Ocean Freight Markets and Spreads

Ocean Freight Comments

Vessel transits and wait times through and at the Panama Canal are rising as Gatun Lake water levels improve. With improving water conditions in Gatun Lake and the rainy season is upon Panama, shippers and vessel owners and operators are opting to transit the Panama Canal to shorten sailing time between the United States and Asia and other routes. The Panama Canal Authority has a limited transit restriction still in place, but as conditions improve those restrictions will be eased.

The Houthis terrorist group reportedly attacked six vessel this week including the m/v Laax that had discharged 60,000 metric tons of Brazilian soybeans in Turkey. No injuries were reported, and the vessel sailed on to safe harbors. The Arabian Peninsula the Red Sea in particular, and according to the Houthis attacked vessels in the Arabian Sea and Mediterranean Sea and remains a tinder box of terrorist activity. The shipping community and others do not see an end to the attacks anytime soon. Vessel owners and operators continue to avoid the region as much as possible.

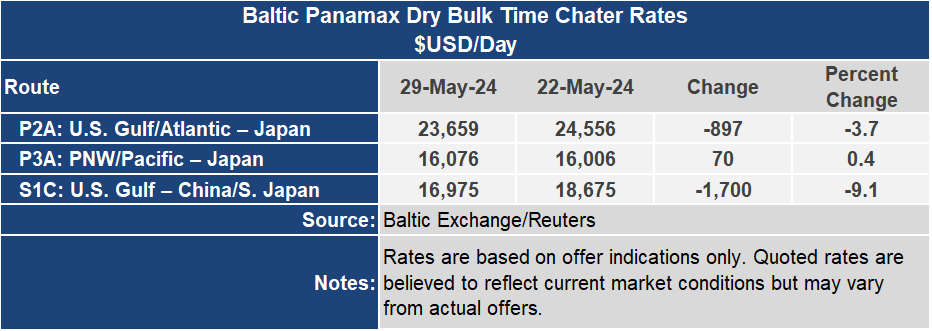

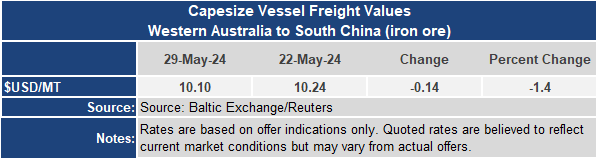

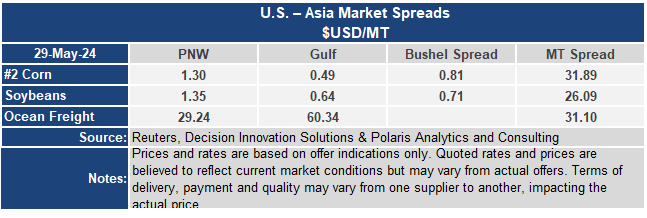

Baltic indices were mixed this week with the Capesize index up 3.5% or 90 points to a reading of 2,674. But those gains were offset by the Panamax index that was down 3.8% to 1,762, and the Baltic Supramax that was down 5.7% to 1,293. Overall the Baltic Dry Index ended the week about 1% lower to 1,790. Ocean freight is not finding any sustained move higher or lower, rather moving more in a sideways range bound pattern. Demand has been sluggish as vessels are in abundance waiting for fresh cargo news.

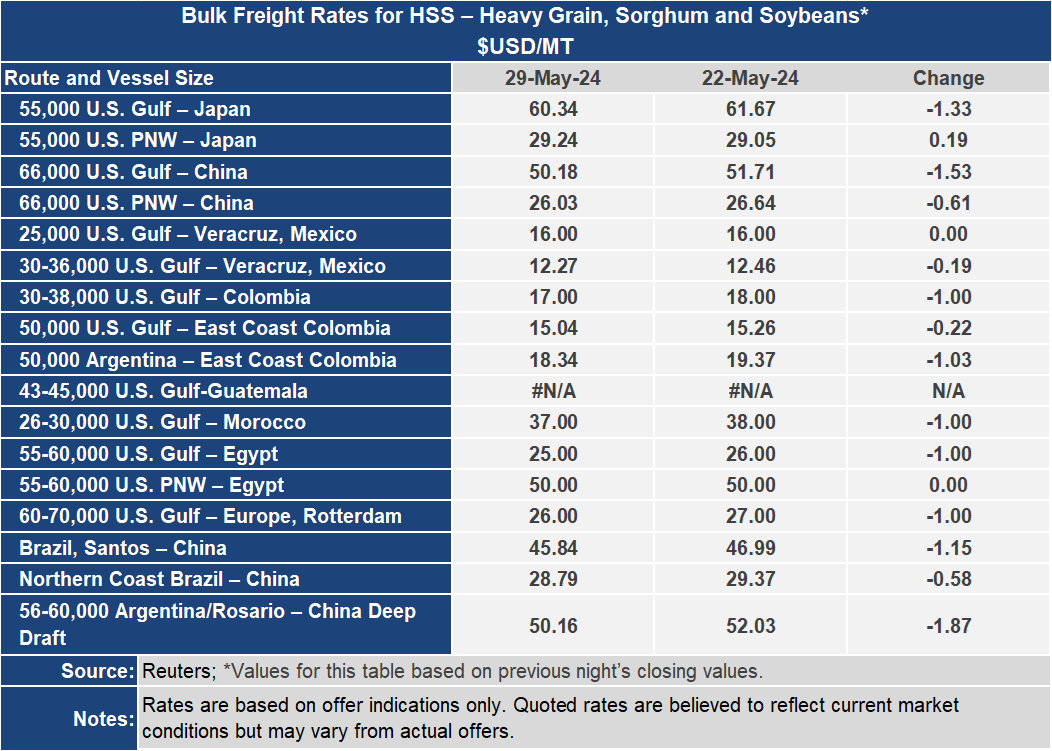

On the key U.S. grain routes, rates were lower mainly out of the Atlantic Basin with the Gulf to Japan rate ending the week at $60.34 per metric ton, a drop of $1.33 or 2.2% for the week and down $1.53 or 3% to China to $50.18 per metric ton. Out of the Pacific Northwest the rate to Japan ended the week nominally higher to $29.24 per metric ton, an increase of less than one percent while to China the rate was down 2.3% or $0.61 per metric ton to $26.03.