Ocean Freight Markets and Spreads

Ocean Freight Comments

The Panama Canal Authority announced this week it is increasing the number of available transit slots by three through the Panamax Locks. Two slots will be available for auction starting March 18 and one more starting March 25, bringing the total number of daily transit slots to 20 through the Panamax Locks. The number of daily transits through the Neopanamax Locks were left unchanged at 7. Overall, the Panama Canal will have 27 daily transit slots available beginning March 25, up from 24. Under normal operating conditions the number of daily slots is 36. The ACP was expected to update transit options in April. This early announcement is good news for shippers, vessel owners and operators struggling with Red Sea diversions and having to deploy assets onto other routes to keep up with capacity requirements.

Despite the ACP’s enthusiasm with three additional slots, water levels in the Gatun Lake were lower again this week, falling to 80.5 feet (down from 80.7 feet last week). While persisting in its dry season that extends through May, water levels in Gatun Lake are expected to fall nearly one foot to 79.6 feet through the remainder of the dry season. The freshwater surcharge is currently 2.89%, up from 2.65% last week. If water levels fall to 79.6 the freshwater surcharge would be 4.11%.

Red Sea diversions continue as Houthis keep attacking vessels. After last week’s attack that killed three mariners, security forces from the United States and United Kingdom have stepped up protection and offensive efforts. But for vessel owners and operators the safest option is avoiding the Red Sea route altogether by deploying vessels on longer routes around the Cape of Good Hope. Shippers are using other commodity flow options that consider ocean freight costs and timeliness of cargo shipments.

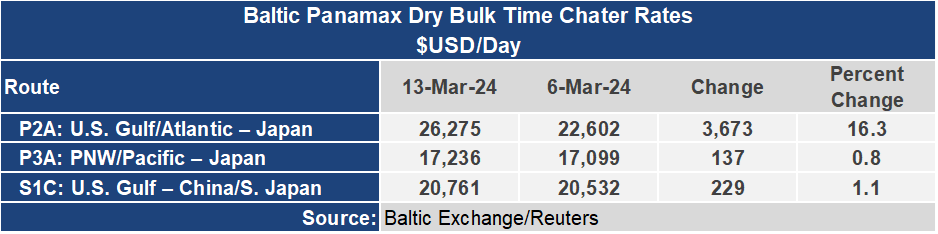

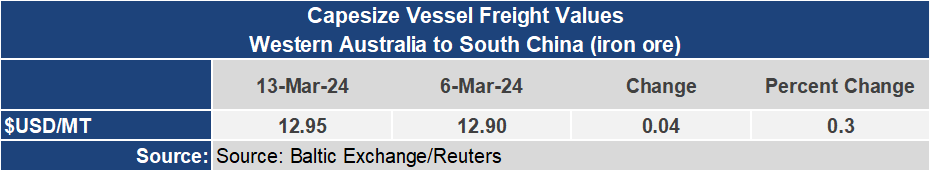

Baltic ocean freight indices are maintaining firm tones. The Baltic Dry Index, for example, a basket of all dry bulk vessel types, ended the week nearly 9% higher to an index of 2,370. The Capesize and Panamax sectors had the most strength for the week. The BCI was 11% higher to an index of 4,189 while the BPI was up 12% to index of 2,043, which was the highest reading since mid-December 2023. However, there are head winds as China built substantial iron ore stocks, while experiencing an on-going slowing in its economy. The result is weakening iron ore prices and less demand for shipment in the larger vessel classes such as the Capesize and Panamax vessels.

Despite potential head winds from the iron ore market, the FFAs (Forward Freight Agreements) for Panamax vessels are rising. The average Panamax time charter FFA in April is pointing to $19,700 per day, up more than $2,000 per day over the past week. The Supramax sector, however, has mixed results, mostly flat to slightly lower this past week, to $16,250 per day for April.

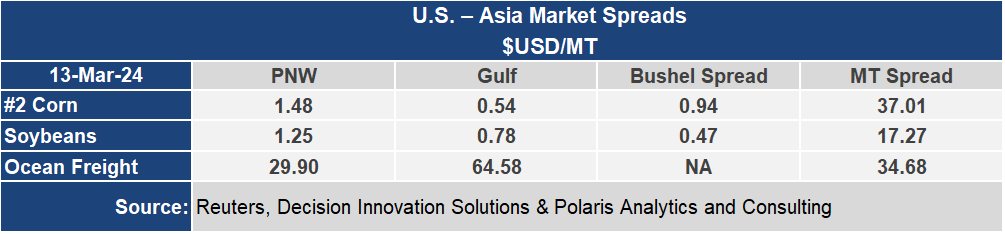

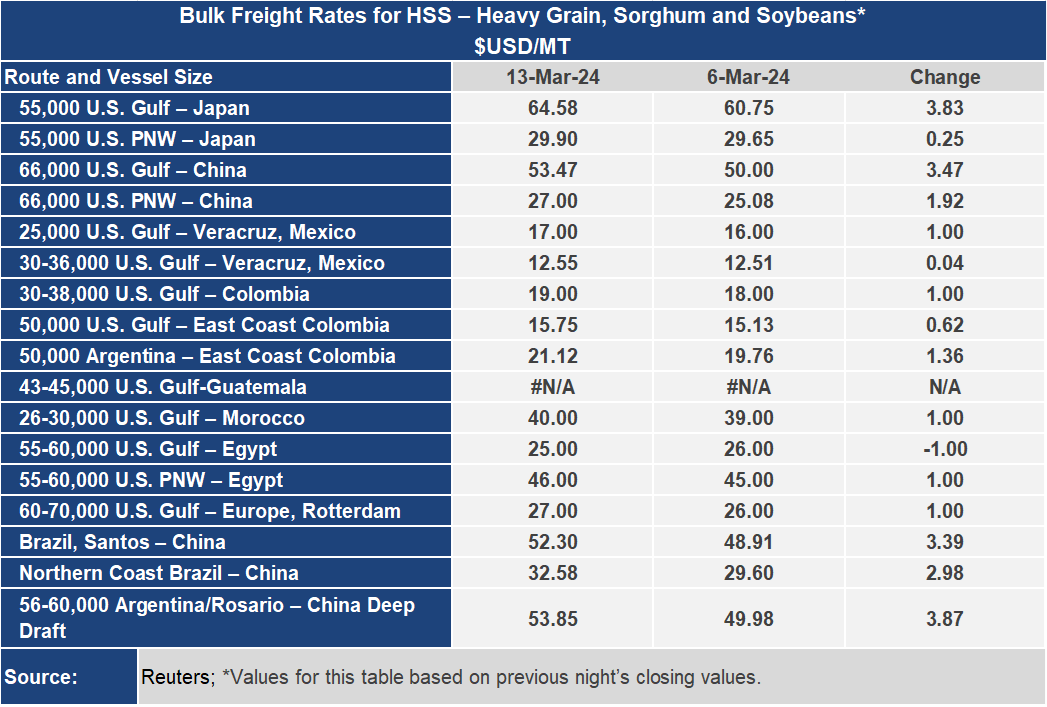

Ocean freight rates for grain shipments out of the U.S. were the strongest out of the U.S. Gulf. The U.S. Gulf to Japan was up more than 6% to $65.58 per metric ton for the week while out of the Pacific Northwest the rate to Japan was up less than 1% to $29.90 per metric ton. The spread between these routes widened 11.5% or nearly $3.60 per metric ton to $34.68 per metric ton. The Atlantic Basin, where the U.S. Gulf is based, had a firmer tone across both North and South America originations. Although, the U.S. Gulf to Egypt was lower on the week, which is likely due to a delay of that rate being reported in a timely manner.