Chicago Board of Trade Market News

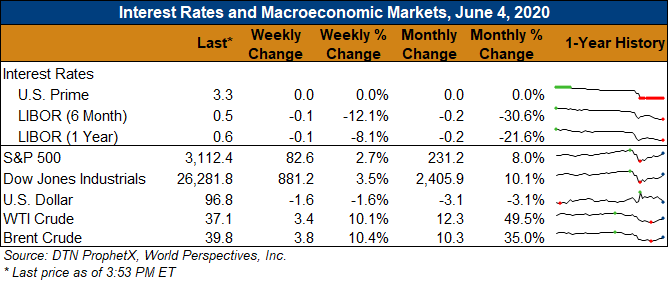

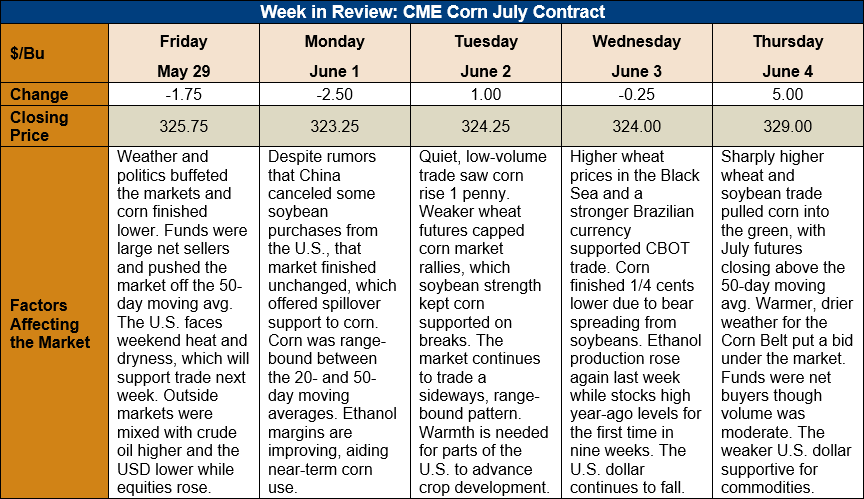

Outlook: July corn futures are 3.25 cents (1.0 percent) higher this week last Thursday’s rally gave way to lower price action early this week. Strength across the entire CBOT on Thursday, June 4, however, pulled corn higher as well, with the July contract finished 5 cents higher for the day. Funds were large buyers while U.S. farmers actively sold old crop stocks and placed 2020 new crop hedges. Price action took the market above key technical resistance points, which suggests the buying strength could continue into next week. Index funds are scheduled to start rolling from the July contract into deferred contracts this Friday, however, which may temporarily dampen trading direction and alter spreads.

The weekly Export Sales report featured net corn sales of 637,000 MT, which was up nearly 50 percent from the prior week. Exports reached 1.346 MMT, up 27 percent from the prior week. The recent shipments put YTD exports at 29.0 MMT (down 28 percent) while YTD bookings (exports plus unshipped sales) stand at 40.4 MMT (down 16 percent). The report also featured 93,300 MT of net sorghum sales and 94,700 MT of sorghum exports. YTD sorghum exports are up 140 percent as international demand has remained exceptionally strong, even with higher prices.

The U.S. corn crop is 93 percent planted as of Monday’s USDA report, which is well above last year’s pace (64 percent by the same day) and the five-year average (88 percent). Sorghum planting is half-finished while the barley crop is 93 percent planted. Seventy-four percent of the U.S. corn crop is rated in good/excellent condition, as is 64 percent of U.S. sorghum and 69 percent of barley. Earlier this week, analysts noted that parts of the U.S. corn belt needed warmer weather to help emerging crops develop, and such weather is in the forecast for the coming week. Fortunately, weather risks are few in the current long-term outlooks.

From a technical standpoint, July corn futures posted a bullish technical day on Thursday with a 5-cent rally sending the contract over the 50-day MA. That will likely bring in additional technical buying in the near future. The market did not make a strong challenge of last Thursday’s daily high, and technical resistance lingers overhead at $3.31. Momentum indicators are turning higher, however, and the market is far from oversold, which bodes well for further price gains. Funds are heavily short corn heading into a time of year when weather concerns frequently create rallies. Any effort to pare back or liquidate this short position will further drive upside moves.