Chicago Board of Trade Market News

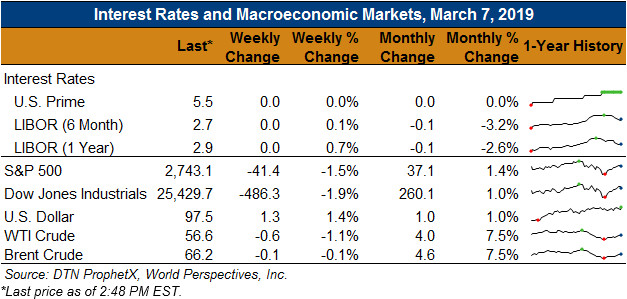

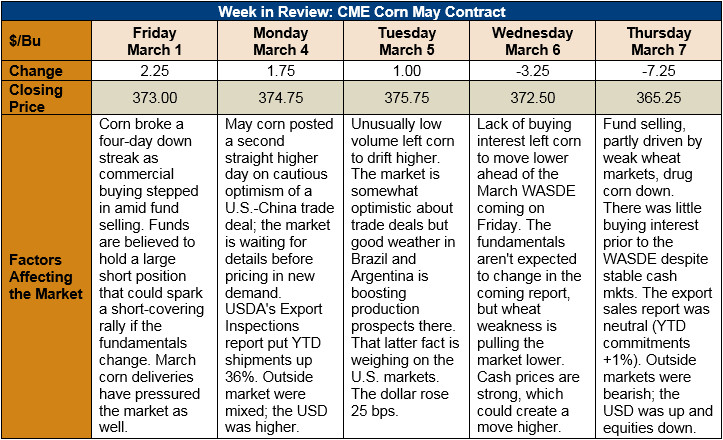

Outlook: May corn futures are down 8 cents/bushel (2.2 percent) from last Thursday as the market remains under widespread selling at the CBOT. The fundamentals are largely unchanged this week with favorable weather in South America maintaining analysts’ expectations for good production there. In the U.S., cold weather across the Midwest is hampering grain movement and creating some concern about planting dates later this spring. The demand side of the balance sheet remains largely neutral for current corn prices, with consistent exports and feed use.

The USDA’s weekly Export Sales report was neutral for the corn market with 1.11 MMT of gross sales, 969 KMT of net sales, and 744 KMT of exports. Weekly shipments increased 12 percent versus last week. Total export bookings (exports plus unshipped sales) are up 1 percent YTD while total exports are up 40 percent YTD. USDA reported the sale of 65,000 MT of U.S. sorghum to China and 55,000 MT of U.S. sorghum to Spain.

Cash prices remain steady across the Midwest but have slipped below year-ago values. With the neutral U.S. export pace, poor weather hampering logistics, and the recent decline in CBOT futures limiting farmer selling, cash prices are likely to remain steady/sideways in the near term.

From a technical standpoint, May corn remains under the bearish influence of widespread CBOT selling, particularly in wheat. The contract is 5 cents above its lifetime low – a point which should be major support. The March WASDE has historically been largely uneventful, and traders expect much of the same this year. Consequently, with the fundamentals expected to remain largely the same as now, corn futures should find support near $3.63-3.65 and move modestly higher from there. However, if the wheat market remains weak, that may limit the rally potential of corn. Therefore, the near-term outlook is sideways/slightly higher.