Chicago Board of Trade Market News

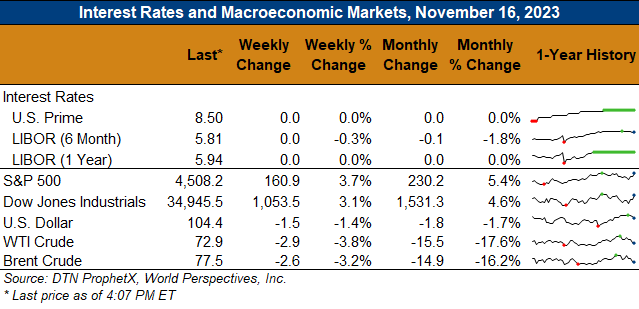

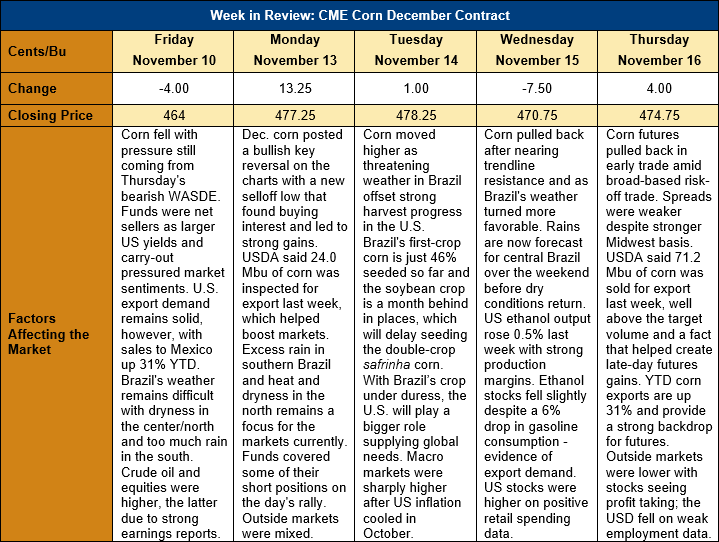

Outlook: Corn futures are 10 ¾ cents (2.3 percent) higher this week as the market reacted to concerning weather forecasts for Brazil amid already-strong U.S. export demand. December corn futures likely made seasonal lows on Monday before they rallied 13 ¼ cents and formed a bullish day on the charts. The move came just two days after USDA’s bearish November WASDE, which suggests traders see more bullish risks ahead than the government report indicated.

Brazil’s challenging weather is the biggest reason for this week’s corn market strength as it could curtail the country’s exports in 2024. The southern states of Parana and Rio Grande do Sul have received above-average rainfall that forced the replanting of some fields and caused other challenges. Meanwhile, the center and north of Brazil have been hot and dry, creating planting delays for the first-crop corn and the soybean crop. Delays in the soybean crop are significant for the corn market as it could disrupt the timing of the safrinha corn crop, which is seeded after the soybean harvest and accounts for about 75 percent of Brazil’s corn production. Brazil’s weather is forecast to remain challenging for crops over the next 10 days. Temperatures will remain above normal for the next 2-5 days, after which cooler temperatures will move into the south and west-central regions. Precipitation, however, will remain below normal for all regions except Parana and Rio Grande do Sul over the next 5 day. The 6-10-day outlook suggests increased precipitation for central Brazil, but agreement is low between models.

Through Sunday, U.S. farmers have just twelve percent of the corn crop left to harvest, though regional progress differences exist. Wet conditions in the eastern Corn Belt and Great Lakes states have created delays there, with just 52 percent of Michigan’s crop harvested (down 14 percent from the five-year average) and 68 percent of Ohio’s crop harvested (down 6 percent from the five-year average). The western corn belt, however, is running ahead of its normal pace and states in the region have harvested more than 90 percent of the crop, except for the Dakotas.

The advancing harvest has pressured basis levels across the Midwest, which now average -25Z (25 cents below December futures) and are down a penny from last week. Basis this year is slightly below the five-year average and significantly lower than the five-year highs of 12Z set this time in 2022. Despite the weaker basis, this week’s futures rally supported flat prices, which currently average $175.55/MT ($4.46/bushel), up 1 percent from last week.

The weekly U.S. Export Sales report featured 1.882 MMT of new corn sales (up 78 percent from the prior week) and exports of 0.683 MMT (down 17 percent from the prior week). Marketing year-to-date exports total 6.497 MMT (up 31 percent) while YTD bookings (exports plus unshipped sales) total 21.098 MMT (up 33 percent). Of note is the fact that corn export bookings for Mexico are up 57 percent YTD at 10.96 MMT (431.5 Mbu) and Japan’s bookings total 2.63 MMT (103.7 Mbu), up 83 percent.

December corn futures posted a bullish technical day on the charts this past Monday with an early move to a new selloff low that preceded a sharply higher close. Commercials were active buyers on the break with export demand increasing as well. Since then, the market has struggled to advance further with resistance looming near $5.00. The market has a tendency, however, to form its seasonal low during this time of year and then push higher as export demand and South American weather worries usually provide support. This year, with corn exports running above expectations and Brazil facing serious weather challenges amid El Nino, it seems likely that Monday’s lows are the seasonal lows. If true, that suggests a steady/higher outlook for corn futures heading into the new year.