Chicago Board of Trade Market News

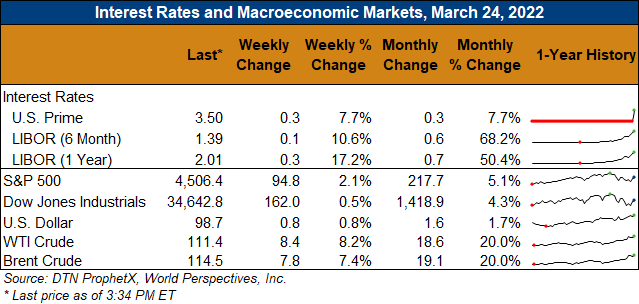

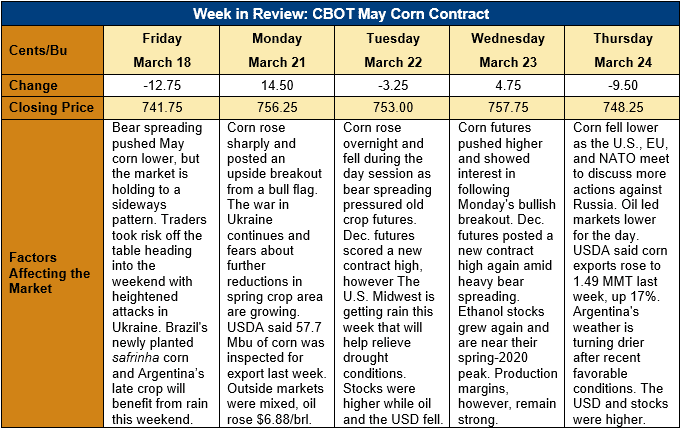

Outlook: May corn futures are 6.5 cents (0.9 percent) higher this week as choppy, two-sided trade has become the norm. The market technically posted an upside breakout from a bull flag formation on Monday but follow through buying interest was limited ahead of next week’s key fundamental reports. Price action has become increasingly choppy amid a decline in trading volume, and it no longer takes large orders to move the market one way or the other.

The Russia-Ukraine war is still ongoing, and analysts are increasingly watching its implications on the Ukrainian spring crop planting effort. Ukraine’s Agricultural Minister Roman Leshchenko said earlier this week that the country may only plant 50 percent of its spring crop area, which would imply 3.3 million hectares (8.15 million acres) of corn, down from 5.4 million hectares (13.6 million acres) planted in 2021. The corn market is carefully weighing this outlook with expectations of U.S. 2022 corn plantings as well as growing conditions for Brazil’s safrinha corn crop.

The market will be closely watching the USDA’s March Grain Stocks report next week along with the Prospective Plantings report. These reports will offer key insights, respectively, into old crop demand and new crop supplies. Early estimates suggest analysts are looking for an increase in March corn stocks versus March 2021, likely in the range of 1-2 percent, but official pre-report survey estimate have not yet been published. For acreage, most analysts are looking for corn acres to be near USDA’s February Ag Outlook Forum forecast of 37.232 million hectares (92 million acres). Current estimates range from 37.03-37.52 million hectares (91.5-92.7 million acres), which would be down from the 37.798 million hectares (93.4 million acres) planted last year.

U.S. corn export sales fell from last week with exporters reporting 0.979 MMT of net sales (down 47 percent week-over-week). Despite a slower sales pace, weekly exports rose 17 percent to 1.49 MMT, putting YTD exports at 30.3 MMT, down 5 percent. YTD corn export bookings (exports plus unshipped sales) are down 18 percent at 53.01 MMT but account for 83.5 percent of UDSA’s current forecast with five months left in the 2021/22 marketing year. The weekly Export Sales report also featured 0.255 MMT of sorghum exports, which were down 2 percent from the prior week but put YTD exports at 6.78 MMT, up 8 percent.

U.S. corn exports received additional positive news this week as the UK agreed to drop its 25 percent retaliatory import tariff in U.S. corn. The tariff reduction was achieved as part of Tuesday’s new Section 232 agreement between the U.S. and the UK. The UK imported 3.05 MMT of corn from all sources in 2020/21 and USDA forecasts the country will import 2.7 MMT in 2021/22.

From a technical standpoint, May corn futures broke out of a bull flag on Monday but follow through trade has since been limited. The market seems to have simply moved into a slightly higher sideways trading range with support at $7.45 and resistance at $7.70. New crop futures are showing more well-defined bullish trends on their charts, which is creating bear spreading in old crop markets. It seems old crop markets are likely to hold their current sideways range into next week’s USDA reports before possibly making another major move. Beyond the current trading range, support lies at $7.26 (the 16 March daily low) in May futures, followed by trendline support at $7.09. The contract high (7.82 ¾) offers upside resistance.