Ocean Freight Markets and Spreads

Ocean Freight Comments

The number of vessels using the Red Sea continues to shrink as the Houthis keep attacking vessels plying the important waterway option. With three merchant mariners having been killed, and two vessels requiring salvage, which is being delayed due to on-going attacks, the prudent option for vessel owners and operators is to avoid the region. But it is not just the Houthis making terrorist attacks, now the Somali pirates are resurging in their efforts to take advantage of the situation by attacking vessels and crews further south of where the Houthis are attacking.

By avoiding the Red Sea and the Suez Canal consequently, that means transit lengths are doubled in many instances, requiring longer delivery times, more fuel consumption, higher insurance costs through war risk premiums on the value of the vessel while requiring enhanced vessel security protocols, and there is then less capacity to move the same volume. For vessel owners the longer routes increase vessel utilization while leading to increasing or higher and stable ocean freight rate levels that are passed on to shippers. Container carriers were already struggling with less cargo being moved due to slowing global economic growth and as several new vessels were about to hit the waters. Those new vessels entering service are being deployed on the longer routes and this crisis allows the carriers to withstand the situation a bit stronger.

Meanwhile, water levels in Panama’s Gatun Lake were unchanged this week at 80.5 feet, keeping the variable freshwater surcharge unchanged at 2.89% as of March 21. Panama is amid its seasonal dry season that continues through May. Water levels in Gatun Lake are expected to fall one foot to 79.5 feet through late May, which would increase the freshwater surcharge would be 4.26%. Next week the three additional slots available for transit through Panama Canal that were announced last week, will be fully available. The number of daily slots will be 27 but that is down from the usual 36 daily transits.

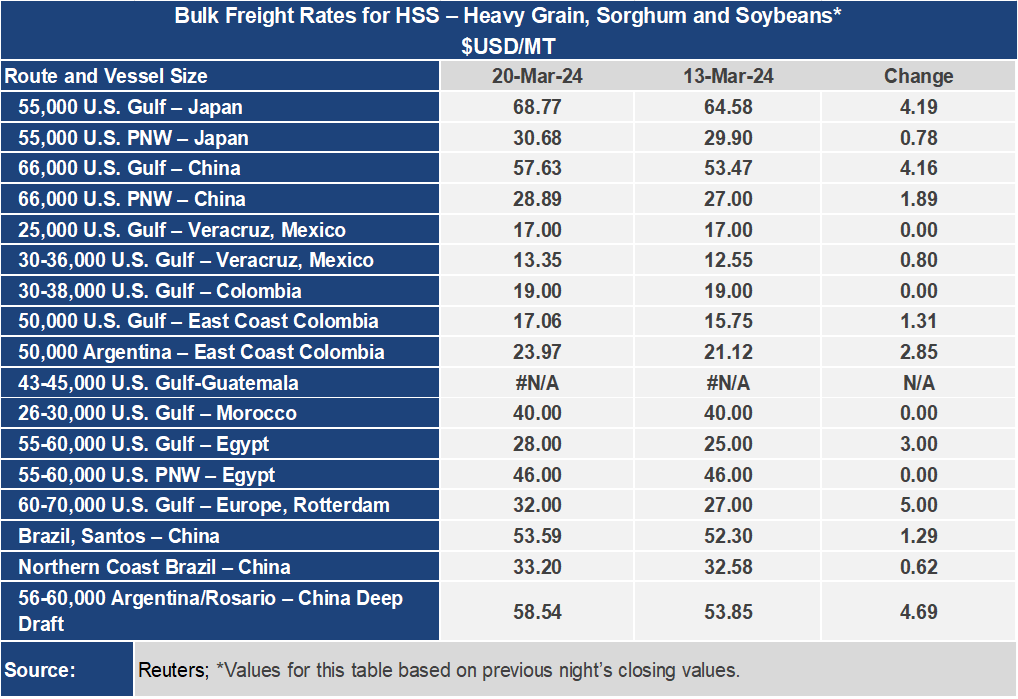

Baltic ocean freight indices are maintaining firm tones for the smaller vessel sizes. Demand for vessel loadings in South and North America are propping up rates, while bunker fuels have strengthened as crude oil prices have been rising since the start of 2024. Bunker prices have been under pressure, especially in the Atlantic and from Houston most notably to accommodate greater usage for vessels bypassing the Red Sea and sailing around the Cape of Good Hope.

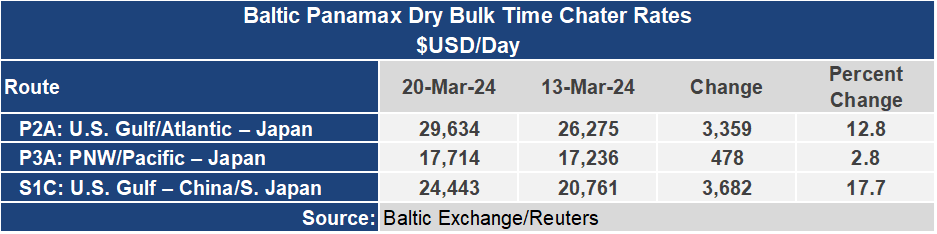

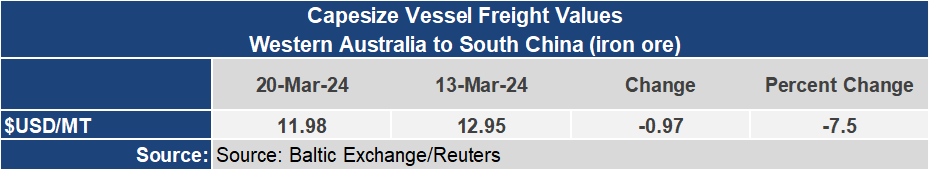

Despite the strength in the smaller vessel classes, the Baltic Dry Index was pulled lower for the week by the Capesize market. The BDI, a basket of all dry bulk vessel types, ended the week 3.6% lower to an index of 2,284 as the Capesize sector, which greatly influences the BDI, was down 12% to an index of 3,690. Concerns with China’s slowing economy, high iron ore stocks and weakening iron ore prices are weakening demand for Capesize and some Panamax vessels. The Baltic Panamax Index was up 10% for the week to 2,251 while the Baltic Supramax Index was up 5% to 1,370.

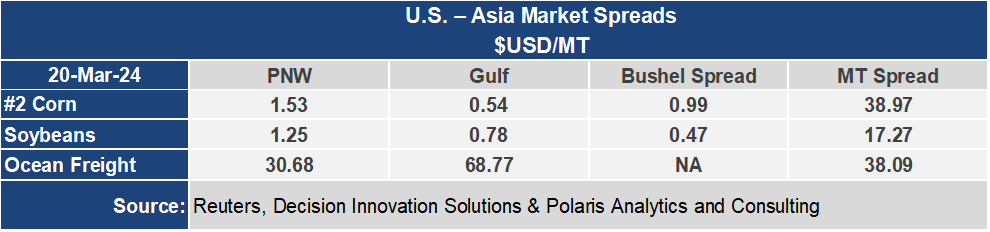

Ocean freight rates for grain shipments remain strongest out of the Atlantic Basin in both North and South America. Out of the U.S. the Gulf to Japan was up 6.5% or about $4.20 per metric ton for the current week to $68.77 per metric ton while out of the Pacific Northwest the rate to Japan was 2.6% or less than one dollar to $30.68 per metric ton. The spread between these routes widened 10% or $3.41 per metric ton to $38.09 per metric ton.