The COVID-19 pandemic is changing the markets and our working situations on a day-to-day basis – but what is not changing is the U.S. Grains Council’s commitment to you, our members’ valued customers.

The Council’s staff worldwide are committed to providing you the service and market information you have come to expect from us during this time. While we are teleworking, we remain ready to assist you and encourage you to contact us as issues or questions arise.

The Council wishes all our customers around the world good health and safety during this trying time.

Chicago Board of Trade Market News

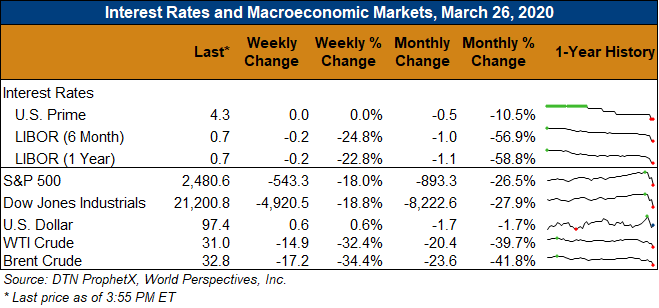

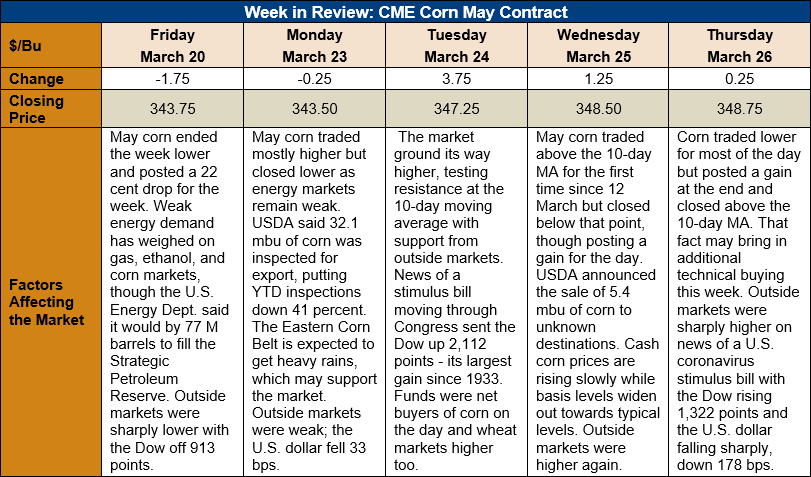

Outlook: May corn futures are 5 cents (1.5 percent) higher this week as CBOT markets rebound from oversold levels and as a U.S. coronavirus stimulus bill makes its way through the U.S. Congress, supporting equity and energy markets. May corn futures briefly dipped below $3.35/bushel last week, which was only the third time the active futures contract has traded below that point since mid-2010. The break brought with it substantial commercial buying interest that has pushed the contract higher again. Global feed demand has remained strong amid coronavirus concerns/quarantines, which is keeping the market supported.

The weekly Export Sales report featured a a sharp increase net corn sales for 2019/20, which reached 1.814 MMT last week, up 101 percent from the prior week. Weekly corn exports, however, slipped 13 percent at 846,000 MT. The latest data puts YTD exports down 41 percent while YTD bookings (exports plus unshipped sales) are down 28 percent at 30.8 MMT. The report also featured 107,600 MT of net sorghum sales and 27,900 MT of exports. The export volume was up 65 percent from the prior week and puts YTD bookings up 161 percent. USDA reported that 3,400 MT of barley was exported last week, keeping YTD shipments at 37,800 MT, up 13 percent.

Cash corn values are higher across the U.S. this week with the futures market’s move higher boosting prices. The average basis level for corn in the U.S. narrowed to 25 cents under May (-25K) futures this week, up from -23K the prior week. Barge CIF NOLA corn values are steady this week at $156.25 while FOB Gulf offers are down 1 percent at $163.50/MT for spot shipment. U.S. corn offers are competitive against South American-origin corn for April, May, and June shipments.

Sorghum prices continue to move higher with 101,000 MT of export inspections this week being collectively destined for China, Japan, and Mexico. Basis offers for FOB NOLA sorghum hit 145 cents/bushel over May futures (145K) this week while Texas Gulf offers are up to 135K.

From a technical standpoint, May corn futures have moved higher from contract lows at $3.32 and closed above the 10-day moving average on Thursday. There is a short -term, supportive trendline in place at $3.40 that will likely be key in determining whether this present rally is mere consolidation, or the start of an extended upside move. Funds hold a modest net short position in corn but have been net buyers this week, especially as long wheat/short corn spreads have been unwound. For now, the market is apt to trade sideways until more fundamental supply clarity comes from USDA’s March Planting Intentions report.