Chicago Board of Trade Market News

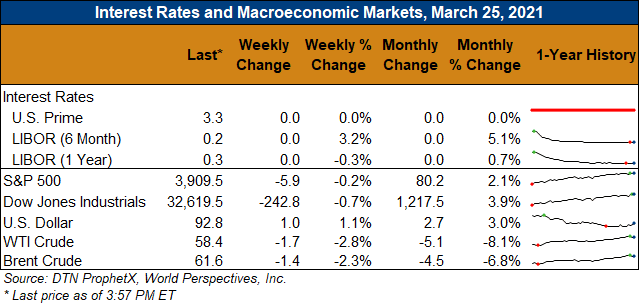

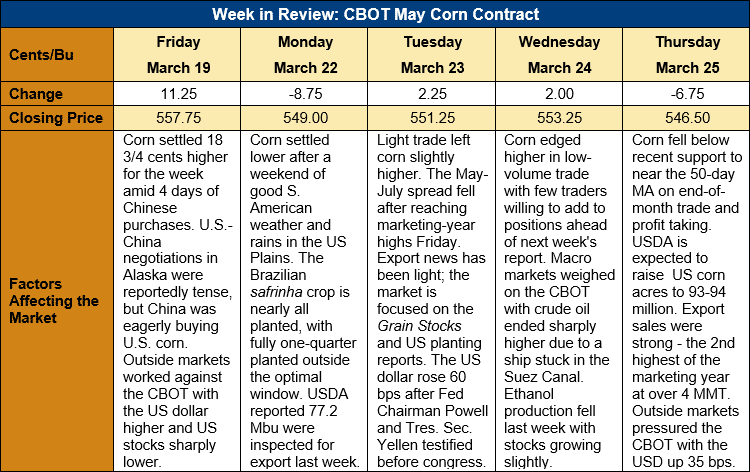

Outlook: May corn futures are 11 ¼ cents (2 percent) lower this week as range-bound trading has dominated the market. For most of the week, May futures found support at $5.45 but that support broke down on Thursday and the market slipped to $5.41 ½ – just below the 50-day moving average. Some end-of-the-month profit taking/position adjusting was blamed for the move lower, which occurred despite a strong export sales report. Overall, the market is trading sideways heading into next week’s Prospective Plantings and Grain Stocks reports from USDA.

Most analysts are looking for USDA to report larger corn and slightly smaller soybean acreage in the Prospective Plantings report compared to the February Ag Outlook Forum. Most analysts are projecting USDA will report farmers intend to plant 93-94 million acres of corn this year along with 89-90 million acres of soybeans. In February, USDA projected 92 million acres of corn and 90 million acres of soybeans. In 2020, U.S. farmers planted 90.8 million acres of corn and 83.1 million acres of soybeans.

The weekly Export Sales report saw international buyers book 4.482 MMT of net export sales, up 355 percent from the prior week and the second-highest figure of the marketing year. Exports totaled 2.036 MMT, down 7 percent from the prior week. YTD exports total 31.998 MT (up 88 percent) while YTD bookings (exports plus unshipped sales) total 64.986 MMT (up 111 percent).

U.S. cash prices are slightly lower this week with the May/July corn futures inverse slipping from last week’s marketing-year highs. Basis levels remain steady at a five-year high of -12K, putting the average U.S. corn price at $213.11/MT ($5.41/bushel). Despite falling below last week’s values, futures spreads and the cash market continue to signal a bullish environment where commercials are becoming aggressive to keep the pipeline full.

Barge CIF NOLA offers are down 1 percent this week at $242.50/MT while FOB NOLA offers are steady. April FOB Gulf positions are offered at $248.60/MT with May at $247.43/MT.

From a technical standpoint, May corn futures are range-bound from $5.41-5.60 are unlikely to break that range before next week’s USDA reports. Major support lies at $5.30 in May futures and it will take a substantially bearish Grain Stocks report to push the market below that level. Major resistance lies at the contract high ($5.72).

December futures traded lower this week to major support at $4.63 ¾ with profit taking and some short position taking pressuring the market amid expectations for a larger acreage outlook. Should December futures settle below that point (a bearish signal) the next major support level is the 16 February daily low at $4.47. Given worsening drought across the U.S. Plains and parts of the Western Corn Belt, the market is unlikely to move significantly below that level until planting starts and/or more reliable summer weather forecast are available. Presently, downside risk seems constrained by 2021 acreage/yield uncertainty while upside potential is significant on weather risks.