Chicago Board of Trade Market News

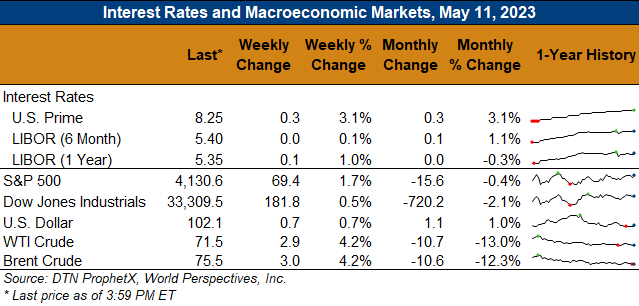

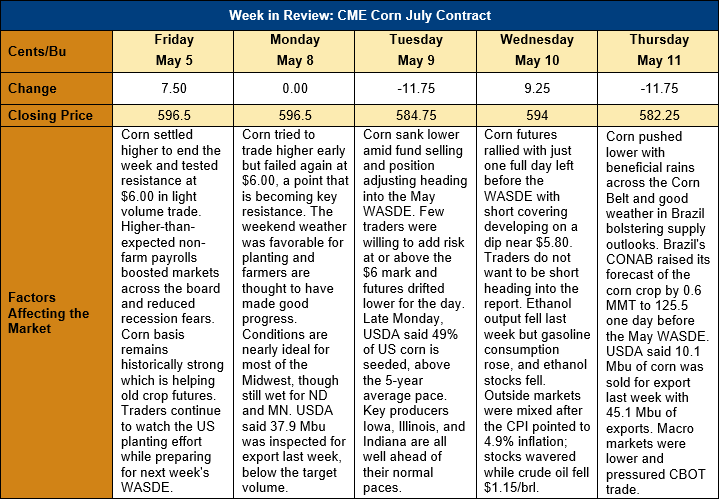

Outlook: July corn futures are 14 ¼ cents lower (2.4 percent) this week as technical trade, good planting progress, and expectations for larger ending stocks pressured values. July futures tried to break above $6.00 early this week but failed to garner sufficient support, which led to a mild pullback. Current planting progress in the U.S. and broadly favorable weather for both the American and Brazilian crops is leading to expectations that USDA will boost ending stocks estimates in the coming WASDE. Despite these projections, however, old crop futures have been unable to sustain downward momentum on breaks as traders are reluctant to be short heading into the report.

The U.S. spring 2023 planting effort continues to make excellent progress amid widely favorable weather. Lingering concerns still exist about wet weather in the Northern Plains, but the South and central Midwest are facing nearly ideal conditions. U.S. farmers had seeded 49 percent of the crop as of Sunday, which is up 23 percentage points from the prior week and above the 42 percent progress over the five-year average. Notably, planting in Missouri is 38 percent above average while Illinois’ planting effort is 27 percent ahead of normal. Iowa and Indiana’s crops are also being seeded more quickly than their average pace, up 19 and 9 percent, respectively. Across the U.S., approximately 12 percent of the crop is emerged so far, which is ahead of both 2022’s rate and the five-year average.

The USDA will release its May WASDE report this Friday, which will include the agency’s first comprehensive look at world 2023/24 grain supply and demand estimates. Heading into the report, analysts are looking for 2022/23 ending stocks to increase slightly from the April projection to 34.44 MMT (1.356 Bbu). For the 2023 crop, production is forecast at 408.91 MMT (16.098 Bbu), on average, with an 11.39 MT/ha (180.8 BPA) yield forecast. U.S. 2023/24 ending stocks are pegged at 51.67 MMT (2.034 Bbu). World 2022/23 ending stocks are pegged at 295.35 MMT while 2023/24 stockpiles are forecast to increase to 307.47 MMT.

U.S. gross corn sales were down from the prior week but above the four-week average at 311.9 KMT with 1.146 MMT of exports recorded last week. The export figure was down from last week’s marketing year high and put YTD shipments at 26.516 MMT, down 36 percent. YTD corn export bookings now total 38.393 MMT, down 34 percent. Sorghum net sales totaled 49.1 KMT and were up sharply from the prior week with 50.6 KMT of exports recorded.

A recent study found that U.S.-origin corn offered higher feed conversion rates (FCR) compared to Brazilian- and Argentine-origin corn. The study, based on poultry feeding trials at Auburn University and swine trials at South Dakota State University, found slightly lower FCR with U.S. corn compared to Argentinean corn. Discovered FCR differences were small but amounted to over $400,000 in savings for feeding an integrated poultry farm of 1.2 million birds per week. A summary of the study can be accessed here: https://informamarkets.turtl.co/story/feedstuffs-april-2023/page/4.

July corn futures are technically in a holding pattern waiting for the May WASDE. The market has forged a trading range from the early May lows at $5.69 ¼ to recent resistance at $6.00. A break above resistance at $6.00 could carry futures to the resistance trendline near $6.40 while a break below the 3 May lows will likely see support at $5.50. Funds have been paring back their long position in corn just ahead of summer, which usually brings a weather-driven rally to the markets.