Chicago Board of Trade Market News

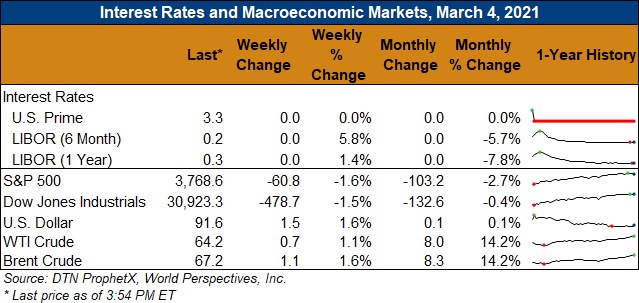

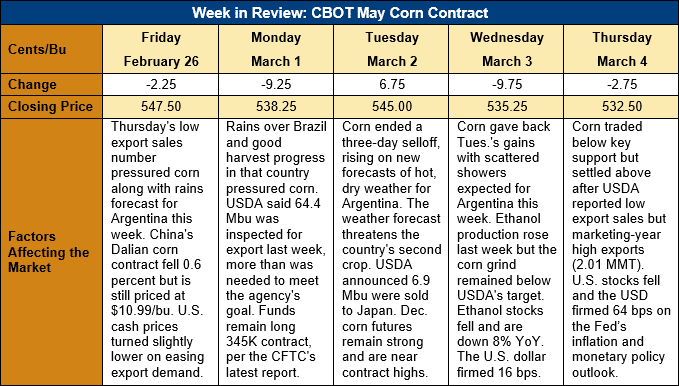

Outlook: May corn futures are 15 cents (2.7 percent) lower this week as the market has mostly drifted lower in advance of the March USDA WASDE report. Funds seem content to hold on to their massive long position and have not emerged as sellers in any meaningful way. At the same time, end users have been moderately active when the market has broken down to key support levels. Weather concerns in Argentina have helped keep the CBOT supported but most traders and analysts are expecting USDA to wait until the April WASDE to make any large adjustments to the South American crop estimates.

After a significant drought in December and January, Argentina’s agricultural lands saw beneficial rains in February that boosted crop conditions and kept yield expectations steady. Now, the country is once again facing a dry spell expected to last into mid-March that will also feature above-average daytime high temperatures. The combination of dry, hot weather has some analysts paring back yield expectations for Argentina’s second-crop corn. Soil moisture levels are mostly adequate, however, which has some traders expecting only minimal yield losses.

The weekly Export Sales report saw international buyers book 115,900 MT of net export sales, down 74 percent from the prior week while exports surged to a marketing year high of 2.01 MMT. The export volume was up 69 percent from the prior week and puts YTD shipments at 26.17 MMT, up 82 percent. YTD bookings now stand at 59.123 MMT, up 122 percent and accounting for 90 percent of USDA’s 2020/21 export forecast.

U.S. cash prices remain firm but declined slightly last week with basis widening out to 13 cents under May futures (-13K). For comparison, the U.S.-average basis was -12K last week and -33K this time last year. Barge CIF NOLA prices are down slightly as river logistics improve and FOB NOLA offers are down 2 percent this week at $243.69/ for April shipment.

From a technical standpoint, May futures are slowly walking lower into major support at $5.30. Thursday’s trade saw the market briefly trade below that level, marking a daily low at $5. 29 ¼ but rebounding on end-user pricing and settling above the key support level. Trading volume has been light this week as both funds and end-users are mostly content to wait and see what the WASDE brings. The low trading volume suggests this week’s lower pricing is a less reliable indicator of market direction than if it had occurred with heavy trading volume.

May futures have initial support at $5.30 and $5.23 ¼ (the 11 February daily low) below that. If bears manage to force a settlement below the latter level, major support lies at $4.94 ½-5.00. It is unlikely the market will be able to trade below that point without confirmation of large South American crops and USDA issuing a bearish U.S. outlook. For now, the market looks to trade mostly sideways heading into the WASDE and, assuming no surprises in the report, will likely subsequently follow Argentine weather forecasts and U.S. export news.