Chicago Board of Trade Market News

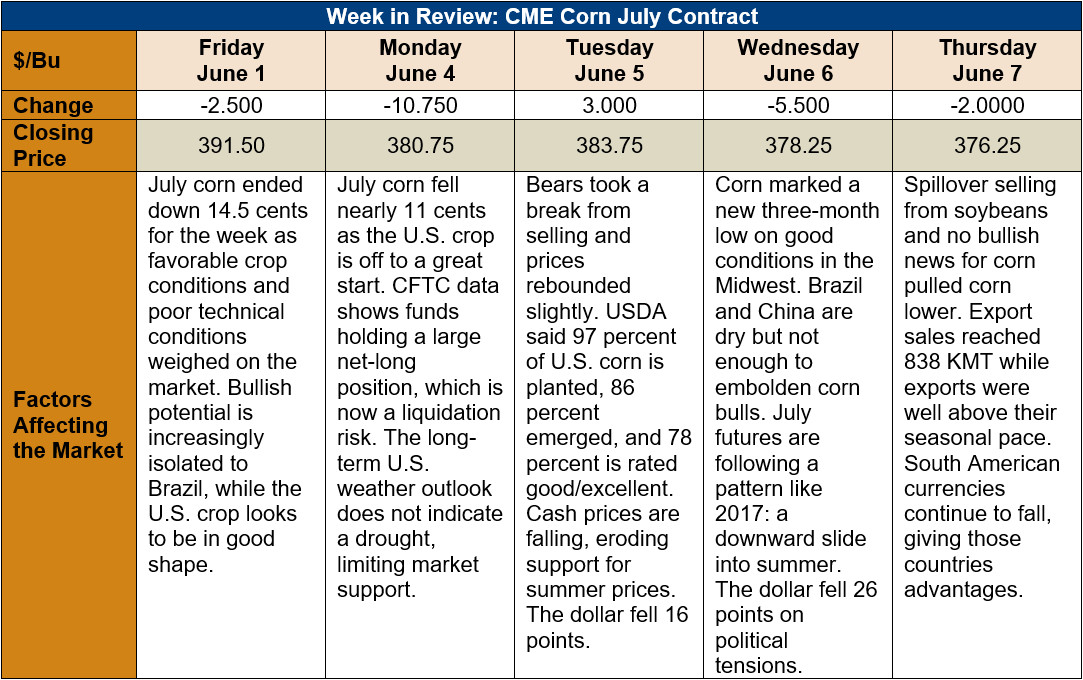

Outlook: July corn is 5 percent lower than our last report as corn bulls struggle to find a significant story. Presently, the dry Brazilian weather is the only bullish factor for the corn market, while rapidly deteriorating technical conditions, fund selling, good crop conditions, and a favorable U.S. weather outlook provide bears ample justification to keep selling.

The major story for the 2018/19 U.S. corn crop is its near-record high conditions ratings. On Monday, the USDA reported 78 percent of the crop is in good or excellent condition (above the five-year average of 71 percent) with 86 percent emergence. While early season conditions correlate poorly with actual yields, they offer some comfort in that the crop is off to a great start.

More importantly, the summer weather forecast for the U.S. does not suggest major periods of hot and dry weather. While the June forecast includes above-average temperatures for the Corn Belt, it suggests precipitation will be average. Similarly, the present outlook for July and August suggests normal temperatures and a slight chance of above-average precipitation. The bottom line is the current weather forecast does not offer much support for the corn market.

Today’s Export Sales report from the USDA showed 838 KMT of net corn sales for the 2017/18 marketing year and exports reaching 1.448 MMT. Exports this week were well above their seasonal trends. YTD corn export bookings (exports plus unshipped sales) are now 2 percent higher than last year, which if realized would imply actual 2017/18 corn exports 5 percent above USDA’s present forecast.

From a technical standpoint, July corn has imploded. The contract breached the trendline formerly offering support, as well as all relevant moving averages. Minor support lies at $3.70 before major support will be tested at $3.62, the life-of-contract low. The latest CFTC data (through last Tuesday) shows noncommercial traders holding large long positions in corn futures. That long position is now a liability for the market as funds are aggressively liquidating. Corn futures tend to decline seasonally heading into the summer and fall harvest, and this year looks to continue that pattern, perhaps starting earlier than normal.