Chicago Board of Trade Market News

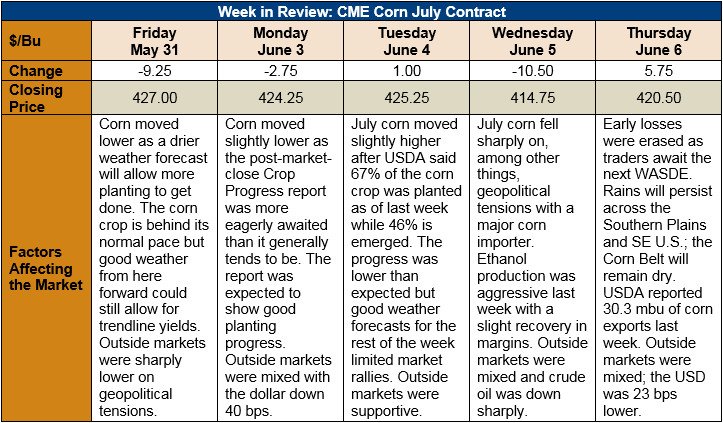

Outlook: July corn futures are 6.5 cents (1.5 percent) lower than last Thursday’s close as improving weather forecasts allow farmers to enter fields and plant spring crops. Beyond better weather conditions, the USDA’s recent announcement that unplanted acres will be ineligible for trade aid (MFP) payments is sending signals for farmers to plant. These factors suggest the acreage reduction may not be as significant as was once thought.

The USDA will release its June WASDE report on 11 June and most analysts anticipate a reduction in 2019/20 U.S. production. The average analyst forecast per Dow Jones suggests the 2019 yield will be 10.7 MT/Ha (170.3 BPA) with 353.15 MMT (13.903 billion bushels) of production. Those figures would imply 81.63 million harvested acres, which (using USDA’s latest ratio of planted/harvested acres) would imply 88 million planted acres. If true, that figure would be 4.8 million acres less than USDA’s Planting Intentions report.

On Monday, USDA said 67 percent of the U.S. corn crop was planted, advancing 9 percent from the prior week. The crop remains behind its normal planting pace. The emergence of the crop is delayed as well; however, good summer weather could help the crop reach trendline yields. The latest summer weather forecasts from NOAA suggest that most of the Corn Belt will see above-average precipitation and average temperatures.

The USDA’s weekly Export Sales report showed 221 KMT of gross corn sales but a large number of cancellations that left net sales at -8.8 KMT. Weekly corn exports totaled 770 KMT, bringing YTD exports to 40.3 MMT, 4 percent above this point last year. Other export sales highlights include 60 KMT of sorghum exports and 500 MT of barley shipments. Barley exports are up 36 percent YTD while barley bookings (unshipped sales plus exports) are up 88 percent.

From a technical standpoint, July corn futures have found major support and resistance at $4.07 and $4.40, respectively. These two points are forming the lower and upper bounds, respectively, of the likely trading range for the contract in the near-term. With the immediate weather threat largely over and farmers entering fields, there is little to prompt traders to push prices higher. Similarly, there is so much uncertainty as to the final planted area figure for corn that traders are unwilling to let prices break below $4.00. Next week’s WASDE will be a much-anticipated report.