Chicago Board of Trade Market News

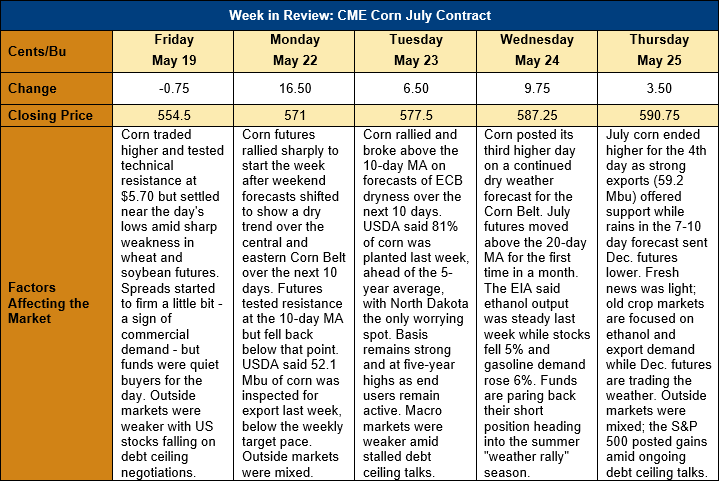

Outlook: July corn futures are 36 ¼ cents (6.5 percent) higher this week as dry weather forecast for the Eastern Corn Belt and technical buying and short covering buoyed markets. This week’s gains have erased all of last week’s losses and July futures are now approaching a major psychological barrier at $6.00. Despite the April-early May weakness in corn futures, Midwest basis levels have remained strong and at five-year highs for many areas, which helped support futures this week. Fundamentally, this is the time of year when old crop markets’ focus narrows to export and ethanol demand while new crop markets are primarily concerned with the U.S. (and other Northern Hemisphere producers) weather. This dynamic often leads to more volatile spreads and diverging market trends for futures tied to different crop years.

The 2023 U.S. corn planting effort entered its final stages this week after USDA reported Monday that 81 percent of fields are planted so far. That figure is up from the five-year average pace of 75 percent and last year’s 69 percent planting. Of the top 20 corn producing states , planting lags the five-year average pace in North Dakota, Colorado, Kansas, and Texas. In contrast, every state that borders or is east of the Mississippi River is running ahead of the normal planting pace. Fifty-two percent of the corn crop has emerged so far, ahead of the normal 45 percent emergence rate with cooler weather in the Upper Midwest delaying emergence in a handful of states.

U.S. corn sales were down from the prior week, but exports rose 38 percent and totaled 1.502 MMT for the week. This week’s exports put YTD shipments at 29.106 MMT (down 35 percent) while YTD bookings (exports plus unshipped sales) now total 37.9 MMT (down 36 percent). There was also 52,000 MT of new crop (2023/24) sales that put outstanding new crop sales at 2.753 MMT.

From a technical standpoint, July futures seem to have made their near-term lows last week at the 18 May daily low of $5.47 and have garnered upside momentum on a combination of bottom-picking and short-covering trade. Wednesday’s trade that took the market above the 20-day MA for the first time since 21 April was a technical win for bulls and one that will likely create a test of trading range resistance at $6.00.