Chicago Board of Trade Market News

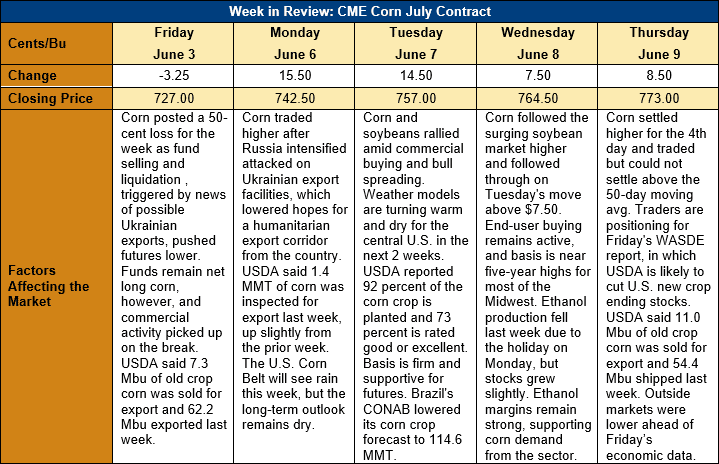

Outlook: July corn futures are 46 cents (6.4 percent) higher this week and have recovered all but 1 penny of last week’s losses. The market found support from strong commercial demand and rising Midwest basis levels, as well as weather forecasts that turned warm and dry for the Corn Belt in the next two weeks. Additional support came from conflict escalations in Ukraine that conflicted with last week’s news that Russia may be preparing an export corridor for Ukrainian grains. Heightened conflict and no discernible progress regarding the export corridor left markets to trade a tight-supply scenario again this week, which pushed prices higher.

The U.S. corn crop is now 94 percent planted with lingering delays essentially isolated to North Dakota and some parts of the PNW. The planting rate is 2 percent ahead of the five-year average, though cooler weather this spring has left the emergence rate slightly below normal. USDA reported that 73 percent of corn fields are in good or excellent condition as of Sunday, which is slightly ahead of the normal rating.

With the corn crop planted, the market’s attention is shifting towards the summer weather and its impact on growing conditions and yields. This week, both the EU and GFS weather models shifted to favor a high-pressure ridge forming over the central United States that will create higher odds of warm, dry weather in the next two weeks. While some dryness early in the growing season can aid crops by forcing root systems to push deeper into the soil to access moisture reserves, the concern is whether this warm, dry trend will persist into July. The long-range weather forecasts indeed favor above-average heat and below-average precipitation through July, which could stress the U.S. corn crop during peak pollination. While markets took the forecast as a signal to move higher and ration demand, the weather outlook and its impact on yields are far from certain.

The weekly Export Sales report featured 280 KMT of net corn sales, up 51 percent from the prior week. U.S. exporters shipped 1.381 MMT of corn last week, down 13 percent but enough to put YTD exports at 47.681 MMT, down 10 percent. The report also featured 217 KMT of sorghum exports, which were 60 percent larger than the prior week.

U.S. basis levels continue to rise amid strong commercial demand, with the average Midwest basis reaching 6N (6 cents over July futures) this week. That is up from 1N last week and near the five-year high of 9N recorded this time last year. The strong basis and inverted futures curve signal commercial demand for corn remains strong, which is further supporting spot futures values.

The futures trade is looking forward to the June WASDE report to be issued Friday, 10 June. Analysis and pre-report surveys suggest USDA is likely to leave U.S. old crop corn ending stocks essentially unchanged but cut the new crop ending stocks by 2 percent from the May estimate. USDA is expected to leave its yield and production estimates unchanged in this month’s report, though potential for acreage reductions certainly exists. Outside the U.S. world 2021/22 corn endings stocks are likely to increase due to larger carry-out in Ukraine while 2022/23 corn ending stocks are likely to be cut some 5 MMT to 305 MMT.

From a technical standpoint, July corn futures are rallying from last week’s retreat to technical and psychological support near $7.25. Last week’s break uncovered strong end-user buying interest, which when combined with the factors mentioned above, sent the market higher. July futures are looking to test trendline resistance near $7.86 in the near future.