Chicago Board of Trade Market News

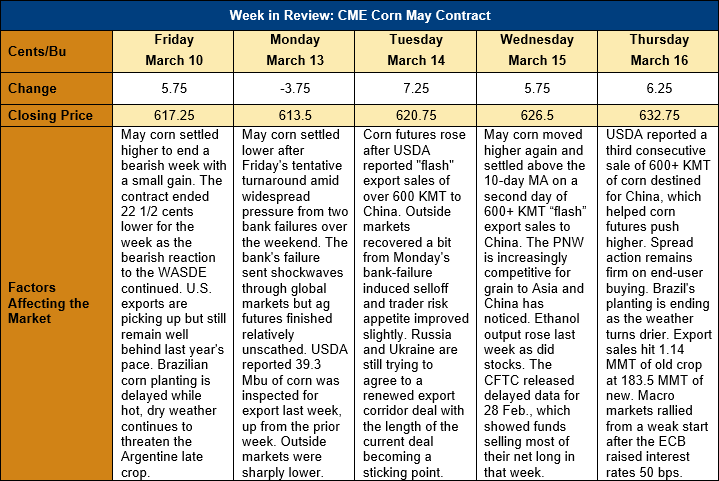

Outlook: The May corn futures are 15 ½ cents higher this week amid an uptick in export sales, short-covering, and a technical correction. On Friday, May corn posted a tentative bullish reversal on the charts, which created follow-through buying and short covering this week. Support has also come from three consecutive days of USDA reporting “flash” export sales of corn to China. On Tuesday, USDA reported 612,000 MT was sold to China, followed by Wednesday’s report of 667,000 MT and Thursday’s news of 641,000 MT (all for 2022/23 delivery). Together, the sales total 1.92 MMT and have set up the Export Sales report to feature the biggest corn sale in at least one year when it is released next Thursday.

The Argentine corn crop continues to suffer from a combination of high temperatures and minimal rainfall. The poor growing and soil moisture conditions prompted the Buenos Aires Grain Exchange (BAGE) this week to cut its forecast of the crop to 36 MMT, below USDA’s March WASDE assessment of 40 MMT. Some private estimates are even lower than the BAGE’s forecast, though the range in predictions is smaller than for the country’s soybean crop. Of note is the fact that USDA’s March WASDE yield assessment represents a 29 percent decrease from the long-run trend, making the current drought the worst in Argentina’s history.

While Argentina’s corn crop is finishing amid record-breaking drought, the final leg of planting the Brazilian safrinha crop remains delayed due to rains. Most of the crop now looks like it will be seeded within the “ideal” planting window with planting progress speeding up this past week. CONAB, the Brazilian equivalent to the USDA, recently raised its forecast for the country’s corn crop by 0.8 percent to 124.67 MMT. A recent survey of analysts conducted by Reuters indicated the crop could reach 126 MMT, despite lingering drought in southern portions of the country.

U.S. gross export sales for corn totaled 1.334 MMT last week while exports rose 11 percent to 1.165 MMT. The YTD export program now totals 17.246 MMT, down 40 percent, while YTD bookings (exports plus unshipped sales) total 31.886 MMT (down 39 percent). The Export Sales report also featured 294 KMT of sorghum gross sales and 72.3 KMT of exports, which were up 47 percent from the prior week.

From a technical perspective, May corn looks to be strengthening from selloff lows posted on 10 March at $6.06 ¾ on the heels of rising exports. The contract cleared initial resistance from $6.20-6.24 and also moved above the 10-day MA this week. Short-covering and bull spreading from commercials has helped fuel the rally, which is now eyeing resistance at the 3 March daily high of $6.42 ¾.