Chicago Board of Trade Market News

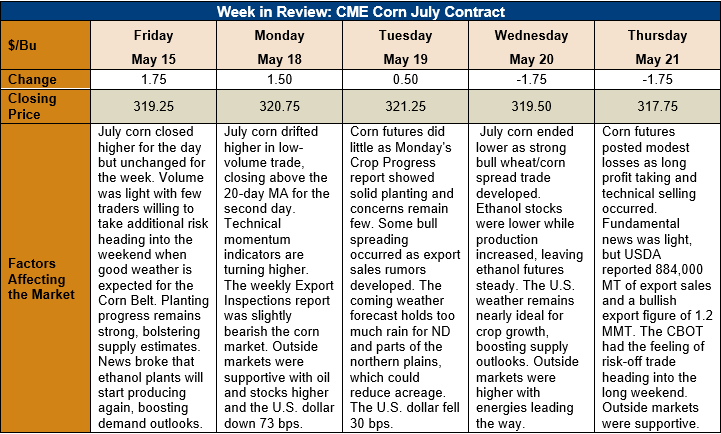

Outlook: July corn futures are 1.5 cents (0.5 percent) lower this week with traders mostly adjusting positions and taking risks off the table ahead of the U.S. Memorial Day holiday on Monday. The futures market remains range-bound with early-week strength inviting mild selling pressure on Wednesday and Thursday. The export market remains strong, which is helping keep futures above the trading range floor.

The weekly Export Sales report from USDA was bullish with 884,000 MT of net sales recorded and 1.26 MMT of weekly shipments. The shipment pace was down 4 percent from the prior week but remained above the pace needed to meet USDA’s projection. YTD exports stand at 26.6 MMT (down 30 percent) while YTD bookings total 39.4 MMT (down 17 percent). USDA reported strong sorghum exports, 263,000 MT, despite this spring’s price increase. Clearly, international sorghum demand remains strong.

The U.S. corn crop is 80 percent planted as of Monday’s USDA report, which is well above last year’s dismal pace (44 percent by the same day) and the five-year average (71 percent). This week has featured rains for the northern Plains which has likely slowed progress. For the Corn Belt, however, the combination of warmer-than-usual temperatures and steady showers has been ideal for crop development. The long-term forecast suggests the 2020 growing season will feature nearly-ideal moisture levels, which is keeping supply concerns at bay for now.

From a technical standpoint, July corn futures are range bound and trading sideways. Trading volume this week has been light with traders content to adjust positions and forego taking additional risk heading into the long holiday weekend. Wheat futures rallied sharply on Wednesday which brought some bear spreading to the corn market. Trade rumors suggest part of the rally was driven by unhedged end-users getting coverage amid developing weather concerns for Europe and the Black Sea. That development is notable as a similar event could easily occur in the corn market. With bearish sentiment prevalent for corn, some end users have likely foregone upside risk protections. If a weather scare or similarly bullish event develops, there could be a rush to get covered that could push prices higher. Historically, the corn market often rallies in the spring/early summer and traders/commercials should not become complacent despite the current sideways trend.