Ocean Freight Comments

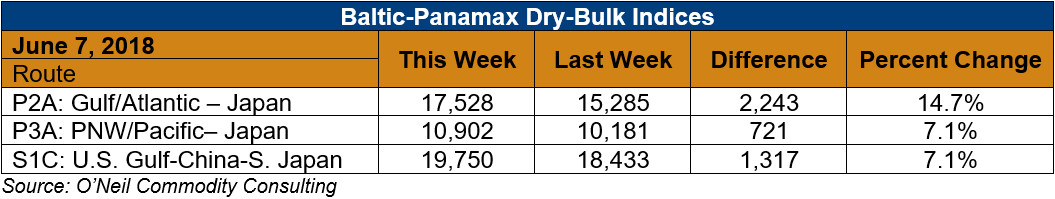

Transportation and Export Report: Jay O’Neil, O’Neil Commodity Consulting: It was another of “those” weeks. Dry-bulk traders felt things had gone low enough and they ran the Baltic Indices up. But the physical market is talking about entering the dull days of summer and questioning if rates can be maintained into the third quarter of 2018. With crude oil, and therefore bunker fuel prices on the rise, vessel owners have good reason to hope for and want higher freight rates.

Posidonia 2018, the big annual global freight conference, is being conducted in Athens, Greece. Of course, all the chatter there is bullish – note that most of the participants are vessel owners, operators and brokers. The three big topics of the conference are de-carbonization, digitalization, and slow steaming. Both dry-bulk and container ships are engaging in slow steaming in an effort to control fuel costs. So, it will take longer for your shipment to arrive. In the world of container shipping markets the trade is estimating vessel growth of 4.5 percent this year versus cargo growth of 5 percent. We will have to see if that holds with all the new vessel orders. The top-10 container shipping lines now control 74 percent of the active fleet and the top-5 lines control 54 percent of the active fleet as consolidation continues.

In dry-bulk, Tomas Kristiansen estimates “…the influx of new, large Valemax vessels could make 67 Capesize vessels unemployed within 24 months. More new ships and less scrapping now creating a poor scenario for dry-bulk carriers. Dry-bulk cargo demand is expected to grow by 2.5 percent.”

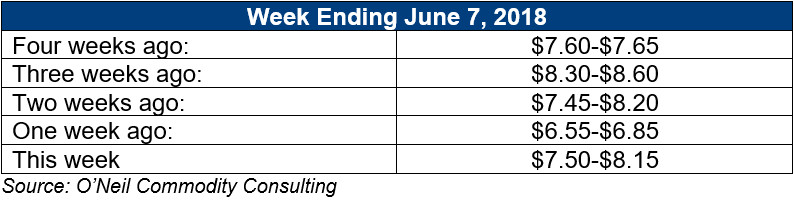

Below is a recent history of freight values for Capesize vessels of iron ore from Western Australia to South China:

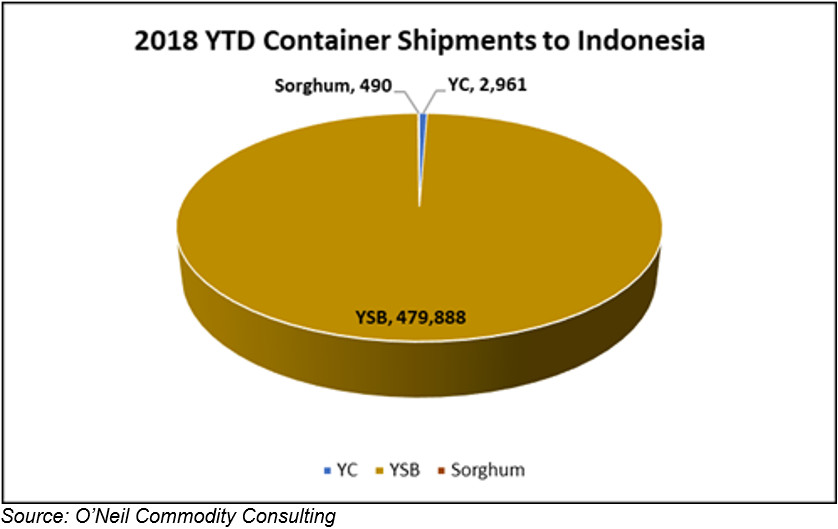

The charts below represent 2018 YTD totals versus 2017 annual totals for container shipments to Indonesia.