Ocean Freight Comments

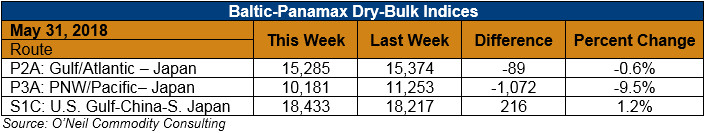

Transportation and Export Report: Jay O’Neil, O’Neil Commodity Consulting: As mentioned last week, a dull or quiet market is not a bullish market. And so it was this week in the dry-bulk freight world. Vessel owners remain hopeful that cargo demand will pick up in the second half of the year and that 2019 will bring improved results. But spot tonnage continues to outweigh cargo demand and rates are therefore weaker. Weak markets are never good for vessel owners and those with long positions in freight, but it is especially painful with bunker fuel prices on the rise. In the past twelve months bunker fuel costs have jumped $160/MT or 53 percent, and dry-bulk vessel operators have been unable to pass this additional cost on the others. Container shipping lines, however, are imposing emergency fuel rate increases to their customers.

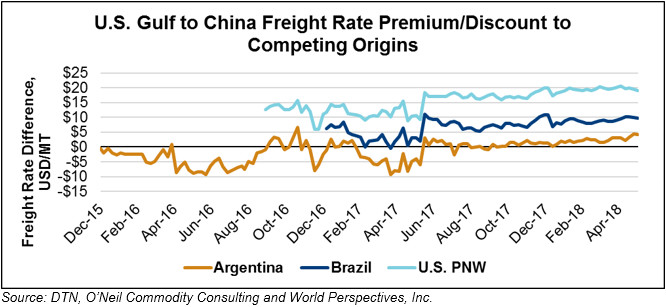

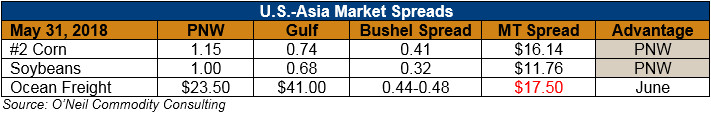

U.S Gulf to China dry-bulk Panamax freight has been offered at $42.50 via the Panama Canal and at $41.00/MT via the Cape of Good Hope. Buyers interest is slightly below these levels, but it is the $1.50 price spread that remains interesting considering the rising fuel cost. Slow steaming will certainly be employed.

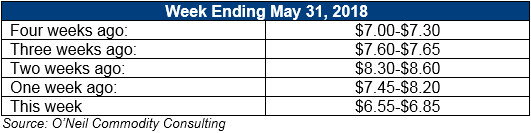

Below is a recent history of freight values for Capesize vessels of iron ore from Western Australia to South China:

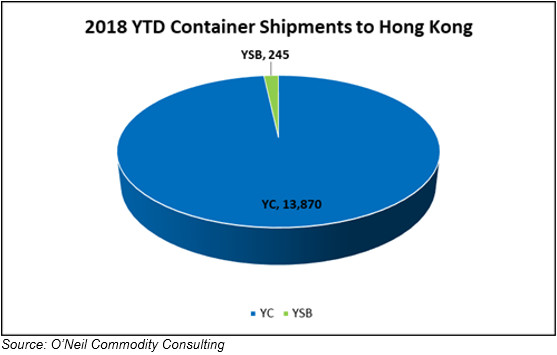

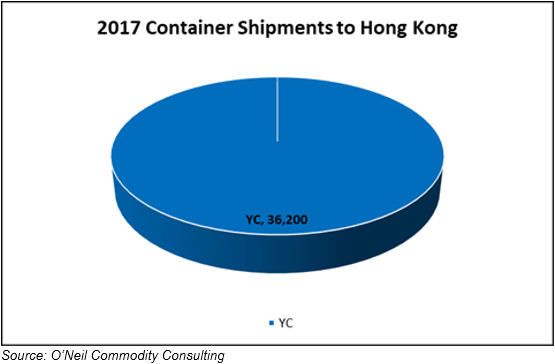

The charts below represent 2018 YTD totals versus 2017 annual totals for container shipments to Hong Kong.