Ocean Freight Comments

Transportation and Export Report: Jay O’Neil, O’Neil Commodity Consulting:

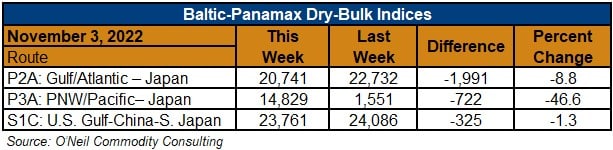

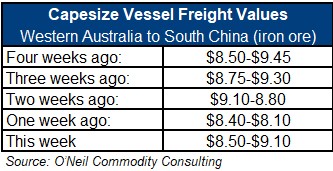

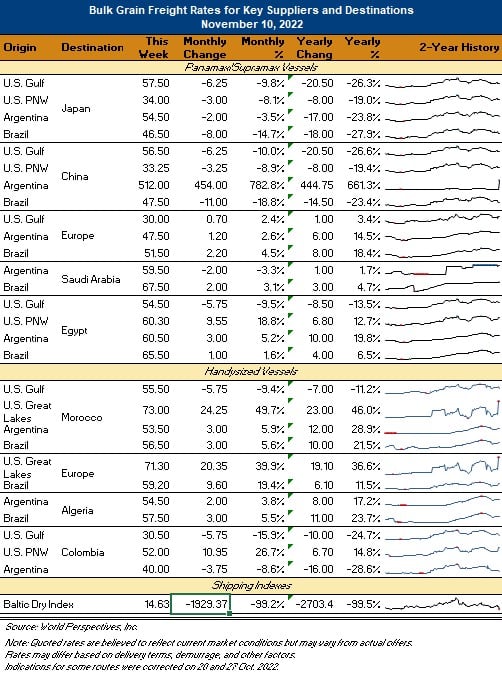

Transportation and Export Report: Jay O’Neil, O’Neil Commodity Consulting: Vessel owners are hoping that history repeats itself. Over the past 5 years Capesize markets have bottomed out in mid-November and rallied slowly into the new year. But this has been an unusual year and FFA paper values for Q1 2023 are not looking very supportive. At the Baltic Freight Brokers conference in Geneva a speaker told participants that “the bottom is in” for Capesize markets but that may be wishful thinking. Lockdowns continue to weigh on the Chinese economy and cargo growth is questionable. Panamax values are holding up a little better than the Capes at $13,100/day for December. Physical freight demand remains soft.

The low water situation on the Mississippi River has improved slightly and barge deliveries are increasing. U.S. Railroad labor contract negotiations continue without resolution but the potential for a strike has been moved forward into mid-December. Much the same is true for the ILWU union contract negotiations at West Coast Container ports.