Ocean Freight Markets and Spreads

Ocean Freight Comments

The International Longshore Association walked out of contract negotiations with U.S. Marime Alliance this week. The contract covers ILA members on the U.S. East and Gulf Coasts, mainly at container terminals. The ILA is objecting to proposed modernization and automation efforts. The USMX argues that such efforts “improve worker safety, increase efficiency in a way that protects and grows jobs, keeps supply chains strong, and increases capacity.” On October 3, both sides agreed to a tentative agreement on wages and will extend the Master Contract until January 15, 2025. ILA’s actions will further lead shippers divert cargo away from the U.S. East and Gulf Coasts until a final contract is approved.

An ambitious carrier was looking to resume transits through the Red Sea this month. Even though the Houthi terrorist organization has been quiet attacking vessel the past few weeks, the carrier canceled their plans and will continue routing to use the Cape of Good Hope route around South Africa. The U.S. led military alliance continues to eliminate Houthi missile and drone assets.

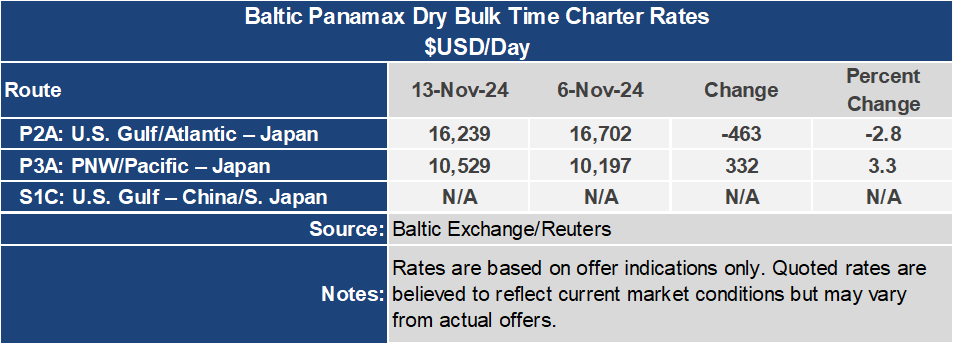

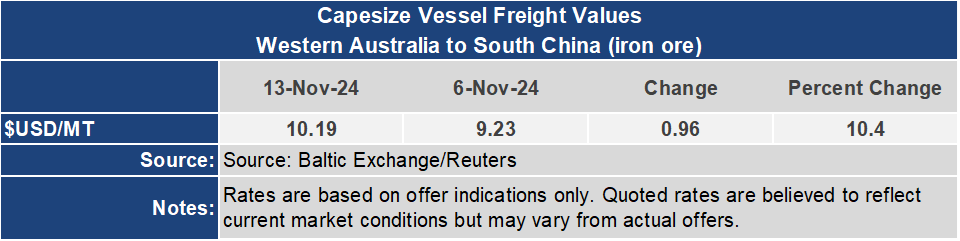

The Baltic indices were mixed this week, with the Baltic Dry Index posting a firmer tone, gaining 14.25 or 203 points to an index of 1,630. The Capesize sector led the index higher, gaining 33.3% for the week to an index of 2,746. The Panamax index gained 1.9% to 1,208. The Supramax on the other hand, was weaker, shedding 7.3% to an index of 1,036.

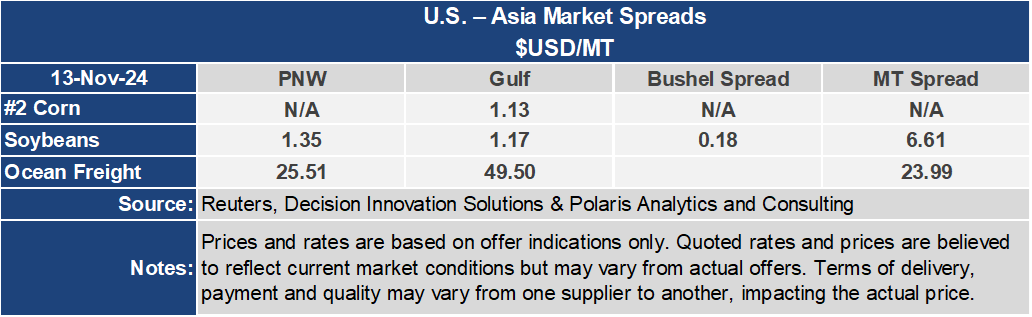

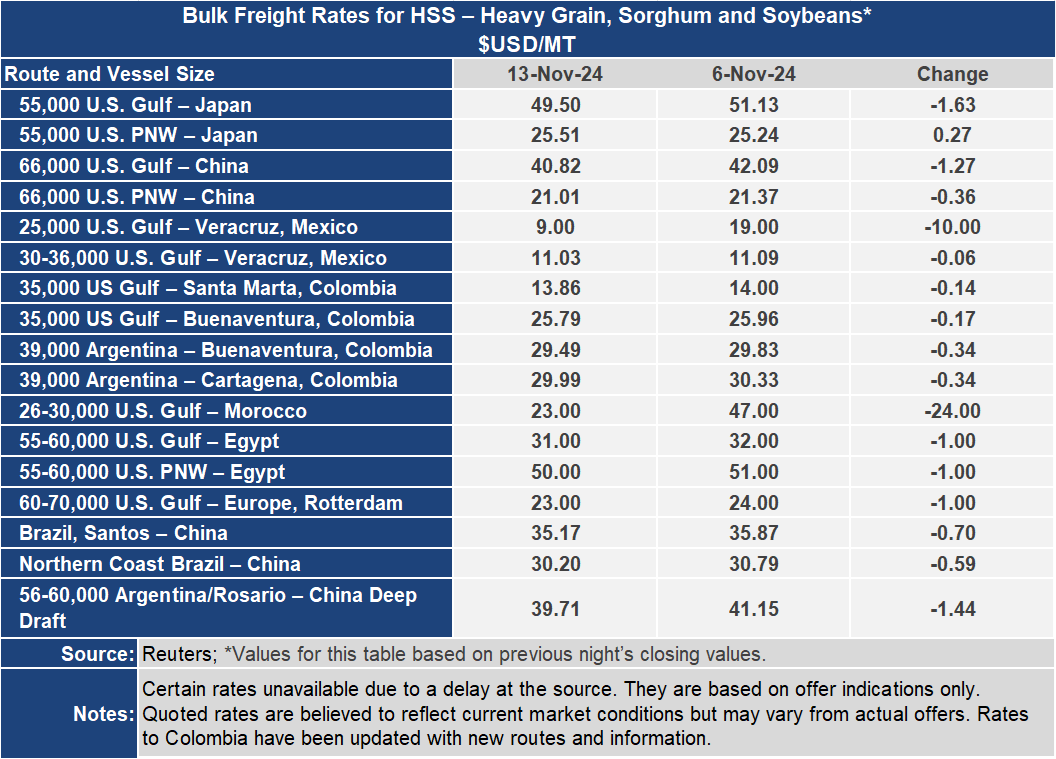

Despite firmness in the indices, voyage rates were mostly lower this week. The U.S. Gulf to Japan grain freight rate was down 3.2% or $1.63 per metric ton to $49.50. This is the first time the Gulf rate was less than $50 since July 2023. From the Pacific Northwest the rate was up 1.1% or $0.27 per metric ton to $25.51 per metric ton. The spread between these key U.S. based grain routes narrowed 7.3% or $1.90 per metric ton to $23.99 per metric ton. This is the narrowest spread since July 2023. Both routes are quoted using vessels loaded with 55,000 metric tons.

To China the rate from the U.S. Gulf was $40.82 per metric ton for the week, down $1.27 per metric ton or 3%. From the PNW, the rate was down $0.36 per metric ton or 1.7% to $21.01 per metric ton. The spread on these routes narrowed by 4.4% or $0.91 per metric ton to $19.81 per metric ton. Both routes to China are quoted using vessels loaded with 66,000 metric tons.