Ocean Freight Markets and Spreads

Ocean Freight Comments

The Unified Command overseeing recovery and restoration efforts of the navigation channels in Baltimore made a significant step to free the m/v Dali, which collided with the Francis Key Scott Bridge and led to its collapse on March 26. The Dali is expected to be freed from the main shipping channel and repositioned to a terminal. In the meanwhile, the command reopened the deeper Fort McHenry Limited Access Channel with daily transits from 8:00 p.m. to 6:00 a.m. The channel will accommodate most vessels calling on Baltimore. It has a controlling depth of 48 feet, 340-foot horizontal clearance, and a vertical clearance of 214 feet. However, the Maryland State Pilots are limiting beam restrictions on container ships, freight ships, tankers and bulk carriers. Because of the collapse of the Francis Key Scott Bridge, the U.S. Coast Guard is studying the vulnerabilities of other bridges near navigation channels around the United States.

The Houthis terrorist group continues its attacks, claiming to fire upon a U.S. warship and a merchant vessel named Destiny in the Red Sea this week. The U.S. Central Command continues to destroy the Houthis drones and inbound anti-ship ballistic missiles. The Arabia Peninsula region remains a tinderbox and many vessel owners and operators continue to divert vessels away from the Red Sea and the peninsula, opting for longer routes around the Cape of Good Hope, which adds costs and leads to higher freight rates on the key routes that otherwise use the Suez Canal and Red Sea for transit.

As water levels in Gatun Lake in Panama have stabilized and are slowly rising, vessel transits and congestion are turning higher. Container and tanker vessels are leading the way with higher transits. The Panama Canal Authority has been negotiating with U.S. liquefied natural gas producers on how to meet increased demand for crossings as water levels recover. Panama’s president-elect, Jose Raul Mulino, wants to expedite permits to expand water reservoir resources to assure the Panama Canal has adequate water.

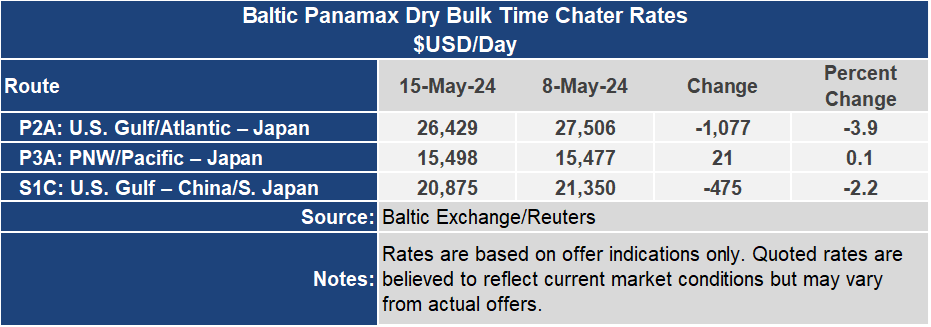

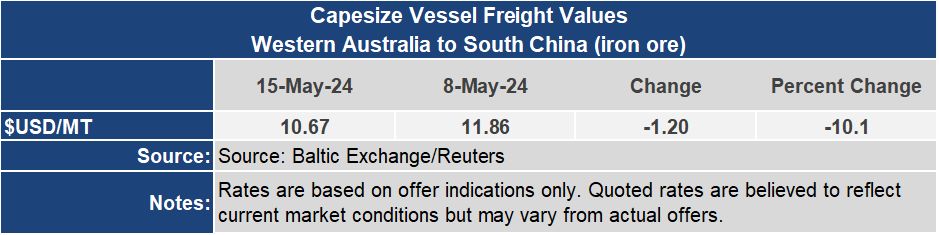

In the topsy turvy world of dry vessel indices, this week the Baltic dry indices turned lower. The Baltic Dry Index, the main index of all dry bulk cargo vessel sizes, dropped 14% to an index of 1,889. The Capesize sector led the way lower being down 24% to an index of 2,699. The Panamax market ended the week 5% lower to an index of 1,905 and the Supramax sector down 2% to an index of 694.

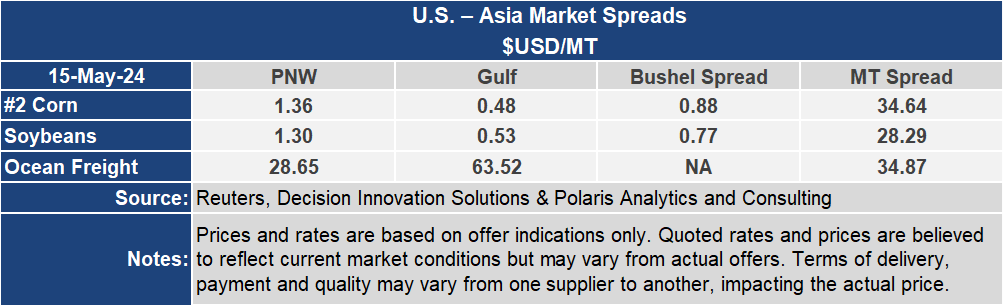

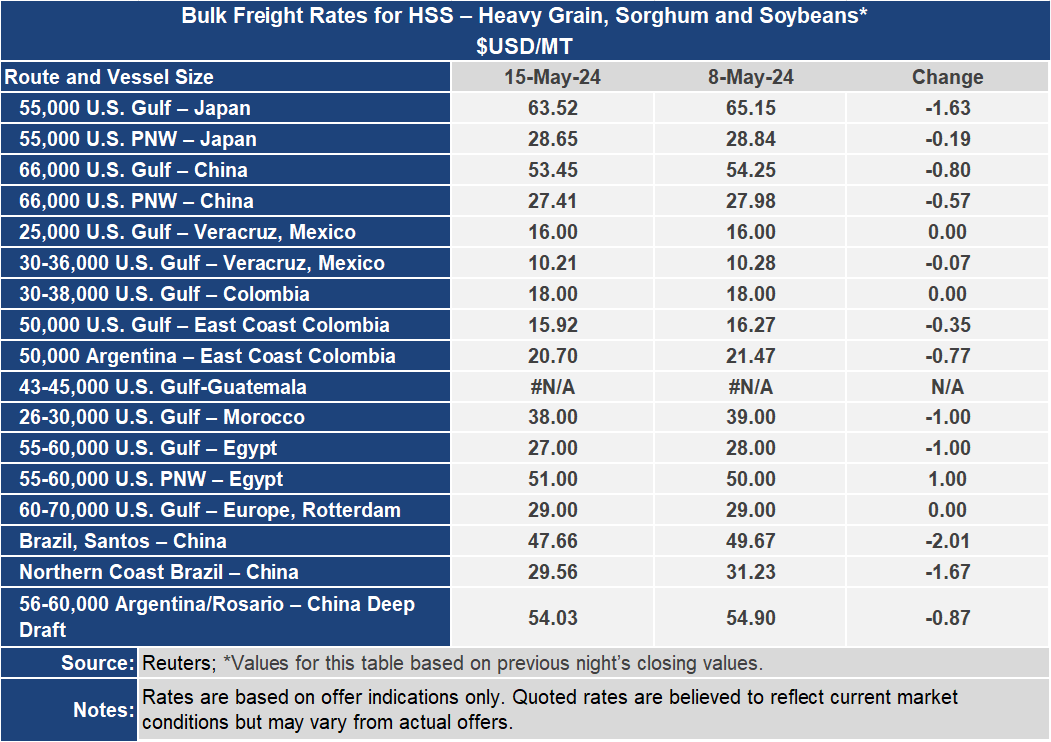

The voyage rates were weaker this week too, with the Atlantic based routes falling faster than the Pacific routes. The rate from the U.S. Gulf to Japan dropped 2.5% or $1.63 per metric ton to $63.52 while the route from the Pacific Northwest to Japan was down less than one percent to $28.65. The spread between these closely monitored routes weakened 4% or $1.44 per metric ton to $34.87. On the routes to China the Gulf rate was down 1.5% to $53.45 per metric ton while the PNW rate declined 2% to $27.41. The freight spread to China narrowed less than one percent to $26.04 per metric ton.