: U.S. DDGS prices are up $2.50/MT this week, erasing last week’s losses as broader feedstuff markets strengthen. Strength in other feed ingredients is creating support in the DDGS market, despite strong U.S. production rates. Cash soymeal prices are up sharply this week amid an increase in demand and a shortage of feed ingredient L-lysine. Kansas City soymeal prices are $15/MT higher this week and at 6-month highs due to the rally. The Kansas City soymeal/DDGS ratio fell to 0.45 this week, down from 0.49 last week but above the 3-year average of 0.42. The DDGS/cash corn ratio slipped to 0.89 this week, down from 0.90 last week and below the 3-year average ratio of 1.09.

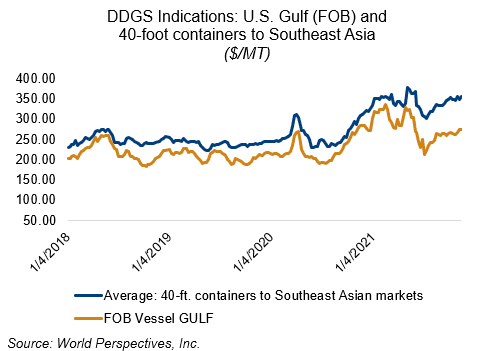

Brokers and exporters report DDGS demand is picking up on the export market. Lower freight rates have helped boost international interest, but buyers also have to contend with this week’s foreign exchange rate swings. Barge CIF NOLA offers are up $7-9/MT for December – February shipment while FOB Gulf offers are $2-3/MT higher for December and January and $7/MT higher for February. Trade to Southeast Asia is still slow and characterized by a wide bid/ask spread but offers are up $5-10/MT for Q1 2022 shipment, averaging $357/MT for 40-foot containers.

Please note that FOB Gulf markets will likely be more volatile than normal as the industry works to recover full capacity in New Orleans area export facilities. There are significant questions about elevation capacity and availability and the DDGS market will have to compete with other grains as the U.S. new crop harvest approaches. Consequently, both flat prices and spreads versus other markets may see greater than normal volatility.