Chicago Board of Trade Market News

Outlook

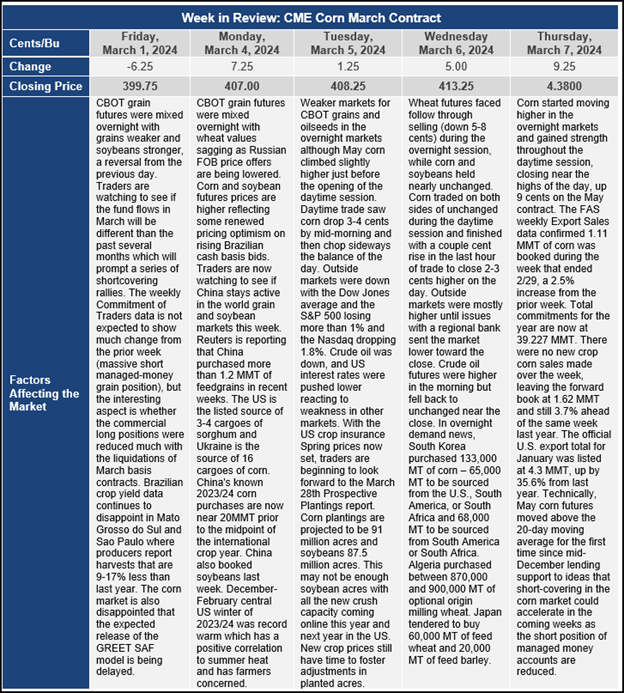

The U.S. and world corn market is well supplied today. Ukraine corn is relatively cheap for neighboring importers. Argentina’s harvest begins in a few months and is expected to be up 20 MMTs year-over-year. Into mid-to-late March, expect May corn futures to find “fair value” in the $4.20 – $4.50 range.

However, for buyers of corn there may be some forward supply risks which are masked by the recent drop in corn prices, and some may say that forward supply risks are enormous. The Brazilian corn crop estimates have been reduced several times and critical Brazilian weather lies just ahead. There are growing concerns that negative soil moisture anomalies spread and deepen in Mato Grosso do Sul, Sao Paulo and pockets of Parana and Mato Grosso. Brazil’s monsoon may be waning, and late March-early April rainfall is critical. If the area receives less than 3 inches of rain in April, the safrinha corn crop will likely have a less than average yield.

There is general consensus, along with Ag Ministry estimates, that corn acreage in Ukraine could be down 8-10% year-over-year. Negative margins, logistical challenges related to the ongoing war and the conscription of ag labor makes spring seeded crops even more difficult this year. If Ukraine only harvests 3.6 million hectares (down 10% from last year) and achieves trend yields, production would be 27 MMTs, down 3.5 MMTs year-over-year. With large carryover supplies, exports from Ukraine of 22-23 MMTs are still possible in crop year 2024/25 which would be unchanged from the current marketing year, but Ukraine is unlikely to contribute to trade growth.

USDA has pegged U.S. corn production at 15 billion bushels with the assumption of a record yield of 181 bushels per acre. This would be down 300 million bushels year-over-year. If reductions in the Brazilian safrinha crop are added to reductions in the Ukrainian crop which are added to reductions in the US crop, global corn production losses begin to mount and are increased if Brazilian dryness is extended into April, and US corn yield is 2-3 percent below trend.

An additional risk is that 2023’s rather strong El Nino will be short-lived as Equatorial Pacific Ocean temperatures are forecast to collapse over the next 6-7 months and a La Nina will be established in June-July. A very strong La Nina event is projected for autumn and winter 2024. This bodes favorably for Australian weather and wheat production but bodes very negatively for weather and yield potential in Argentina and southern Brazil in Nov 2024 – Feb 2025. Historically, the Argentinian corn crop is very challenged under these conditions.

The market is likely to readjust its assessment of risk if and when weather and supply issues emerge and are manifest. But risk is heightened amid current Brazilian forecast, consistent calls for a strong La Nina, while U.S. weather remains uncertain following record warmth in winter. Current prices may offer very good value for end users of corn and forward coverage on the current price weakness could be an option for managing risk.