Chicago Board of Trade Market News

Outlook

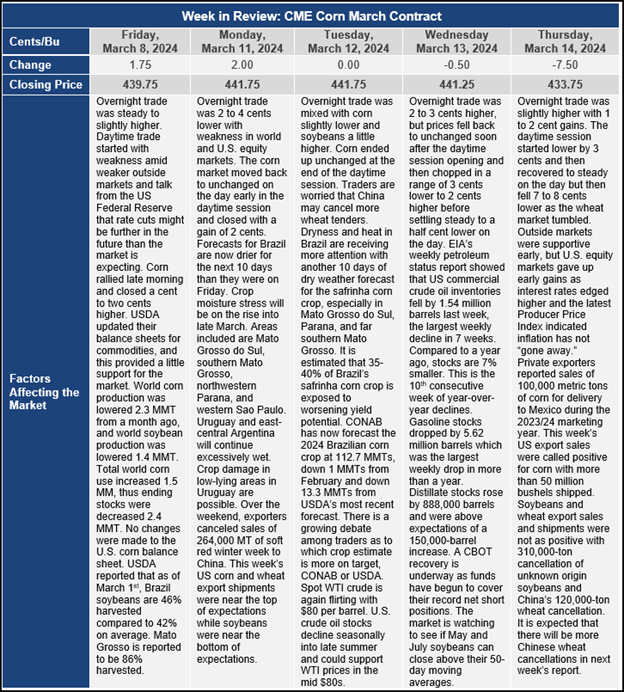

CBOT grain futures came under pressure after a couple weeks of steady-to-higher prices as soybeans pushed against the 50-day moving averages and palm oil futures rose to the best levels in a year. But the weight of Chinese cancelations of wheat purchases pushed the wheat market sharply lower and with outside markets showing signs of running out of momentum, corn prices follower lower also. Add to these pressures, a northern and central Brazil weather forecast that is slightly wetter than prior runs and markets retreated to lower levels.

While the lackluster global demand for U.S. corn has fueled a bearish market, the ethanol industry has been consuming corn at record-high levels. The accumulated corn consumption for ethanol in 2023/24 has reached a record high of 2,837 million bushels, surpassing the previous record of 2,818.8 million bushels in 2021/22. This figure represents a 5.9% increase above the long-term average, indicating robust demand for corn in ethanol production.

Ethanol margins continue to reach historic record highs, surpassing the margins of the previous year. As of March 12, ethanol margins soared to an average of $1.37 per gallon, particularly prominent in key production regions like the Corn Belt, marking an all-time high for this part of the season.

In February, corn consumption for ethanol production increased significantly to 434.5 thousand bushels, up from 398.6 thousand bushels in January and 410.9 thousand bushels in February 2023.

According to market indicators, analysts at LSEG Agricultural Research project the U.S. corn consumption for ethanol in 2023/24 to be 5,464.4 million bushels, while the USDA’s March WASDE estimate is slightly lower at 5,375 million bushels. These revisions underscore the robust outlook for ethanol consumption, reaffirming the ethanol industry’s strong position and positive momentum in the market.

On Tuesday, March 12th, Brazilian crop agency CONAB again lowered projections for Brazil’s corn and soybean production as weather continues to take it toll on crops in Brazil. CONAB cut Brazil’s corn production estimate to 112.75 million tons from the February forecast of 113.70 million tons. CONAB also lowered the soybean production forecast by 2.6 million metric tons to 146.86 million metric tons. The gap between USDA’s estimate of Brazilian crop production and estimates originating from Brazil continues to widen. In USDA’s latest release, they still have Brazil estimated to produce 155 million metric tons of soybeans and 124 million metric tons of corn. If USDA eventually lowers its crop production estimates for Brazil, that may lead to increases in USDA’s estimates for U.S. corn and soybean export sales. In its latest report, USDA did lower corn production estimates for the FSU-12, Ukraine, Russia, South Africa, and Mexico. It raised the corn production estimate for Argentina.