Distiller’s Dried Grains with Solubles (DDGS)

DDGS Comments: DDGS values are lower this week as the market corrects lower amid the broader commodity market selloff. Better rains forecast for the U.S. Midwest have prompted a slide in corn, soybean, and soymeal futures, which has spilled over into the DDGS market. Brokers report that values are now likely approaching ranges where end-users will be more aggressive booking product.

The DDGS/cash corn ratio is up from last week at 1.01 but still below the three-year average of 1.02 while the DDGS/Kansas City soymeal ratio steady with last week at 0.48 and below the three-year average of 0.50.

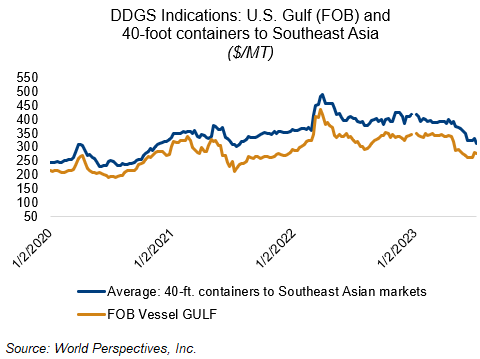

Barge CIF NOLA DDGS offers are $15/MT lower this week amid steady barge freight and falling offers for product destined for the river system. Traders are closely watching water levels and draft restrictions along the Mississippi River for possible impacts on the market. FOB NOLA offers are lower as well but are seeing greater support than the barge market due to navigation difficulties on the river. FOB NOLA offers for July are down $4/MT at $276 this week while deferred positions are down $2-3/MT. U.S. rail rates are down $18-20/MT for July-September positions while offers for 40-foot containers to Southeast Asia are down $15/MT at $315 for July shipment.