Chicago Board of Trade Market News

Outlook

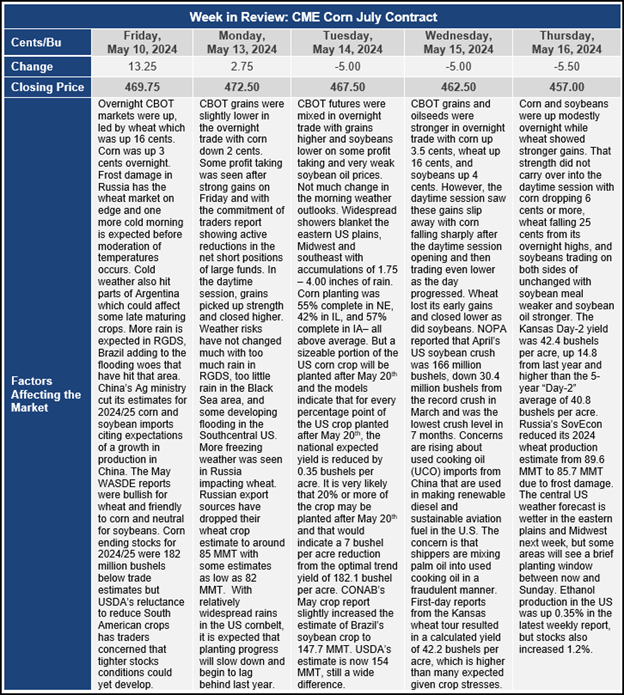

The USDA released its updated WASDE report on May 10, 2024. The May report is one of the more watched WASDE reports of the year as it coincides with the USDA’s first balance sheets estimates for production and use of corn and soybeans for 2024 for the U.S. and the world. With the very large gap between USDA and Brazilian-based estimates of South American corn and soybean production, trade reactions could be significant. This report brought overall friendly news to both the corn and soybean markets. WASDE estimates for U.S. endings stocks domestically and globally were mostly lower than trade expectations, particularly for U.S. and world corn stocks. In general, the initial production estimates for U.S. corn and soybean production were below pre-report trade estimates.

U.S. corn ending stocks for 2023/24 were reduced by 100 million bushels to 2,022 million bushels. This was mostly due to increases in corn use for ethanol (50 million bushels) and increased export expectations (50 million bushels). USDA reduced 2023/24 world ending stocks for corn by 5.2 MMT, to 313.08 MMT, despite very modest reductions by USDA to the South American crop. Relatively wide gaps remain between South American estimates of Brazilian and Argentinian corn and soybean crops and what USDA has estimated. The bigger surprise was in the 2024/25 balance sheets for corn. USDA’s first numbers for the 2024/25 corn crop came in with less acres than were in the USDA outlook released in February and using the 181 bushel/acre trendline yield and lowered beginning stocks, dropped total supply by 269 million bushels. While feed use was down 50 million bushels from the February outlook, use for ethanol was up 150 million bushels and exports were 150 million bushels higher than in the February outlook. This resulted in carryout stocks being 514 million bushels less than in the February outlook and reset the baseline for the crop that is being planted now.

For soybeans, there were essentially no changes for the U.S. 2023/24 balance sheet. USDA did lower ending stocks in the world soybean balance sheet by 2.44 MMT from their April estimate. This is a modest reduction in world soybean ending stocks given the documented weather disruptions and catastrophic events that have and are occurring in parts of Brazil and Argentina. Despite Argentina’s dryness & the hefty 10- to 25-inch Brazilian rains in RGDS the past 2-3 weeks, the World Board left its Argentine estimate at 50 MMT & only sliced 1 MMT from the April estimate for Brazil to 154 MMT. Given bean reports of 47.5 to 49 MMT from Argentina’s exchanges and the likely spoiling (mold) of Brazil’s RGDS crop before it can all be harvested, many traders remain cautious about these crop levels. Similar to corn, the U.S. weather hasn’t provided many extended planting periods in the Midwest this past week. The prospect of having 50% of the U.S. soybeans planted by May 15 doesn’t seem likely either and does not bode well for the best production outlook.

For the 2024/25 balance sheet, USDA’s planted and harvested soybean acres were down half a million acres from the February outlook, beginning stocks were up 120 million bushels, and production down 25 million bushels. On the demand side of the balance sheet, USDA increased crush by 50 million bushels but lowered seed and residual by 13 million bushels and lowered export projections by 100 million bushels. This resulted in projected ending stocks for 2024/25 being 159 million bushels higher than the February outlook.