Chicago Board of Trade Market News

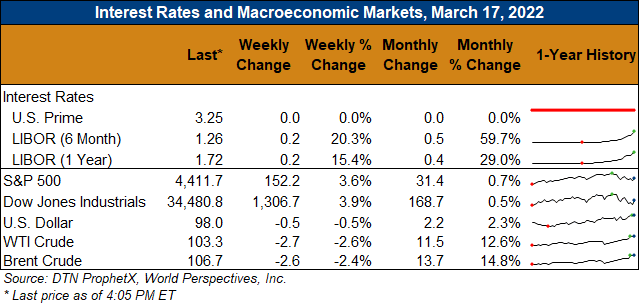

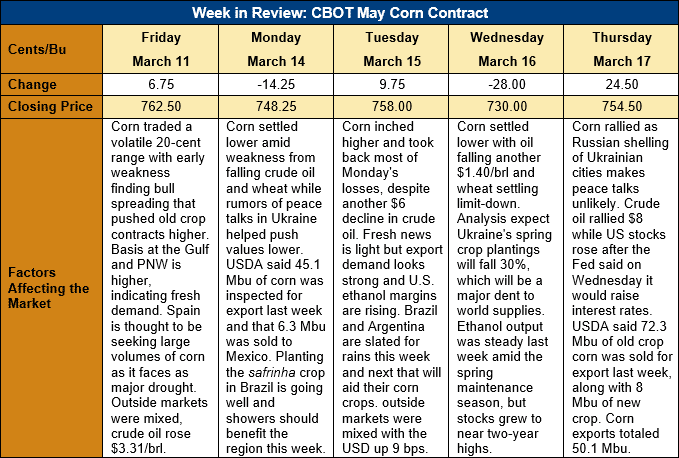

Outlook: May corn futures are 8 cents (1.0 percent) lower this week as back-and-forth rumors of peace talks in Ukraine buffet markets. Profit taking was evident in early-week trade as crude oil and wheat broke lower, but commercials, importers, and funds used the break as a buying opportunity. Corn is maintaining a sideways trading range and seems likely to hold that pattern amid strong old-crop demand.

The war in Ukraine is now in its fourth week and markets are adapting to the reality that Ukraine will not be a significant corn exporter in 2022. Industry estimates indicate Ukraine’s spring crop planted area could fall by 30-45 percent amid ongoing military activity, destruction of infrastructure, and the inability to secure inputs like seed and fertilizer. Moreover, the government has banned the export of corn, wheat, sunflower oil, and fertilizer, which further decreases the odds of Ukraine playing a major role in supplying world demand. In 2021/22, Ukraine produced 41.9 MMT of corn and, until the war, was expected to export 33.5 MMT. The production and exports forgone in 2022 due to the war will benefit the export programs of other major world suppliers, including the U.S. and South America.

Brazil’s safrinha crop continues to develop under favorable conditions in the central and northern parts of the country. Southern Brazil remains dry, but showers are forecast for the region this week. CONAB, the Brazilian equivalent of the USDA, recently pegged the safrinha crop at 86.1 MMT, which was up from it prior estimate and put the total crop at 112.3 MMT. That figure is above last year’s production of 87.0 MMT but below USDA’s March WASDE projection of 114 MMT.

The weekly Export Sales report showed a 1.98 MMT of net sales, which were down 14 percent from last week’s marketing-year high. Exports fell 28 percent to 1.27 MMT, which put YTD exports at 28.8 MMT, down 4 percent. YTD bookings currently total 52.04 MMT, down 14 percent.

A potential emerging issue in the U.S. is the drought across the Plains and western Corn Belt. Drought has been present in the region since last fall but intensified this spring, especially in the southern Plains. The southern Plains are facing the greatest threat currently, but drought remains a concern for most of Iowa as well. The latest long-term forecast from NOAA expects continued dryness across the southern Plains and western Midwest that will be combined with above average temperatures. While risks to the planting and early development of the 2022 U.S. corn crop are minimal right now, the current conditions and forecasts suggest this issue is one worth watching.

From a technical standpoint, May corn futures are holding within their sideways trading range from support $7.25 and resistance at the contract high ($7.82 ¾). Funds remain net long the corn market and, like commercials and importers, are using breaks as buying opportunities. Expectations for a sustained increase in U.S. corn exports this spring is keeping bear spreading active and helping the market maintain a strongly inverted curve. Until the old crop demand looks like it will soften, old crop futures are unlikely to post significant breaks and will likely hold to their current range.