Ocean Freight Comments

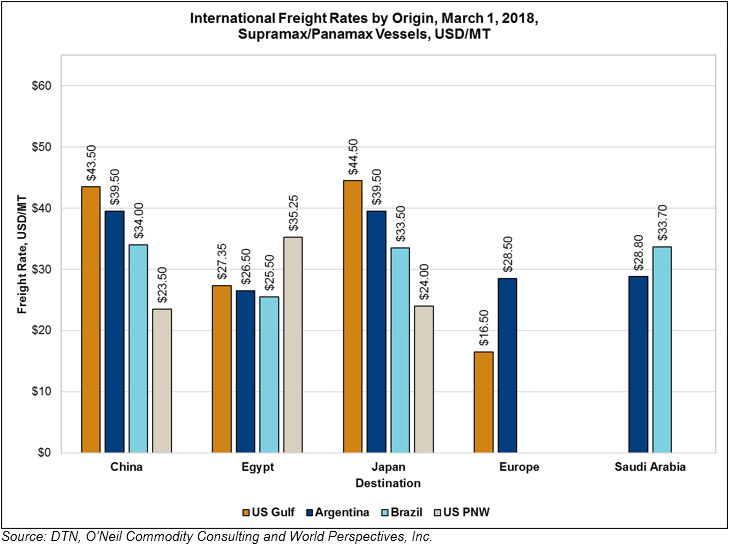

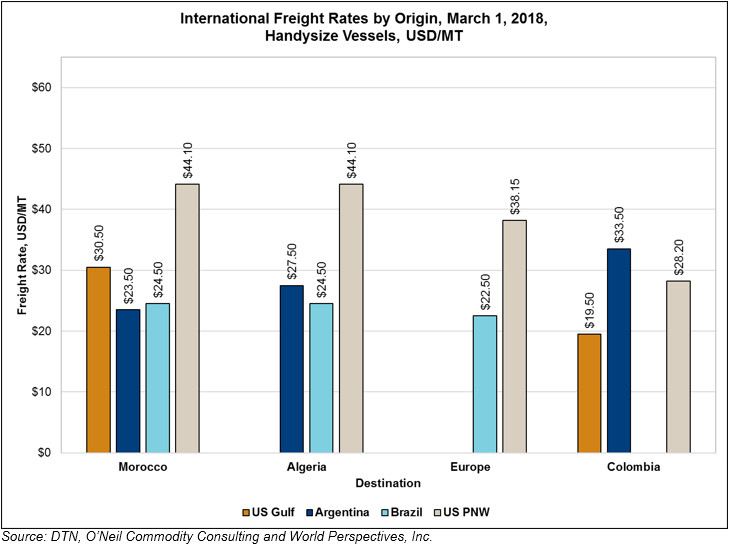

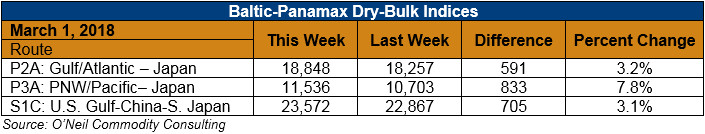

Transportation and Export Report: Jay O’Neil, O’Neil Commodity Consulting: Everyone is now back from the Lunar New Year Holidays and business is ramping up a bit. Vessel owners remain bullish towards the markets and are trying their hardest to ratchet prices up. Physical markets, however, are showing signs of resistance. Profitability is a wonderful thing, and a new situation for vessel owners after suffering in the red for the past 8 years. But, this is probably not the time to get greedy. Panamax vessels are netting $12,800/day in Q1 of this year and can lock in $13,600 for Q2. After that the market is inverted and drops to just under $12,000 for Q3-4. Physical rates are up slightly for the week but are showing signs of resistance in both the Capesize and Panamax sectors.

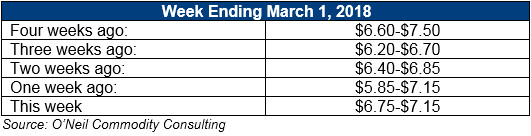

Below is a recent history of freight values for Capesize vessels of iron ore from Western Australia to South China:

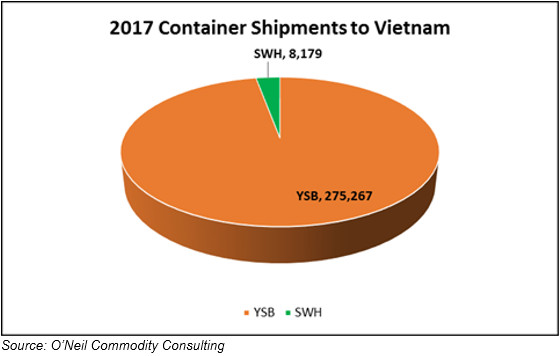

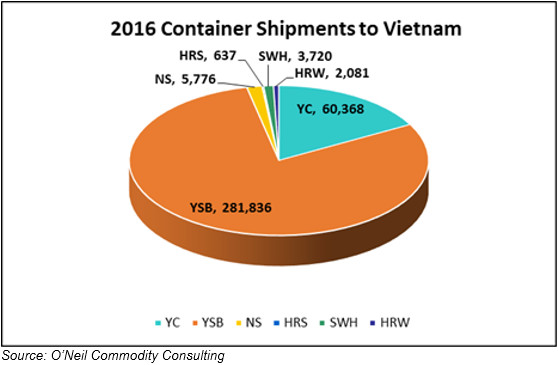

The charts below represent 2017 annual totals versus 2016 annual totals for container shipments to Vietnam.