Chicago Board of Trade Market News

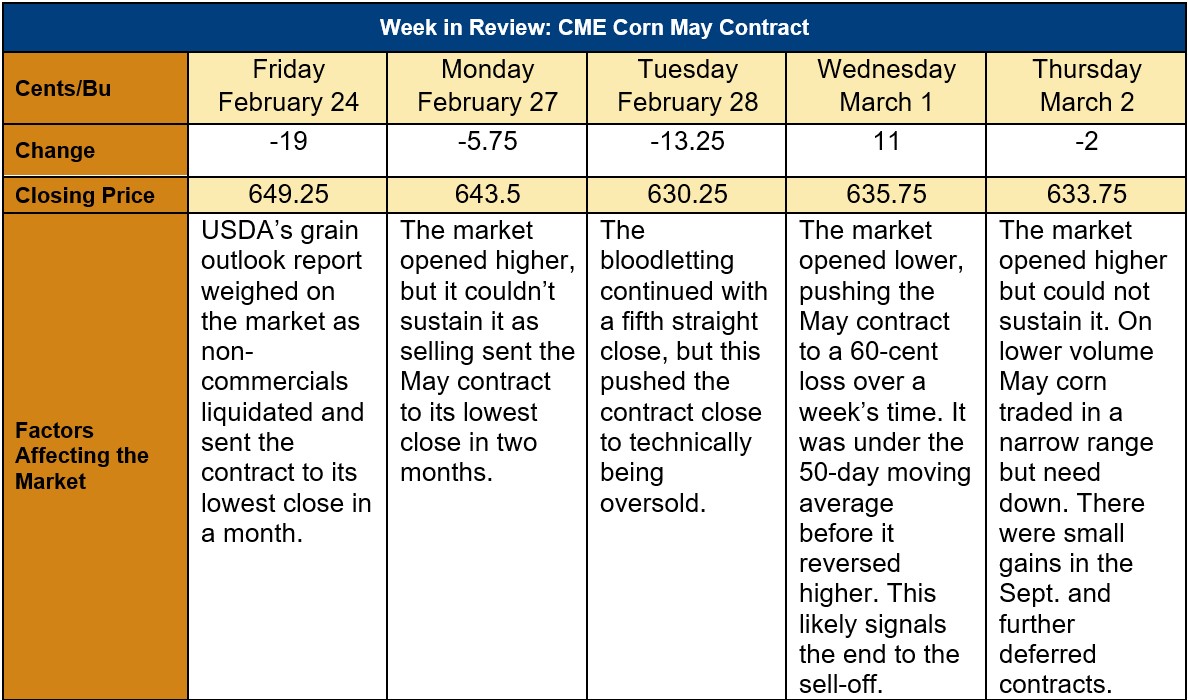

Outlook: The May corn contract hit 680.50 cents/bushel on 21 February and has lost nearly 47-cents since then. The market broke lower this past week based on USDA’s bearish 2023/24 outlook and slow 2022/23 exports.

Traders are now watching whether the nearly 50-cent/bushel drop in the corn price attracts importer interests. U.S. corn is now priced more competitively with Brazil, and it should be clear by Friday whether yesterday’s 11-cent jump higher in the March contract was related to a rumored sale to China.

U.S. sales should pick up during the May-June window before Brazil’s safrinha corn crop comes on to the market. China’s corn supply will become tight in the coming months. Planting of Brazil’s second corn crop is advancing despite the rain but is about a week behind schedule. Meanwhile, the Buenos Aires Grain Exchange again lowered its quality estimate of the Argentine corn crop. Future direction in the corn market will be based on how the Brazilian crop develops.

Corn basis is flat but strong for this time of year. However, bearish is the fact that with just weeks to go before planting, there are few serious concerns about moisture in U.S. corn growing areas. An impending large crop will keep downward pressure on the market, but proof will not come until the crop is planted and well under development.

Though ethanol output fell 2.6 percent last week on slower winter driving and tight margins, stocks fell too and that implies demand. Falling gasoline prices may be causing driving to rebound and that combined with improving crush margins will pull more corn into the grind. There is some support on word that the White House will move forward on allowing higher ethanol blends in certain U.S. Midwest states. Blends are currently capped at 10 percent in summer months. The national blend rate hit a record 10.39 percent in 2022, breaking through the so-called blend wall. Any change to the current cap will not occur until 2024.

Last week’s U.S. export sales included a net 598,100 MT of corn with 34 percent going to Mexico, 18 percent to Japan, 17 percent to Colombia, and 12 percent to China. Overall, net sales were down 27 percent from the previous week.