Chicago Board of Trade Market News

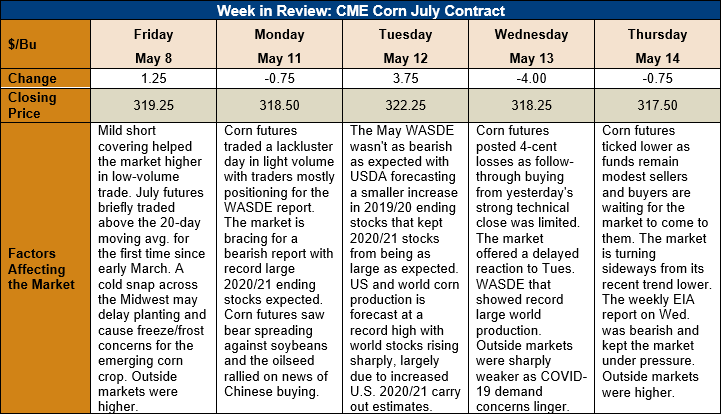

Outlook: July corn futures are 1.75 cents (0.5 percent) lower this week after the May WASDE failed to create much bullish or bearish sentiment. The first interpretation of the 2020/21 outlook was bearish with increased U.S. and world supplies. However, with funds holding a large (220,000- contract) short position in corn, interest in extending this position was limited. Seasonally, corn often rallies during the late spring/early summer and this upside risk is keeping sellers on the sidelines.

USDA’s first detailed forecast of the 2020/21 marketing year included a 406-MMT (15.995-billion bushel) production forecast for the U.S. That figure was based on a planted area forecast of 39.255 million hectares (97 million acres) and trendline yields of 11.21 MT/ha (178.5 bu/ac). The large production figure was well-anticipated by the market and offered few surprises. USDA noted it will resurvey areas of the northern Midwest that have suffered from delayed planting and update its planted area forecast in next month’s report. Private analytical firms are projecting a modest decrease in the planted area figure in the updated report.

On the demand side, USDA is expecting feed and ethanol consumption of corn to rebound from 2019/20 levels. Feed use is forecast to reach 153.678 MMT (6.05 billion bushels) in 2020/21 while ethanol consumption is expected to grow 8.89 MMT (350 million bushels) from the latest 2019/20 estimates. USDA also expects a strong export program to develop in the coming year, with marketing year exports pegged at 54.613 MMT (2.15 billion bushels). In total, USDA is expecting total corn consumption to grow 7 percent in the coming year.

The agency’s forecast for 2020/21 U.S. ending stocks is 84.28 MMT (3.318 billion bushels), which is up sharply from 2019/20. The increased carryout prompted the USDA to peg the 2020 average farm price at $125.98/MT ($3.20/bushel), down from 2019 expectations.

Globally, USDA projected 2020/21 production at 1,186 MMT, up 72 MMT from the current crop year and a record high. Production increases in the U.S., Brazil, Ukraine, Mexico, and Canada were the primary drivers of the record forecast. Total world consumption is expected to grow 73.3 MMT, leaving 2020/21 ending stocks of 339 MMT, up 24 MMT from 2019/20. USDA noted that much of the ending stocks figure is accounted for by Chinese and U.S. stocks, but that ending stocks outside these countries will still increase 4 percent versus the current year.

Beyond the corn market, USDA estimated the 2020/21 U.S. sorghum crop at 8.915 MMT (351 million bushels), up 3 percent from 2019/20, based on a 202,000-hectare (500,000 acre) increase in planted area and an 11 percent increase in yields. USDA lowered the feed and residual consumption estimate from 2019/20 to 1.27 MMT (50 million bushels) but increased the export figure 10 percent to 5.588 MMT (220 million bushels). The net effect is that 2020/21 ending stocks are expected to fall 11 percent from the current marketing year.

U.S. farmers continue to make exceptional progress planting spring crops. USDA reported that, as of Sunday night, 67 percent of intended corn plants were completed, which is 12 percent ahead of the five-year average pace. Planting of the sorghum and barley crops is well ahead of last year’s pace but both statistics lag their five-year average pace. A recent cold and wet weather pattern across the Midwest may delay some progress this week, but the coming report from USDA is expected to show three-quarters or more of the corn crop already seeded.

From a technical standpoint, July corn futures are continuing to trade sideways with a brief break above the 20-day MA earlier this week unable to garner follow-through buying. The May WASDE report should have been bearish but the muted reaction from the futures market suggests there is little that will spark additional selling. As noted earlier, funds hold a large net short position and are not looking to extend sales with weakness in other commodities offering bull spreading opportunities. Buyers have so far remained very patient and have shown little interest in chasing prices higher. Amid patient buyers and speculative funds mostly unwilling to extend their short position, the outlook for the corn market is one of choppy, sideways trade.