Ocean Freight Comments

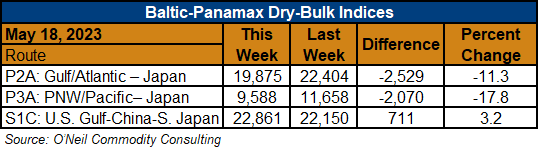

Transportation and Export Report: Jay O’Neil, O’Neil Commodity Consulting: Every week there is hope and small efforts by the FFA paper traders to rally dry bulk markets. Despite vessel owners’ best wishes, however, the early week support fades and sellers come out to even up positions before the weekend. Such was the case again this week as markets sold off on Wednesday and rates lost a little ground week over week. The market is neither seeing nor expecting a substantial drop in rates for Q2 or Q3, it is more a case of a soft and rather flat market looking and waiting for something to interesting happen.

Panamax FFA spot paper dropped to $10,900/day and Q3 traded down $1,900 to $12,600/day with Q4 trading down to $12,55000/day. The vessel supply side situation looks bullish to many observers, but the demand side of the equation has not yet come to the table with sufficient growth to support the anticipated market turnaround. Capesize vessel owners believe rates are currently below their operating costs, but they are still sailing.