Chicago Board of Trade Market News

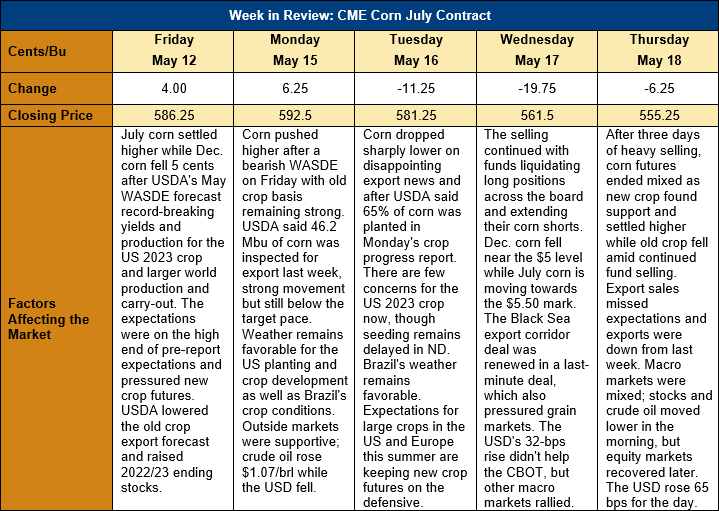

Outlook: July corn futures are 31 cents (5.3 percent) lower this week after the USDA’s May WASDE forecast record-high global corn production for 2023/24 and larger U.S. production and ending stocks. Also contributing to the week’s declines was the renewal of the Black Sea grain export corridor deal, with an eleventh-hour deal struck just one day before the prior agreement expired. The renewed agreement will help ensure grain supplies for the coming marketing year by allowing Ukraine to more fully participate in export markets, despite the forecast for sharply lower production from the country.

The May WASDE featured USDA’s first complete look at the 2023/24 U.S. and world grain balance sheets and initial forecast imply greater grain availability for the coming year. The agency maintained its acreage forecast from the February Ag Outlook Forum of 37.25 million hectares (92.0 million acres) but pegged the 2023 corn yield at 11.39 MT/ha (181.5 bushels per acre) – a new record high – due to expected favorable weather this year. In total, 2023 production was forecast at a record 387.75 MMT (15.265 billion bushels, or “Bbu”), which would be up 11 percent from 2022/23.

On the demand side of the U.S. balance sheet, USDA pegged feed and residual use at 133.99 MMT (5.65 Bbu), up 7 percent from 2022/23 due to the larger crop and expected lower prices. Ethanol use was pegged 3.6 percent higher at 134.62 MMT (5.2 Bbu) while exports are expected to increase 18 percent from 2022/23 to 53.34 MMT (2.1 Bbu). The fundamental driver behind the export increase is the expectation that lower prices will “support a sharp increase in global trade”.

In total, the U.S. 2023/24 corn balance sheet forecast featured record production, increased use, and larger ending stocks. Ending stocks were forecast at 56.44 MMT (2.222 Bbu), up 57 percent from the prior year. The ending stocks-to-use forecast is expected to increase from 10.3 percent in 2022/23 to 15.3 percent in 2023/24 with the season average farm price falling to $188.97/MT ($4.80/bushel).

Outside the U.S., USDA raised its forecast of the Brazilian 2022/23 corn crop from 125 MMT to 130 MMT due to favorable growing conditions and left the Argentine crop estimate unchanged at 37 MMT. The world 2022/23 corn crop estimate was raised from 1,1445.0 MMT to 1,1502.04 MMT with larger trade offsetting the change and leaving ending stocks to grow fractionally to 297.41 MMT.

For the 2023/24 international crop, USDA pegged global production at 1,219.6 MMT, up 6 percent from the prior year. The increase was driven by growth in crop for the U.S., Argentina (forecast 17 MMT higher at 54 MMT), the EU, and China. Global ending stocks were forecast 5 percent higher at 312.9 MMT, “mostly reflecting larger stocks for the U.S.” with smaller carry-out in Brazil and China offsetting some of the impact.

U.S. farmers seeded another 16 percent of the corn crop last week, bringing the total to 65 percent. That rate is slightly above the five-year average progress of 59 percent with the biggest increases from the average pace coming in Missouri, Iowa, Illinois, and Indiana. Delays still exist in North Dakota, Wisconsin, Ohio, and Michigan as a combination of cool and/or wet weather has delayed field work in these states. Thirty percent of the crop has emerged so far, up from the five-year average of 25 percent. Planting is expected to reach three-quarters finished, or better, by next week’s Crop Progress report, which will all but eliminate any worries about negative yield impacts due to planting delays.

U.S. corn sales were down from the prior week but exports remained strong at 1.086 MMT. The export pace was down 5 percent from the prior week and put YTD shipments at 27.603 MMT (down 36 percent) while YTD bookings (exports plus unshipped sales) now total 38.05 MMT (down 35 percent). There was also 74,000 MT of new crop (2023/24) sales that put outstanding new crop sales at 2.7 MMT.