Ocean Freight Comments

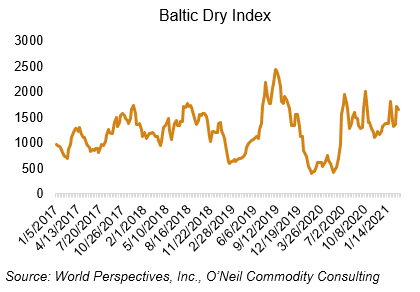

Transportation and Export Report: Jay O’Neil, O’Neil Commodity Consulting: Bullish paper traders are still holing on and moving FFA paper markets up faster than physical rates. Their strategy is following the concept that covid-19 is coming to an end, global economies are improving, and the market is entering a new economic “Super Cycle”. Traders also seem to want to get out in front of the curve, but some argue this bullish outlook is too much too soon. For the moment markets appear to be cautious about moving much higher.

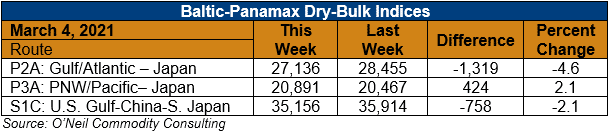

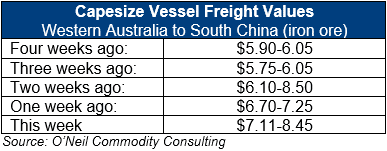

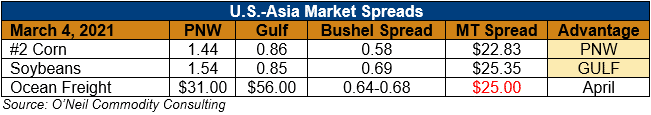

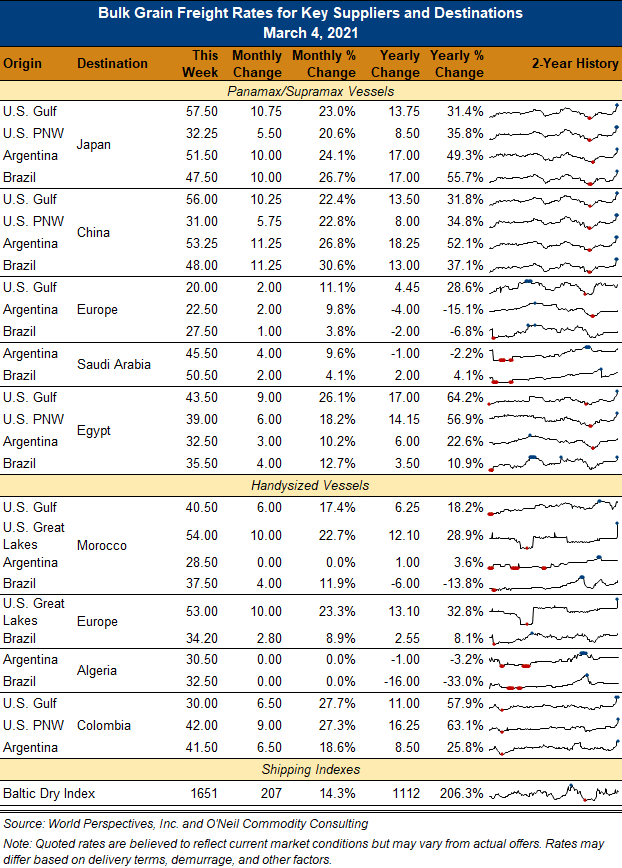

This week’s market brought a mixed bag of results. Freight markets are starting to readjust spread relationships between Capesize and Panamax markets and between the Atlantic verses Pacific trade. Handysize and Supramax vessel sectors are finding better support then the larger vessels. March Panamax topped out at $21,500 with Q2 at $19,000, and Q3 and Q4 paper markets at highs of $15,850 and $14,500 respectively.