Chicago Board of Trade Market News

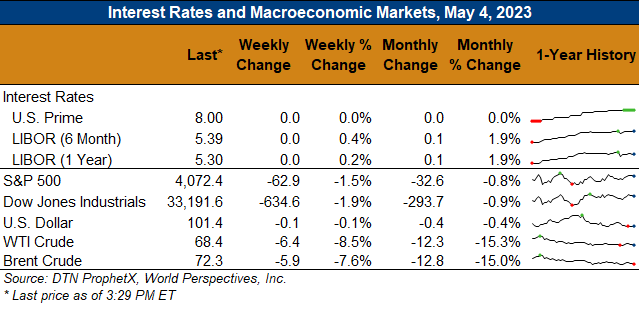

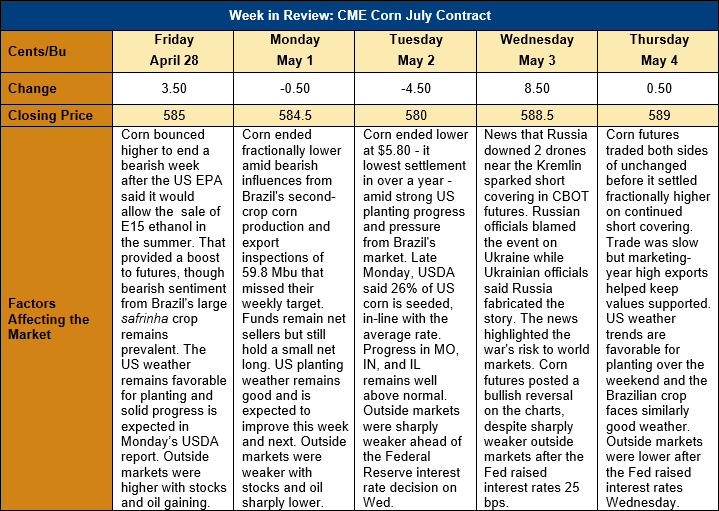

Outlook: July corn futures are 4 cents (0.7 percent) higher this week on a combination of technical support and short-covering. Additionally, political developments in the Black Sea helped create a meaningful rally on Wednesday. Early Wednesday, Russian officials said two Ukrainian drones were downed near the Kremlin, a move the country said was an assassination attempt on President Putin. Ukrainian officials denied any involvement in the incident and said it was a story fabricated by Russia. Regardless of either side’s perspective, the development highlighted the ever-present risks from the ongoing war and created a large wave of short-covering that sent the July corn contract 8 ½ cents higher.

American farmers continue to make strong progress seeding the 2023 crops amid mostly favorable weather in the Midwest. On Monday, USDA said that 26 percent of U.S. corn fields were seeded, a pace exactly in-line with the five-year average. Notably, the planting effort in Missouri is 40 percent above the average pace, while seeding in Illinois and Indiana are 12 and 7 percent above average, respectively. Cooler and wetter conditions in the western Corn Belt and Northern Plains have so far prevented much fieldwork progress, with Iowa’s planting 2 percent behind normal and Minnesota’s lagging the normal pace by 15 percent. The weather outlook for the next two weeks offers good chances of above-average temperatures and diminished rainfall that will help increase the pace of fieldwork.

U.S. corn exports hit a marketing year high last week with 1.699 MMT exported. That volume was up 58 percent from the prior week and put YTD exports at 25.37, down 37 percent. Last week’s gross export sales totaled 0.48 MMT, down from the prior week but enough to put YTD bookings (exports plus unshipped sales) at 38.136 MMT (down 35 percent). Bookings now account for 81 percent of USDA’s projected export program with four months left in the marketing year.

Last Friday, the U.S. Environmental Protection Agency (EPA) announced a move to allow the sale of gasoline blended with 15 percent ethanol (E15) during the summer. The waiver will temporarily exempt E15 fuel from regulations that currently effectively block sales from 1 June through 15 September in much of the U.S.

On Monday, the USDA released its monthly Grain Crushings report, which featured 11.125 MMT (438 Mbu) of corn used for fuel ethanol in March. That volume was above pre-report expectations and marked a 9.8 percent gain from February. The March corn grind was down 3.4 percent from March 2022. Corn used for industrial ethanol totaled 151 KMT (5.9 Mbu) in March, up 19.6 percent from February but down 33.5 percent from 2022, while corn for beverage ethanol totaled 145 KMT (5.7 Mbu), up 70 percent from February and up 32 percent from March 2022. The report also noted that 1.55 MMT (1.7 million short tons) of DDGS were produced in March, up 18 percent month-over-month and up 17 percent from March 2022.

July corn futures posted a bullish reversal on Wednesday after early selling pressure took the market to new selloff lows before short covering based on the Russia drone story carried values higher. Wednesday’s lows coincided with major psychological support near $5.70 and deeply oversold technical conditions, which helped support the market’s subsequent rally. Technically, it looks like near-term lows have been made and that sideways trade may develop heading into next week’s WASDE.