Ocean Freight Markets and Spreads

Ocean Freight Comments

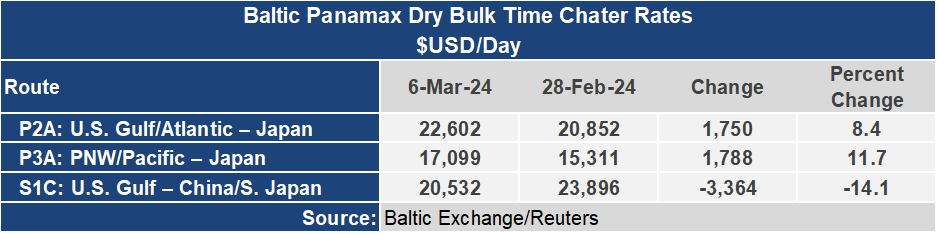

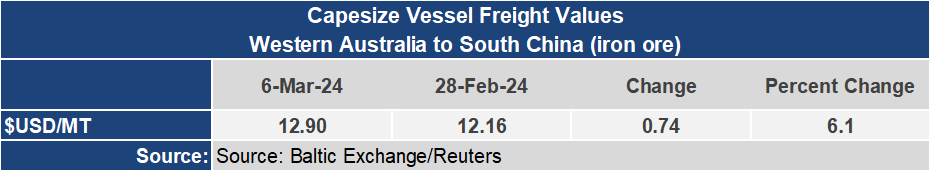

While the Baltic indices finished higher for the week, the strength of the Capesize sector weakened as the week wore on. The Baltic Dry Index, a basket of all dry bulk vessel types, ended the week nearly 7% higher to an index of 2,176. But over the last two days of the week, it lost 121 points from the weekly high. BDI is being pulled lower by the Capesize sector that has run out of steam after hitting a three-month high this week, despite ending the week 5% higher to an index of 3,769. The smaller vessel classes are slower to respond to the moves of the Capesize sector, gaining ground each day this week. The Panamax sector was 12% higher at 1,823 and the Supramax sector 6% higher at 1,312.

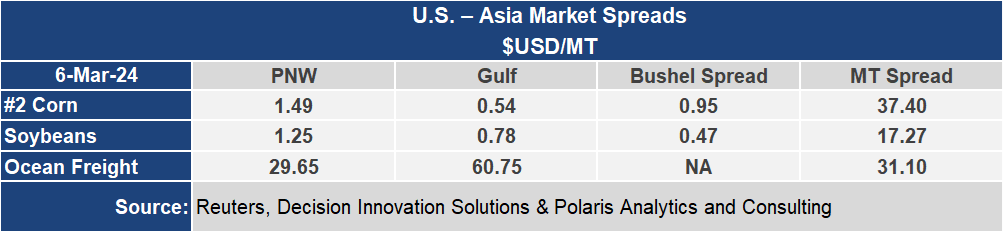

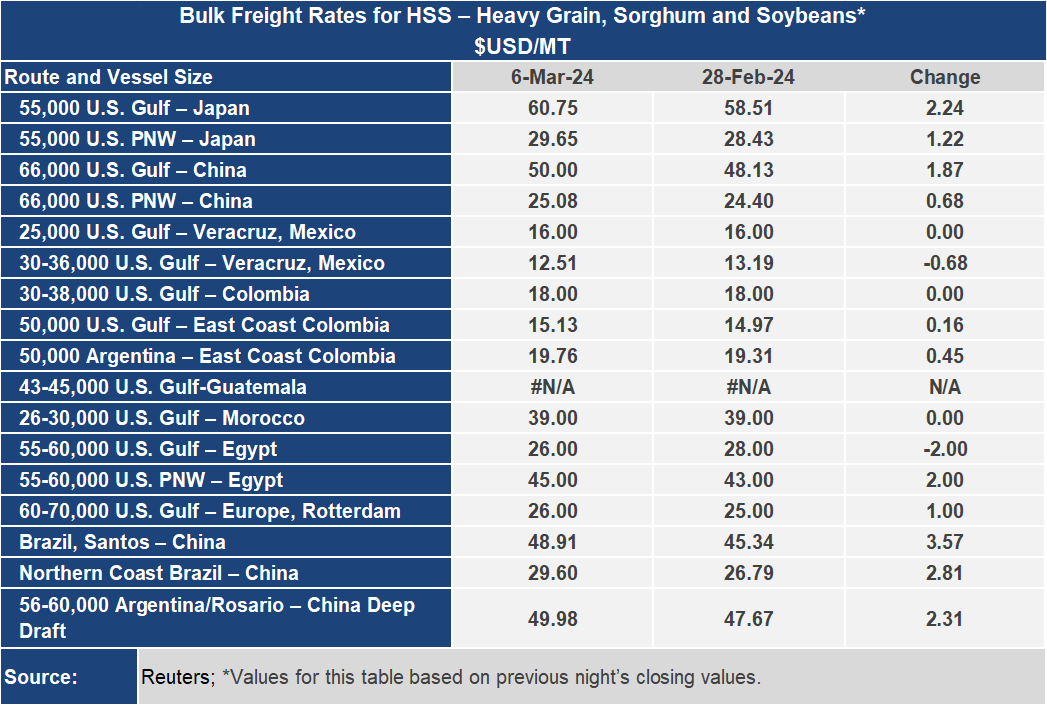

Other than lower rates out of the Gulf to Vera Cruz and Egypt, dry bulk voyage rates were higher on the key grain routes this week. Out of the U.S. Gulf to Japan the rate was 4% higher to $60.75 per metric ton for a 55,000 metric ton shipment, while out of the Pacific Northwest the rate was up more than 4% to $29.65 per metric ton. The spread between these key routes narrowed 3.4% or about $1.00 per metric ton to $31.10 per metric ton. The Pacific Basin is experiencing stronger dry bulk vessel demand from Indonesia and Australia.

Water levels in the Gatun Lake at Panama were relatively steady the past week at 80.7 feet (down from 80.8 last week). Panama is amidst its dry season that extends through the month of May. There was decent rain this past week, but not enough to make a material difference to a parched country. The Panama Canal Authority initiated water saving measures during 2023 by limiting the draft through the neo-Panamax locks to 44 feet, down from 50 feet, and restraining the number of daily vessel transits to 24, down from a normal 36. The authority is expected to update the restrictions in April. The freshwater surcharge is currently 2.65%, up from 2.54% last week.

The on-going attacks on maritime vessels using the Red Sea led to the first fatalities of seafarers this week. The Houthis attacked a Barbados-flagged, Greek-operated bulk vessel, killing three civilian seafarers. This will further confirm for other shipowners and operators to avoid the Red Sea even more so. Meanwhile, supply chains are adjusting to the longer routes bypassing the region, and container rates are stabilizing. Container rates from Far East Asia to the West Coast United States jumped nearly 200% from December to late February when the rate on that key route peaked. The rate has since retraced 8% from the late February peak. The backhaul rates from the West Coast and East Coast United States to Far East Asia have been flat, however. The unofficial start-to-container rate and volume negotiations is off to a slow start this week as shippers are taking a wait and see approach. The prevailing thought is that the container fleet is getting lager and demand is flat, while it is anticipated that the logistics circumventing the Red Sea is stabilizing to keep rates in check. Capacity utilization will be more relaxed and will lead to subdued rate hikes during this year’s rate negation season and throughout all of 2024, absent a demand shock or further supply chain disruptions.