Ocean Freight Comments

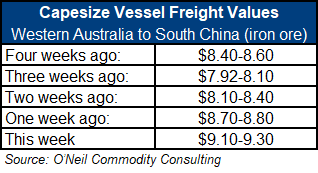

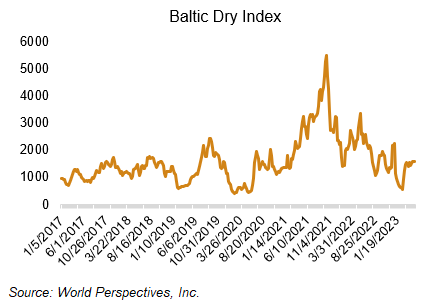

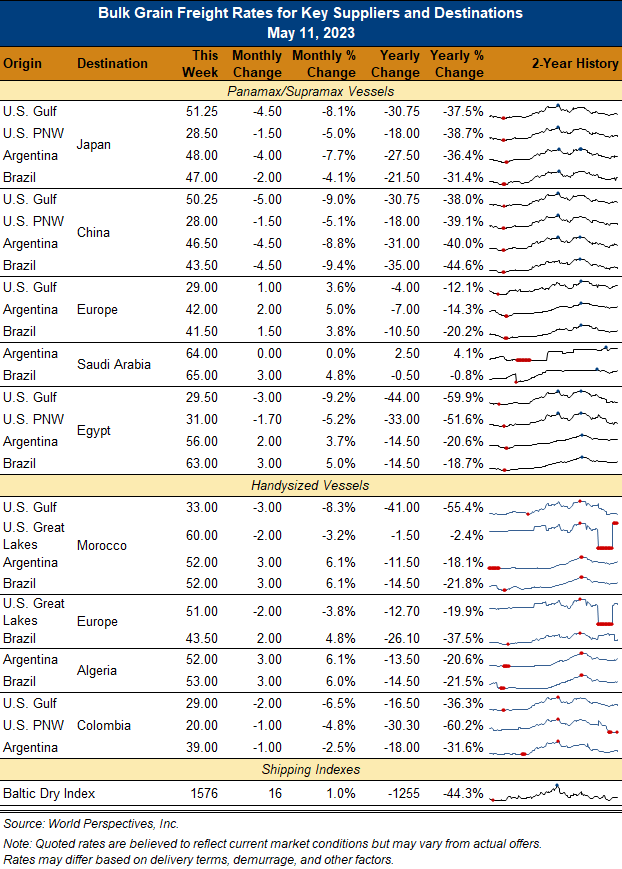

Transportation and Export Report: Jay O’Neil, O’Neil Commodity Consulting: Dry bulk markets continue to slide back. In order to answer the first question, what is wrong with ocean freight markets; one must first answer the second question, what is wrong with the Chinese cargo demand. As mentioned, many times, ocean freight rates depend heavily on Chinese business. The latest Chinese PMI index report was a big disappointment and traders are worried that the lack of economic growth there will cause a reduction in coal and iron ore cargo demand and thus negatively impact freight rates.

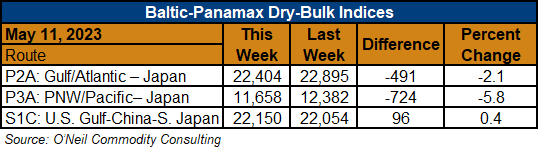

Panamax FFA paper for Q3 traded down $800 points to $14,500/day with Q4 trading down to $14,000/day and calendar year 2024 at just $12,350/day. High expectations are being dashed and bulls are reassessing their market opinions. The market knows well the vessel supply side situation (dry bulk fleet at 984 million dwt), it is the demand side of the picture that is in serious question. Port congestion in Brazil and China is however rising and will have to be watched carefully.